Expectations Raised by the Mention of the 'Mobility Industry' as a State Affairs Task by the Transition Committee

[Asia Economy Reporter Minji Lee] Companies related to Urban Air Mobility (UAM), mentioned as a national agenda by the Presidential Transition Committee, are sweeping the stock market. Although the business feasibility evaluation of these companies has not yet been concretized, they are showing a rapid rise solely on expectations, solidifying their position as a new thematic stock.

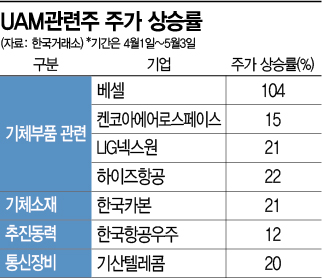

According to the Korea Exchange on the 4th, Vessel's stock price surged about 104% from 4,430 won on the 1st of last month to 9,060 won on the 3rd of this month. The catalyst driving the stock price was UAM. The Transition Committee highlighted the mobility industry as a future growth industry and announced the goal of commercializing UAM for the first time by 2025, three years from now, which acted as a catalyst.

Simply put, UAM refers to a system where ultra-small aircraft transport passengers or cargo within urban areas. While the current mobility industry is focused on expanding electric and hydrogen vehicles, the Transition Committee plans to actively utilize domestic communication infrastructure to establish a future-oriented eco-friendly urban air transportation system and lead the global market.

According to market research firms, the UAM market size is expected to grow to $1.5 trillion (approximately 1,890 trillion won) by 2040. The annual growth rate is anticipated to reach 30%, which is higher than the growth rate of electric vehicles (20%) during the same period, increasing market interest. UAM technology integrates various technologies such as aircraft development, batteries, transportation and operation, flight management support, and facility control. Recently, the stock market has been reacting strongly to companies related to aircraft development. Companies that have risen linked to the UAM theme since last month include Kenko Aerospace (15%), LIG Nex1 (21%), Korea Carbon (21%), Hize Aviation (22%), and Korea Aerospace (12%), mainly companies related to aircraft parts, materials, and power. Additionally, Gisan Telecom, a company related to communication equipment, surged about 20%.

However, it is observed that the rapid rise in UAM-related stocks is driven solely by expectations for these companies, so caution is advised when investing. The Federation of Korean Industries stated in a report, "Although the government is supporting at the pan-government level with the goal of commercialization by 2025, the technology in key areas is only about 60-70% of the world's top level," and "It is expected that related companies will realize profits only between 2028 and 2030." Extreme volatility is also appearing, especially in stocks that have risen significantly. In the case of Vessel, despite achieving a total return of over 100% in about a month, the Korea Exchange designated it as an investment warning stock, causing the stock price to drop about 10% in one day, increasing volatility. As of 1:50 PM on the same day, Hize Aviation is also showing a decline of about 4%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)