China's Strict Lockdown Policy Threatens Economic Slowdown

Some Countries' Currencies Decline Alongside Yuan's Value Plunge

A delivery worker in Shanghai, China, is handing over food to a security guard in a residential complex under lockdown measures to prevent the spread of COVID-19. [Image source=Yonhap News]

A delivery worker in Shanghai, China, is handing over food to a security guard in a residential complex under lockdown measures to prevent the spread of COVID-19. [Image source=Yonhap News]

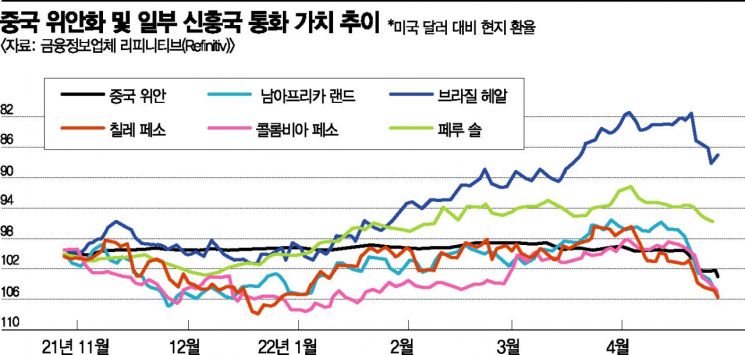

[Asia Economy Reporter Kim Hyun-jung] The sharp decline in the value of the Chinese yuan, influenced by China's strict zero-COVID policy, the Ukraine war, and expectations of US monetary tightening, is threatening the economies of major emerging markets. Since last month, some countries' currencies have shown a simultaneous downward trend, increasing the possibility of capital outflows.

On the 1st (local time), Bloomberg reported, "The widespread sell-off of China in the market is causing ripples in emerging markets," adding, "It is dragging down growth rates and threatening everything from stocks to currencies and bonds." The report diagnosed that the outbreak of COVID-19 and the Chinese government's strict zero-COVID policy to contain it are raising global investors' concerns about demand reduction due to China's shutdowns and supply chain disruptions, pressuring developing countries that heavily depend on trade with the world's second-largest economy to sell off their assets.

In fact, some emerging market currencies have shown trends similar to the yuan, with recent weakness becoming prominent. The Brazilian real had risen nearly 20% against the benchmark since the beginning of the year but has shown a clear simultaneous decline since mid-last month when the yuan's value plummeted. The Peruvian sol and Colombian peso have also widened their losses, and the Chilean peso is showing a similar trend.

Yelan Sizdikov, Global Head of Emerging Markets at Amundi, France's largest asset management firm, said, "China's strict lockdown measures are causing weakness across the economy," citing the worst-case scenario of a 10% contraction in manufacturing and an 18% reduction in steel production due to city lockdowns. Sizdikov predicted, "This will negatively impact commodity prices and particularly harm the trade of Latin American countries." He further noted that even before the Ukraine war, inflation in emerging markets was expected to peak around mid-year, but this timing has been delayed by at least three months, potentially increasing sustained pressure on various countries' currencies.

As the stock prices of Chinese tech companies listed on the Hong Kong Stock Exchange plunged due to supply chain impacts, the effect reached as far as South Africa on the opposite side of the globe. Naspers, South Africa's largest listed company holding a 28.8% stake in Tencent, saw its stock price plunge to a five-year low. The report analyzed that fear over China's COVID-19 response caused emerging markets to slump over the past three weeks, wiping out approximately 2.7 trillion KRW in related markets. The South African rand, which had been performing well this year, gave up four months' worth of gains in just two weeks.

According to data released by China's National Bureau of Statistics on the 30th, China's manufacturing Purchasing Managers' Index (PMI) for April was 47.4, down 2.1 points from the previous month, marking the lowest level in 26 months since February 2020 (35.7). Mansur Mohiuddin, Chief Economist at a Singapore bank, observed, "China's economic downturn will negatively affect the outlook for emerging economies facing soaring energy prices and major central banks' monetary tightening policies."

Additionally, HSBC downgraded its forecasts for nine Asian currencies due to the slowdown in China's economic growth, while US TD Securities and Singapore's Neuberger Berman predicted that the South Korean won and Taiwanese dollar will face greater pressure. Prashant Singh, Senior Portfolio Manager of Emerging Market Bonds at Neuberger Berman, said, "We continue to maintain a cautious stance on Asian currencies, and volatility will increase until these growth concerns ease."

Furthermore, the report emphasized the need to pay attention to the April inflation rates of South Korea, Thailand, and Taiwan, which are scheduled to be announced early this month. It also advised monitoring Russia's PMI, Turkey's inflation response, and Brazil's interest rate hike decisions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)