Foreign Investors Who Sold Over 5 Trillion Won Last Month

Net Selling of 600 Billion Won in May... Selling Pressure Slightly Eases

[Asia Economy Reporter Ji Yeon-jin] In the first week of May, when the US Federal Reserve implemented a so-called 'big step' by raising the benchmark interest rate by 50bp (0.5%P), institutional investors' 'panic selling' stood out in the domestic stock market. The selling pressure from foreigners, who sold more than 5 trillion won worth of domestic stocks last month, has somewhat eased.

According to the Korea Exchange on the 8th, foreigners net sold about 590.3 billion won worth of domestic stocks from the 2nd to the 6th of this month. They recorded a net sale of 408.7 billion won in the KOSPI market and sold 181.5 billion won worth in the KOSDAQ market.

During this period, institutional investors net sold about 1.0517 trillion won, including 844.9 billion won in KOSPI and 206.2 billion won in KOSDAQ. Individuals bought 1.6095 trillion won worth of domestic stocks, defending the index's decline.

The stock most heavily net sold by institutional investors was Samsung Electronics (-121.2 billion won), followed by Kakao (-105.9 billion won), SK Hynix (-68.0 billion won), LG Household & Health Care (-62.3 billion won), and LG Energy Solution (-60.0 billion won).

Foreigners also sold Samsung Electronics (-320.0 billion won) the most, followed by Kakao (-99.9 billion won), NAVER (-88.7 billion won), SK Hynix (-81.5 billion won), and LG Household & Health Care (-58.9 billion won). On the other hand, they net bought Kia (106.6 billion won), Hyundai Heavy Industries (43.9 billion won), KB Financial Group (41.6 billion won), and Korea Aerospace Industries (34.9 billion won) the most.

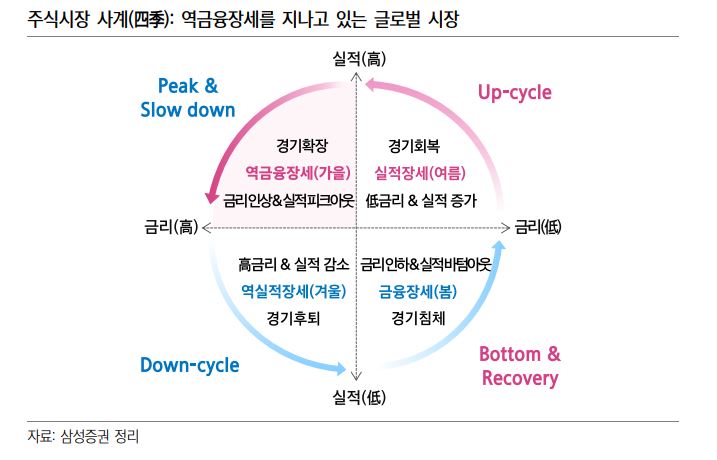

Shin Seung-jin, a researcher at Samsung Securities, said, "Currently, the market can be seen as entering a reverse financial market because interest rate hikes are in full swing and concerns about companies' earnings peaking out due to inflation continue." He explained, "Typically, in a reverse financial market phase, investors look at companies' earnings and cash flows due to reduced market liquidity, so companies with low price-to-earnings ratios (PER) and small to mid-cap stocks with solid earnings tend to perform well."

He added, "High-value companies that have received growth premiums so far will inevitably show sluggish performance if reasonable earnings are not supported," and "Now, since the historically increased market liquidity is entering a withdrawal phase, investors whose portfolios are not performing well this year need to check whether their holdings are caught in a valuation trap."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)