Raw Material Prices Surge Due to Ukraine Crisis

Fueling Inflation and Currency Woes

Increasing Downward Pressure on Corporate Earnings

Need for Careful Stock Selection by Sector

[Asia Economy Reporter Kwon Jae-hee] With the 50bp (0.5 percentage point) interest rate hike at the May Federal Open Market Committee (FOMC) becoming a foregone conclusion and already priced into the stock market, the 'reverse financial market' has emerged as another concern for the Korean stock market, rather than being a negative factor. Unlike the previous rise in the Korean stock market driven by abundant liquidity, it is now expected to enter a phase of individual stock performance, prompting analysis that 'picking the gems' among stocks will be necessary.

According to the securities industry on the 3rd, there is an analysis that the global stock market has entered a reverse financial market phase. Shin Seung-jin, a researcher at Samsung Securities, analyzed, "The global stock market, including the Korean stock market, has passed through the liquidity-driven and earnings-driven markets from 2020 to 2021, and this year, after a boom, foreign investors are withdrawing and governments are implementing tightening policies, entering a 'reverse financial market'."

The reverse financial market is the opposite of a financial market phase, referring to a situation where central banks withdraw money, corporate earnings slow down, and stock prices decline. The period right after COVID-19, when central banks around the world injected money and stock prices boomed, is considered a financial market phase, and the exact opposite is the reverse financial market. Typically, in a reverse financial market, when inflation intensifies during a boom, central banks raise interest rates to suppress it, leading to a decline in stock prices.

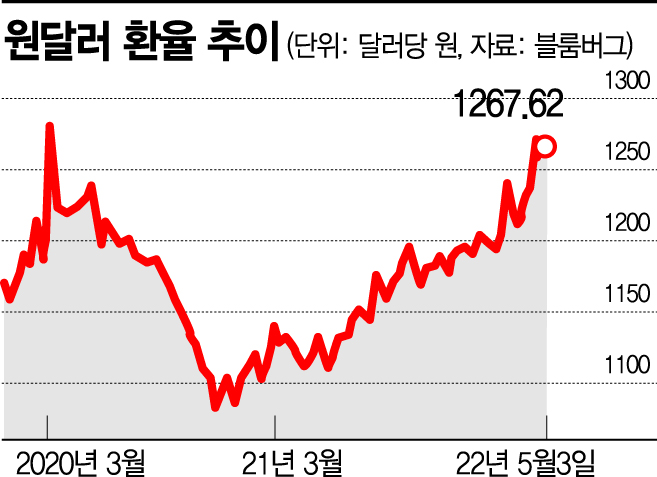

The interest rate hikes, coupled with the Russia-Ukraine issue causing a surge in commodity prices and fueling inflation, are also cited as negative factors affecting corporate earnings. Meanwhile, the won-dollar exchange rate is at 1,267.62 won, approaching 1,270 won and threatening the 1,300 level. On the 28th of last month, the won-dollar exchange rate closed at 1,272.5 won, marking the highest level in 2 years and 1 month since March 19, 2020.

Although the possibility of further decline in the Korean stock market is low, there is analysis that picking the gems among stocks is necessary as downward pressure on corporate earnings increases. This is because the attractiveness of growth stocks, which had risen due to liquidity, diminishes in a reverse financial market.

KB Securities stated, "Funds are likely to flow out from energy and industrial stocks, which currently attract money, and financial stocks benefiting from rising interest rates, into stocks that have been neglected so far," adding, "It is time to pay attention to the liquor and beverage industry, cosmetics industry, rental and entertainment industries, which can pass on cost increases to consumers through price hikes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.