[Asia Economy Reporter Park Byung-hee] The U.S. central bank, the Federal Reserve (Fed), is expected to decide on a so-called 'big step' of raising the benchmark interest rate by 0.5 percentage points at the Federal Open Market Committee (FOMC) meeting on June 3-4.

According to the Chicago Mercantile Exchange (CME) FedWatch as of June 1 Korea time, the probability of a 0.5 percentage point increase reflected in the federal funds futures market is as high as 97.1%. Right after the last FOMC on March 17, the probability of a 0.5 percentage point hike was only 32.9%. At that time, the probability of a 0.25% increase was much higher at 67.1%.

The last time the Fed decided on a big step was in May 2000 during the dot-com bubble. At that time, the Fed raised the benchmark interest rate from 6% to 6.5%. If the big step is decided this time, the U.S. benchmark interest rate will be 0.75?1%. The key question is how much the Fed will accelerate its pace going forward.

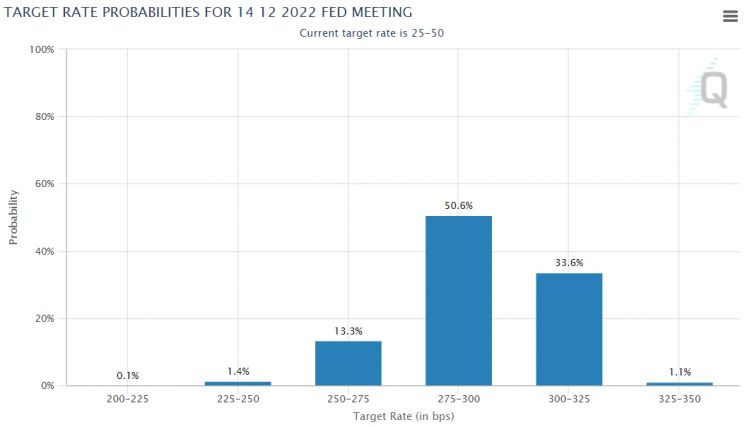

◆ Expected U.S. year-end benchmark interest rate is 3% = FedWatch expects the U.S. benchmark interest rate to be 2.75?3% after the December FOMC this year. The probability of a 2.75?3% benchmark interest rate is reflected highest at 50.6%. The probability of a 3?3.25% rate is 33.6%, and the probability of a 2.5?2.75% rate is 13.3%.

Even if the big step is decided at this FOMC, it implies an expectation of a 2 percentage point increase in the benchmark interest rate over the remaining five FOMCs this year, averaging 0.4 percentage points per FOMC.

Accordingly, there is a high possibility that big steps will continue in the remaining FOMCs this year. The possibility of the Fed raising the rate by 0.75 percentage points at once cannot be ruled out. James Bullard, President of the St. Louis Fed, said at a U.S. Foreign Relations Committee event on May 18 that the benchmark interest rate should be raised to around 3.5% by the end of this year and that a 0.75 percentage point hike should be considered if necessary.

Chicago Mercantile Exchange (CME) FedWatch's Year-End U.S. Federal Funds Rate Forecast

Chicago Mercantile Exchange (CME) FedWatch's Year-End U.S. Federal Funds Rate Forecast [Image source= CME]

In fact, FedWatch has already factored in a 0.75% increase in the benchmark interest rate at the June FOMC. The probability of a 0.75 percentage point hike is reflected at 88.8%. It also expects an additional 0.5 percentage point increase at the July FOMC, bringing the benchmark interest rate to 2?2.25%. The probability of a 0.5 percentage point increase in July is 82.7%.

Recently, Fed officials have emphasized the need to reach the neutral interest rate quickly through preemptive measures, increasing the likelihood that the Fed will raise the benchmark interest rate significantly in May through July.

Christopher Waller, a Fed Governor, said in an interview with CNBC on May 13 that he expects multiple big steps and prefers preemptive tightening measures. President Bullard also said that before raising the benchmark interest rate to 3.5%, the Fed should first reach the neutral interest rate level quickly. The neutral interest rate refers to the rate that neither stimulates nor depresses the economy, and the Fed currently considers about 2.4% as the neutral rate.

Nomura Holdings expects the Fed to raise the benchmark interest rate by 0.5 percentage points at the May FOMC, followed by consecutive 0.75 percentage point hikes at the June and July FOMCs. Rob Subramanian, Head of Global Research at Nomura, stated, "To prevent a wage-price spiral, the Fed will try to reach the neutral interest rate as quickly as possible," and "We expect the Fed to take stronger preemptive tightening measures than anticipated." Nomura also expects additional 0.25 percentage point hikes at each FOMC even after reaching the neutral rate, forecasting the U.S. benchmark interest rate to reach 3.75?4% by May next year.

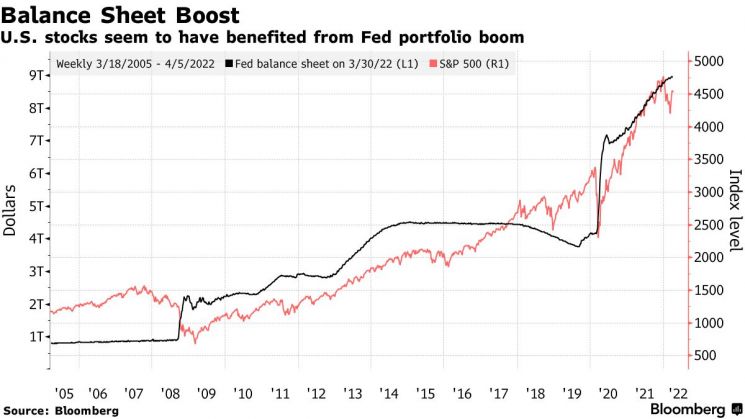

◆ Asset size to shrink by $3 trillion over 3 years = The Fed is also expected to announce a quantitative tightening (QT) plan to reduce its asset holdings at this FOMC.

The Fed previously conducted QT over about two years starting in October 2017. At that time, the Fed reduced its asset size by about $650 billion. Before QT began, the Fed's holdings were $4.5 trillion, and after QT ended, more than $3.8 trillion remained.

This time, a much stronger QT is expected because the Fed's holdings doubled over the past two years in response to the COVID-19 pandemic. As of May 25, the Fed's holdings stood at $8.9392 trillion.

The market currently expects the Fed to reduce its assets by about $3 trillion over the next three years. However, even in 2017, the Fed did not reduce its holdings as much as originally planned. Large-scale asset sales by the Fed caused a sharp rise in market interest rates, leading to financial market turmoil.

The scale of assets held by the U.S. Federal Reserve (Fed) and the trend of the S&P 500 index [Image source= Bloomberg]

The scale of assets held by the U.S. Federal Reserve (Fed) and the trend of the S&P 500 index [Image source= Bloomberg]

When the Fed first started QT in October 2017, it reduced assets by $10 billion per month?$6 billion in Treasury securities and $4 billion in mortgage-backed securities (MBS). The Fed increased the asset reduction amount by $10 billion each quarter, reaching a maximum monthly sale of $50 billion?$30 billion in Treasuries and $20 billion in MBS.

Originally, the Fed planned a maximum monthly sale of $95 billion?$60 billion in Treasuries and $35 billion in MBS. However, QT was stopped after reaching only about half of the target.

Bloomberg reported that despite the Fed setting a sales limit, the repo rate, a key short-term funding rate, surged. Ultimately, the Fed halted QT after two years.

The March FOMC minutes released last month confirmed that members generally agreed to reduce asset holdings by $95 billion per month.

It is not easy to quantify the impact of the Fed's quantitative tightening on the market. Deutsche Bank estimates that the Fed will reduce its holdings by $1.9 trillion by the end of next year, which would have the effect of raising the benchmark interest rate by 0.25 percentage points four times.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)