[Asia Economy Reporter Kwon Jae-hee] It has been confirmed that domestic IT companies are facing increased labor cost burdens due to a shortage of developers. In particular, Kakao's labor cost ratio rose by about 8 percentage points in one year, and the labor cost ratios of top IT companies by sales showed a significant difference compared to distribution and trading sectors, which maintained a 3% range at around 11% last year. Additionally, among the 110 major companies surveyed, low-cost airlines Jeju Air and Jin Air recorded labor cost ratios of around 40% last year due to the impact of COVID-19.

According to the "Analysis of Changes in Labor Cost Ratios Relative to Sales of 110 Major Domestic Companies Over Three Years (2019-2021)" released on the 5th by Korea CXO Research Institute, the labor cost ratios of the 110 companies surveyed were 7.5% in 2019, 7.6% in 2020, and 7.2% in 2021. The labor cost ratio decreased by 0.4 percentage points from 2020 to 2021.

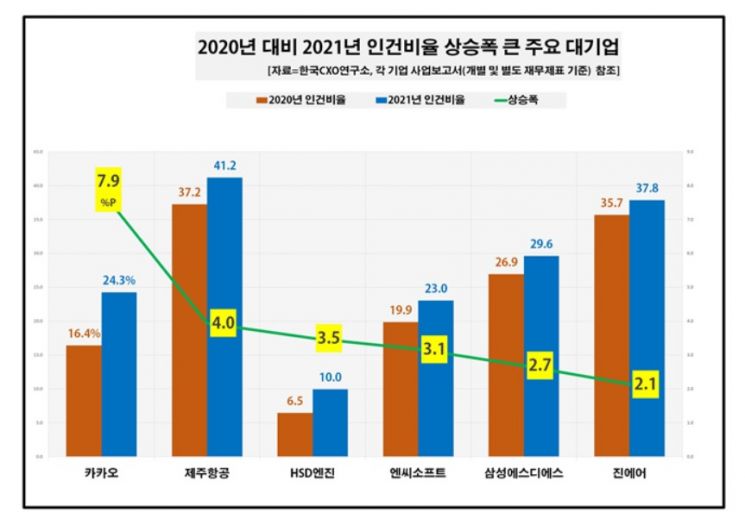

The company with the largest increase in labor cost ratio last year was Kakao. Kakao's labor cost ratios were 14.6% in 2019 and 16.4% in 2020. However, last year it rose sharply to 24.3%. Kakao had maintained a labor cost ratio below 20% for five years from 2017 to 2020.

Among IT companies including Kakao, NCSoft increased by 3.1 percentage points (19.9% in 2020 to 23% in 2021), Samsung SDS by 2.7 percentage points (26.9% to 29.6%), Naver by 1.8 percentage points (9.3% to 11.1%), SK Telecom by 1.5 percentage points (5.7% to 7.2%), and Hyundai AutoEver by 1.3 percentage points (15% to 16.3%). These five companies accounted for half of the 12 companies whose labor cost ratios rose by more than 1 percentage point in the past year. This indicates that management concerns over labor costs deepened significantly among IT companies last year.

In particular, Kakao had the highest average employee salary in the IT industry last year at 172 million KRW. In 2020, Kakao ranked third with an average salary of 108 million KRW, following Samsung Electronics and SK Telecom, but last year, with a 59% increase in average salary, it jumped to first place. Other companies with average employee salaries exceeding 100 million KRW last year included NCSoft (106 million KRW), Samsung SDS (119 million KRW), Naver (129 million KRW), and SK Telecom (162 million KRW).

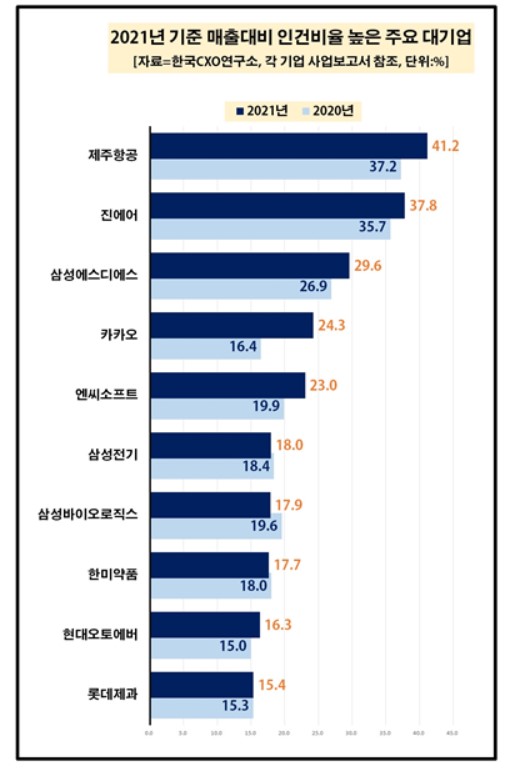

Among the 110 major companies surveyed, 10 companies had labor cost ratios exceeding 15% of sales last year. The top two in labor cost ratio were both low-cost airlines, with Jeju Air's labor cost ratio reaching 41.2% last year. This means that out of every 100 KRW in sales, 41 KRW was spent on employee labor costs. Compared to 37.2% the previous year, this is an increase of 4 percentage points.

Jin Air's labor cost ratio was also close to 40% at 37.8% last year. Considering that Jeju Air and Jin Air had labor cost ratios in the 10% range in 2019 (13.2% and 11.7%, respectively), the impact of COVID-19 was identified as the main cause.

By industry, among 11 major sectors, IT companies had the highest labor cost ratio at 11.8% last year. This was followed by automotive (9%), food (8.8%), machinery (8.7%), electronics (8.4%), and construction (5.7%). In contrast, the distribution and trading sector had the lowest ratio at 3.6%, indicating a relatively small proportion of labor costs in sales. Additionally, petrochemicals (4.7%) and transportation (4.4%) also had labor cost ratios below 5% last year.

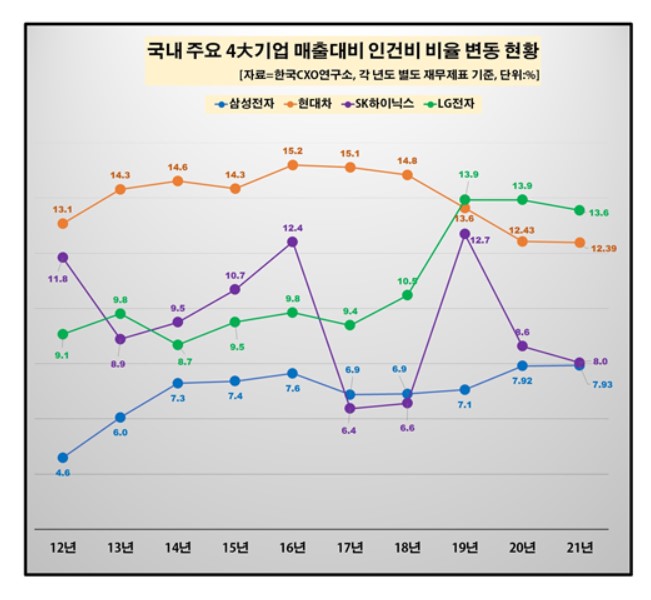

Looking at the labor cost ratio trends over the past 10 years for Korea's four major companies?Samsung Electronics, Hyundai Motor, SK Hynix, and LG Electronics?Hyundai Motor, SK Hynix, and LG Electronics showed a downward trend, while Samsung Electronics was the only company showing an upward trend.

Samsung Electronics' labor cost ratio was about 6.9% in 2018. It has steadily increased since then: 7.06% in 2019, 7.92% in 2020, and 7.93% in 2021.

There is growing interest in whether Samsung Electronics' labor cost ratio will rise to the 8% range this year or remain in the 7% range.

Hyundai Motor reached its peak labor cost ratio of 15.2% in 2016 and has since reduced its labor cost proportion, falling to the low 12% range last year. Last year's labor cost ratio was the lowest in the past 10 years.

SK Hynix's labor cost ratio fluctuated like a roller coaster depending on sales. It reached as high as 12.7% in 2019 but was as low as 6.4% in 2017. Last year, it maintained around 8%.

LG Electronics had a labor cost ratio below 10% until 2017 but has maintained around 13% since 2019. However, compared to Samsung Electronics and SK Hynix, it still shows a difference of more than 5 percentage points.

Oh Il-seon, director of Korea CXO Research Institute, said, "Last year, domestic IT companies generally faced a greater increase in labor costs than in sales growth, which increased management burdens. If sales growth slows down in the future, management may consider lowering salary levels somewhat compared to last year or, in some cases, reducing some workforce."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)