K-Fintech Dynamism Recovery and Sustainable Development Policy Tasks Forum

Top Investment Attraction but Only One Fintech Unicorn

Need for Regulatory Relaxation and Policy Support

[Asia Economy Reporter Minwoo Lee] An analysis has emerged that the social benefits gained through fintech innovation will reach 15 trillion won. It is explained that more active regulatory relaxation and support policies are necessary to achieve this.

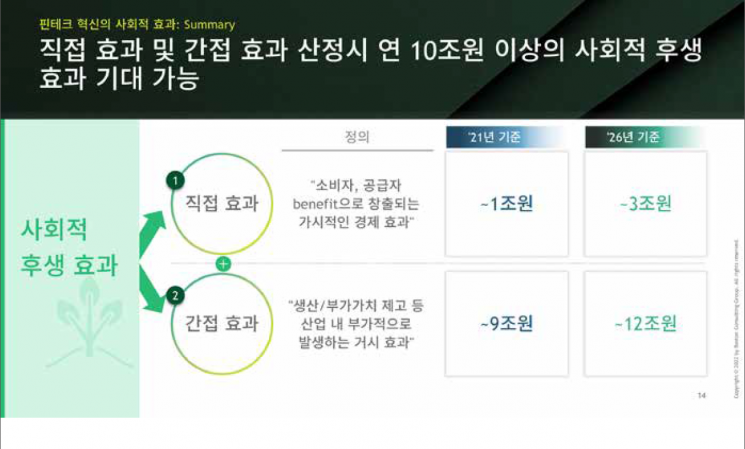

On the 3rd, Park Young-ho, partner at Boston Consulting Group (BCG) Korea, stated at the policy discussion hosted jointly by Yoon Chang-hyun, a member of the People Power Party, and the Korea Fintech Industry Association titled "Policy Tasks for Restoring the Dynamism of K-Fintech and Sustainable Development," "The social welfare effect from fintech innovation was estimated to be over 10 trillion won annually as of last year and is expected to reach 15 trillion won by 2026," adding, "If domestic regulatory issues related to fintech are resolved, the expected social welfare effect will grow even larger."

He analyzed these effects by dividing them into direct and indirect effects. The direct effect is a visible economic benefit where consumers and suppliers both gain. Through services such as loan, card, and insurance comparison analysis, as well as simple payment and remittance, companies experience increased sales, and consumers see income growth and reduced expenditures. Partner Park explained, "The direct welfare effect of fintech innovation was about 840 billion won last year but is expected to grow to around 3.2 trillion won in five years."

The indirect effect, which increases added value and arises additionally within the industry, is even greater. Currently nearing 9 trillion won, it is projected to reach 12 trillion won in five years. He analyzed, "Considering factors such as enhancing consumer financial sovereignty, resolving financial blind spots, and strengthening the status of Korea as an IT powerhouse, the overall contribution to future society will be significant."

Among these, he pointed out that it is somewhat regrettable that there is only one fintech unicorn (unlisted startup with a valuation over 1 trillion won), Viva Republica, the operator of Toss. He diagnosed, "Korea is a leading fintech country in the Asia-Pacific region based on investment attraction, but unlike high-growth countries such as Singapore and Indonesia, which develop personal financial management (PFM), cross-border payments, and mobility together, Korea is lagging in discovering growth engines beyond payment solutions," adding, "It is necessary to induce the growth of second and third fintech unicorn companies through regulatory relaxation and support policy establishment by future policy authorities."

On the same day, Kang Hyun-gu, a lawyer at the law firm Kwangjang who co-presented the topic with Partner Park, also stated, "The current domestic fintech industry is facing limits due to barriers from existing regulations and legislative deficiencies," and argued, "To prevent domestic fintech companies from falling behind on the international stage, it is essential to amend the Electronic Financial Transactions Act and introduce a small license system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.