Korea's COVID-19 and Debt

Debt Risks Hampering National Economy

Urgent Need for Debt Risk Reduction Measures Such as Regulatory Reform

[Asia Economy Reporter Park Sun-mi] South Korea's total national debt ratio has surged sharply since the COVID-19 pandemic, showing a trend opposite to that of the Group of Twenty (G20) countries. Experts warn that excessive debt growth could lead to fiscal and financial crises, emphasizing the urgent need for risk management measures such as regulatory reforms and enhancing growth potential.

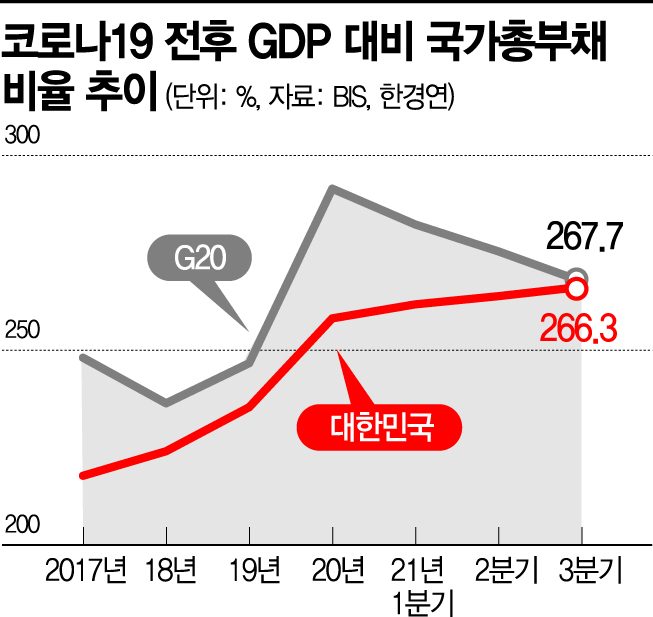

According to an analysis of Bank for International Settlements (BIS) statistics by the Korea Economic Research Institute on the 4th, as of the third quarter of last year, South Korea's total national debt ratio stood at 266.3%, slightly lower by 1.4 percentage points than the G20 average of 267.7%.

However, since 2017, South Korea's debt growth rate was about 2.5 times higher than the G20 average increase of 19.6 percentage points, recording a 48.5 percentage point rise. In 2017, South Korea's total national debt ratio was 217.8%, which was 30.3 percentage points lower than the G20 average of 248.1%, but this gap narrowed significantly after the COVID-19 outbreak. South Korea's plunge into a 'debt mountain' greatly reduced the difference with the G20 average.

Notably, while South Korea's total national debt to GDP ratio has continuously increased since 2017, the G20 average has decreased since the onset of COVID-19 in 2020, showing a contrasting trend. The average total national debt ratio among G20 countries fell by 23.8 percentage points year-on-year as of the third quarter of last year, whereas South Korea's average total national debt ratio rose by 8.1 percentage points due to increases in household, corporate, and government debt even after the pandemic.

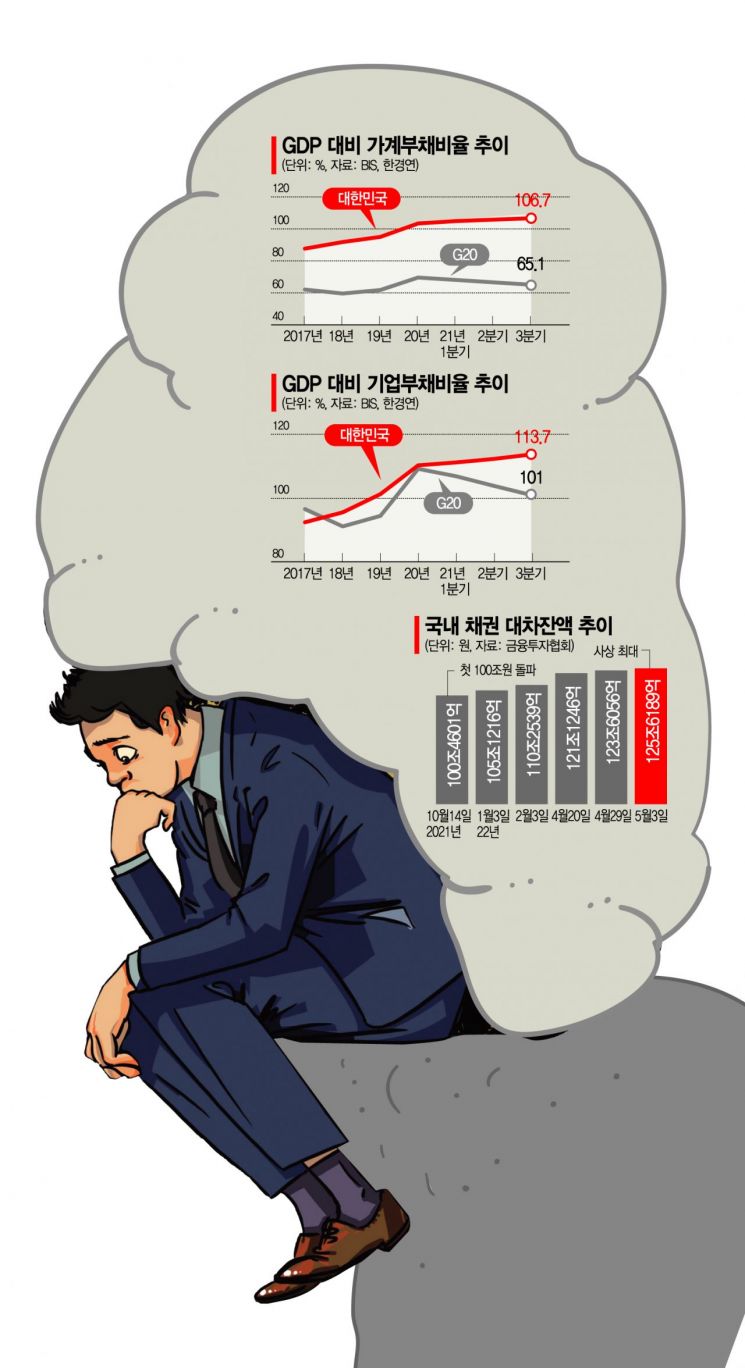

Household debt was particularly severe. South Korea's household debt to GDP ratio surpassed 100% in 2020, when the COVID-19 outbreak began, rising from 89.4% in 2017, and soared to 106.7% by the third quarter of last year. The increase in household debt ratio from 2017 to the third quarter of last year was 17.3 percentage points, approximately 5.8 times higher than the G20 average increase of 3 percentage points.

Among the 43 countries reporting related statistics to BIS, only four countries?China (13.5 percentage points), Hong Kong (21.6), South Korea (17.3), and Thailand (11.6)?recorded household debt ratio increases exceeding 10 percentage points, with China and South Korea being the only G20 members on this list.

Rising Inflation Reduces Real Household Income and Pushes Interest Rates Upward

Unlike the international trend over the past five years, South Korea's total debt ratio surged sharply mainly due to rapid increases in household and corporate debt following the COVID-19 outbreak. The increase in household debt was overwhelmingly high, ranking second among the 43 countries reporting to BIS. Concerns are growing that rising inflation and interest burdens, combined with declining real household income, could exacerbate household debt risks and negatively impact the overall economy.

South Korea's average household debt to GDP ratio rose by 17.3 percentage points from 89.4% in 2017 to 106.7% in the third quarter of last year. Fueled by low interest rates, the craze for debt-financed investment (debt investment) and borrowing to the limit (Yeongkkeul) led many to take on debt, while households and self-employed individuals, whose incomes sharply declined due to the COVID-19 spread, accounted for the majority of loans. In contrast, the average household debt ratio among the G20 countries increased only slightly by about 3 percentage points, from 62.1% to 65.1% during the same period. Consequently, the gap in household debt ratios between South Korea and the G20 average widened from 27.3 percentage points in 2017 to 41.6 percentage points in the third quarter of 2021.

Corporations also increased their debt. Although the corporate debt ratio was higher on average in the G20 in 2017, South Korea surpassed the G20 average by the third quarter of last year amid the COVID-19 pandemic. During this period, South Korea's corporate debt to GDP ratio jumped from 92.5% to 113.7%, an increase of 21.2 percentage points. Meanwhile, the G20 average rose only 4.5 percentage points, from 96.6% to 101.1%.

The gap between South Korea and the G20 average (South Korea minus G20 average) reversed from -4.1 percentage points in 2017 to 12.7 percentage points. While the international debt situation has shifted to a downward trend after the COVID-19 outbreak, showing signs of improved soundness, South Korea's debt is increasing across all sectors: households, corporations, and government.

National Debt Warning Lights... Inflation as a Negative Factor

The decrease in real household income due to inflation and the ongoing trend of interest rate hikes are identified as factors that could further amplify household debt risks. In fact, real household income began to decline last year amid rising prices.

According to the Statistics Korea Household Income and Expenditure Survey, real household income recorded negative growth for the first time in four years, with year-on-year declines of -1.0% and -3.1% in the first and second quarters of last year, respectively. Although real household income rebounded by 5.4% in the third quarter, this was largely due to COVID-19-related public subsidies. In the fourth quarter of last year, the increase slowed to 2.8%.

The high inflation trend is expected to continue until the end of this year. The International Monetary Fund (IMF) raised its consumer price inflation forecast to 4% last month while lowering the economic growth forecast to 2.5%. If the Bank of Korea raises the base interest rate further to counter inflation, household debt risk is likely to increase.

The Korea Economic Research Institute estimates that a 1 percentage point increase in the base interest rate would raise households' annual interest burden by 18.4 trillion won, adding an average of 876,000 won in annual interest costs per household. There are calls to reduce delinquency and default rates among financially vulnerable groups such as low-credit and low-income households by increasing the proportion of fixed-rate loans over variable-rate loans through refinancing.

Researcher Lim Dong-won of the Korea Economic Research Institute advised, "If debt continues to increase excessively, it could lead to fiscal and financial crises. Instead of artificial debt reduction, it is necessary to enhance growth potential and income through regulatory reforms to reduce household and corporate debt, and to manage fiscal soundness by introducing fiscal rules for government debt."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.