[Asia Economy Reporter Hwang Yoon-joo] Although the uncertainty surrounding the supplementary budget (추경) that had driven the rise in government bond yields has been resolved, concerns have been raised that volatility in the domestic bond market could increase as uncertainty over domestic and international monetary policies continues.

Jae-kyun Lim, a researcher at KB Securities, stated, "Following the remarks by Jerome Powell, Chair of the U.S. Federal Reserve (Fed), yesterday, the market volatility may increase during the 'blackout' period when Fed officials are prohibited from speaking until the May FOMC (Federal Open Market Committee)."

Researcher Lim pointed out, "Ahead of the May FOMC, Fed officials have been continuing their hawkish remarks. The increase in hawkish comments indicates that concerns about U.S. inflation are high even within the Fed."

Fed officials refrain from public comments during the ten days immediately preceding the FOMC regular meeting. This is called the 'blackout' period. This time, it is from May 23 to May 5.

Recently, Bullard, President of the St. Louis Fed, mentioned that the U.S. benchmark interest rate should reach 3.5% by the end of this year and also raised the possibility of a 75 basis points (bp) hike. The last time the Fed raised rates by 75bp was in 1994. Since Bullard is considered the most hawkish within the Fed, the likelihood of a rate hike as he suggested is low.

However, Researcher Lim explained, "Bullard's remarks cannot be ignored," adding, "He was the first within the Fed to advocate tapering and a 50bp rate hike after the pandemic, and the Fed's policy is gradually moving toward Bullard's stance."

Uncertainty over domestic monetary policy also persists. Lee Chang-yong, Governor of the Bank of Korea, mentioned concerns about long-term growth during his confirmation hearing but made it clear that in the short term, the focus of monetary policy is on inflation and household debt management rather than growth.

Meanwhile, concerns about domestic inflation are also rising. Researcher Lim diagnosed, "The IMF has revised upward South Korea's 2022 consumer price inflation forecast to 4.0% from the previous 3.1%. Based on the remarks by Acting Governor Joo Sang-young at the April Monetary Policy Committee meeting, it is expected that the Bank of Korea will also revise its consumer price inflation forecast to the 4% range in the upcoming revised economic outlook to be announced in May."

He further analyzed, "Although consumer prices rose by 4.1% in March, if the annual domestic consumer price inflation reaches the 4% range as mentioned by the IMF and the Bank of Korea, the peak of inflation has not yet been confirmed, since the average inflation rate from January to March was 3.8%."

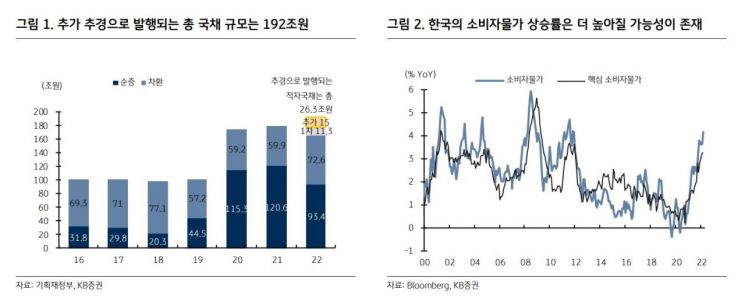

However, the uncertainty over the supplementary budget, which had driven the rise in domestic interest rates, is being resolved. The transition committee has reduced the supplementary budget size from the original 50 trillion won to 30-35 trillion won, and announced that 15 trillion won of this will be financed through deficit bond issuance.

Researcher Lim explained, "Although deficit bonds will be issued, the market had already factored in the issuance of deficit bonds, and with the guideline on the scale now announced, the uncertainty related to the supplementary budget is expected to be significantly reduced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)