Possibility of Trade Deficit for 2 Consecutive Months Grows... Deficit Widened 2.5 Times in a Year

High Energy Import Costs Due to Soaring Oil Prices... Crude Oil Up 83% YoY

'Zero COVID' China Lockdown Policy Also a Negative Factor... Korea's Export Damage Inevitable

March Exports and Imports Both Reach All-Time Monthly Highs... Trade Balance Returns to Deficit

March Exports and Imports Both Reach All-Time Monthly Highs... Trade Balance Returns to Deficit(Busan=Yonhap News) Reporter Kang Deok-cheol = On the 1st, container handling operations are underway at Gamman Pier, Busan Port. In March, South Korea's exports reached an all-time monthly high, driven by strong exports of semiconductors and petrochemicals. However, imports also increased to a record high, causing the trade balance to return to a deficit after one month. The Ministry of Trade, Industry and Energy announced on the 1st, through the 'March Export-Import Trends' report, that March exports recorded $63.48 billion, an 18.2% increase compared to the same month last year. 2022.4.1

kangdcc@yna.co.kr

(End)

<Copyright(c) Yonhap News Agency, Unauthorized reproduction and redistribution prohibited>

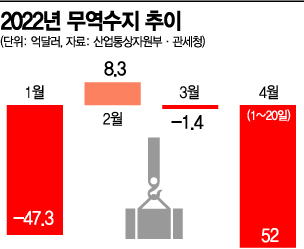

[Asia Economy Sejong=Reporter Lee Junhyung] The trade balance is likely to continue its deficit streak for the second consecutive month. This is due to the ongoing increase in energy import costs caused by high oil prices, as well as the lack of signs that the Ukraine crisis will subside. Additionally, China's large-scale lockdown policies in response to the spread of COVID-19 are prolonging, raising growing concerns that trade, the 'growth engine' of the Korean economy, may suffer a blow.

According to the Korea Customs Service on the 21st, the trade balance from the 1st to the 20th of this month was preliminarily recorded as a deficit of $5.199 billion. Imports amounted to $41.5 billion, up 25.5% compared to the same period last year, while exports increased by only 16.9% to $36.3 billion. Considering that the trade balance recorded a $2 billion deficit during the same period last year, the deficit has more than doubled in the past year.

Looking only at the export growth rate, the performance is not bad. Key export items such as semiconductors (22.9%), petroleum products (82%), and auto parts (3.9%) showed strong growth. Exports to major countries including the United States (29.1%), the European Union (12.3%), and Vietnam (37.2%) also increased compared to last year.

The problem is that energy import costs are soaring. Among major import items, the import growth rates of the three main energy sources?crude oil (82.6%), gas (88.7%), and coal (150.1%)?stood out. This is due to the sharp rise in international energy prices caused by geopolitical conflicts such as the Ukraine crisis. In fact, as of last month, the prices of major imported energy sources?crude oil (72%), gas (200%), and coal (441%)?have risen significantly compared to a year ago.

China's lockdown policies are also acting as a negative factor for the trade balance. Recently, China has locked down 45 major cities, including Shanghai, to prevent the spread of COVID-19. The large-scale lockdown policies in China, Korea's largest trading partner, inevitably lead to export damage as well as a surge in raw material prices due to supply chain instability.

The possibility of the trade balance recording a deficit for two consecutive months has increased. Previously, the trade balance turned positive in February, but due to the surge in energy prices, imports reached a record high last month, returning to a deficit within a month. With rising import price pressures caused by high oil prices, it is highly likely that the trade balance will continue to show a deficit this month as well.

Experts are also concerned about the impact on Korea's export-driven economy. Professor Jung In-gyo of Inha University's Department of International Trade said, "As the Ukraine crisis prolongs, adverse external trade factors are expected to continue for the coming months," adding, "The fact that major countries are implementing interest rate hikes and other policies due to inflation will inevitably have a negative impact on our exports."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.