[Asia Economy Reporter Ji Yeon-jin] Since the COVID-19 pandemic, the stock investment craze has intensified, leading to a sharp increase in stock accounts held by minor customers.

According to Korea Investment & Securities, a subsidiary of Korea Financial Group (President Jeong Il-moon), the number of minor customers reached 163,000, a 234% increase compared to 49,000 at the end of 2019. Over 91,000 minor accounts were newly opened last year alone, and about 17,000 new stock accounts were created in the first quarter of this year. Since last year, minor customers opening accounts have averaged 9.4 years old, lowering the average age of all minor customers from 12.7 years in 2019 to 10.8 years.

This increase in minor customers is largely attributed to the activation of stock investment and the public offering investment craze in recent years, leading parents to open accounts in their children's names. Not only opening accounts, but parents are also increasingly gifting stocks or investing together to provide early financial education.

The stock balance of minor customer accounts grew from 127.4 billion KRW in 2019 to 618.6 billion KRW as of the end of April this year, a 385.7% increase. During the same period, the stock balance growth rate for customers in their 30s and 40s also rose by 189.7%, but the increase in children’s accounts far outpaced that of the parent generation.

In the rollercoaster market since last year, the return on investment for minor customers was more stable. From early last year to the first quarter of this year, the stock return rate for minor accounts was 1.51%. In the same period, the return rate for customers in their 30s and 40s was -0.64%. Both generations recorded relatively high returns until the end of last year, but the decline was smaller for the younger generation during the market correction earlier this year.

The difference is analyzed to stem from the nature of children’s accounts, which involve less short-term trading and have a stronger long-term investment character compared to stock picking. In fact, since early last year, the average number of orders per minor customer was 19.1, only 12% of the 164.5 orders per customer in their 30s and 40s. However, the stocks most held by each generation are not significantly different, including Samsung Electronics, Samsung Electronics Preferred Shares, Kakao, and KakaoBank.

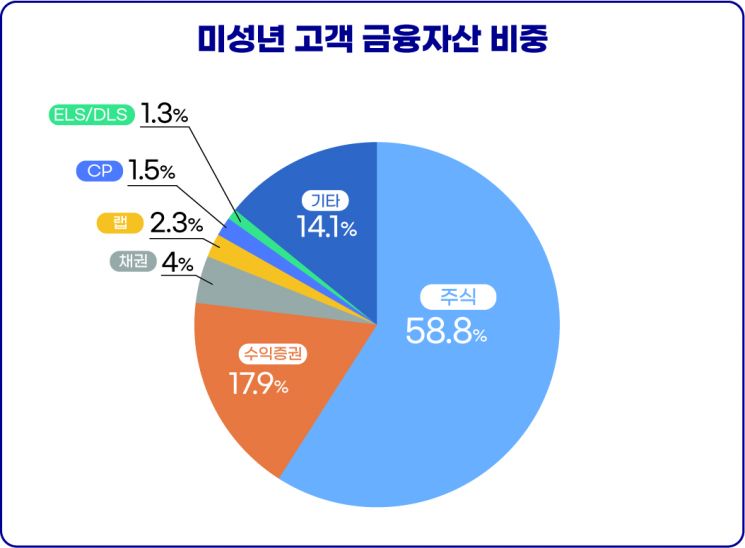

Among Korea Investment & Securities’ minor customers, stocks accounted for the largest portion of financial assets at 58.8%, followed by investment trusts (funds) at 17.9%. Other investments included bonds at 4%, wrap accounts at 2.3%, commercial paper (CP) at 1.5%, and equity-linked securities (ELS)/derivative-linked securities (DLS) at 1.3%.

Among funds, long-term investment products such as Korea Value 10-Year Children and Korea Value 10-Year Investment had a large share. Among developed market equity funds, Fidelity Global Technology and Korea Investment Wellington Global Quality ranked high, while among emerging market funds, KB China Mainland A Shares and Korea Investment Vietnam Growth were top holdings.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.