All '3 Major Tax Items' Increased... 2% Growth Rate and Ukraine Crisis Keep Economic Uncertainty

Minimizing National Debt Issuance... 'Revenue Supplement + Expenditure Restructuring' to Accompany Around 35 Trillion Won Supplementary Budget Plan

[Asia Economy Sejong=Reporter Son Seon-hee] The shock of high inflation hitting after 11 years has resulted in national tax revenues being collected more than expected. This is due to a significant increase in value-added tax (VAT), which reflects inflation. Since VAT, one of the three major national taxes, inevitably increases as prices rise, excess tax revenue is expected to continue growing. The additional revenue will likely be used as funding for the supplementary budget (추경) to be announced by the new government launching next month through a revenue adjustment.

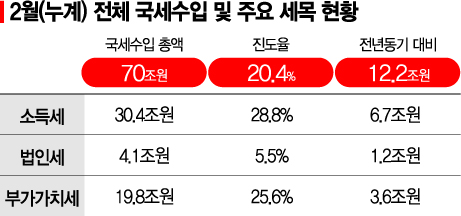

According to the 'Monthly Fiscal Trends' recently released by the Ministry of Economy and Finance on the 21st, the total VAT collected up to February was 19.8 trillion won, which is 3.6 trillion won more than the same period last year. The progress rate against the government's annual target (77.5 trillion won) reached 25.6%. This means that more than a quarter of the annual target was achieved in just two months. Total national tax revenue, including VAT, was 70 trillion won, an increase of 12.2 trillion won compared to the same period last year.

The increase in VAT includes a deferred VAT amount of 2.3 trillion won that should have been collected in October last year. However, even excluding this, VAT revenue is rising thanks to the recent recovery in consumption. VAT is imposed at 10% on the final price of goods or services, and as prices rise, VAT increases in tandem without any separate rate hike. With the full lifting of COVID-19 social distancing measures starting this month, consumption is expected to further revive, which will also impact tax revenue growth.

The Presidential Transition Committee plans to pursue revenue adjustments based on the higher-than-expected tax revenue. The size of the second supplementary budget is expected to be around 35 trillion won.

For the Yoon Seok-yeol administration to prepare a large-scale supplementary budget aimed at 'compensating for COVID-19 damages' promised to the public, revenue adjustments are inevitable. Amid rising interest rates and a policy to 'minimize government bond issuance,' the only feasible options are to cut existing spending plans or increase tax revenue estimates. However, the economic growth rate, a key variable in tax revenue forecasting models, is being revised downward to the 2% range, below the government's target, and there are internal concerns that it is premature to be confident about excess tax revenue.

According to the Transition Committee's COVID-19 Emergency Response Special Committee, a 'package support plan' including compensation for small business owners affected by COVID-19 will be finalized as early as next week. It is expected to include tailored cash support for accumulated small business damages, strengthened loss compensation measures, and additional quarantine support payments of up to 6 million won. Depending on the contents of this support plan, the scale of the second supplementary budget will also become clearer. Currently, there is discussion about including the first supplementary budget (16.9 trillion won) in the '50 trillion won supplementary budget' pledge made by President-elect Yoon Seok-yeol. This means the second supplementary budget is expected to be around 35 trillion won.

The issue is funding. According to officials from the Transition Committee and the Ministry of Economy and Finance, government bond issuance will be minimized considering rising interest rates and bond market stability. If the government issues a large amount of bonds again amid rising treasury bond yields, it would stimulate market interest rates such as bank bonds, ultimately raising loan interest rates and passing the burden onto the public. Deputy Prime Minister and Minister of Economy and Finance nominee Choo Kyung-ho has also voiced strong opposition to deficit bond issuance during his time as a member of the National Assembly.

To minimize government bond issuance, existing spending plans must be revised and revenue adjustments made considering excess tax revenue. The Budget Office of the Ministry of Economy and Finance is reportedly mobilizing all personnel to prepare intensive spending restructuring plans. However, since the government is accelerating fiscal execution to support economic recovery, there are limits to securing large supplementary budget funds through spending restructuring.

Therefore, a large-scale revenue adjustment is also expected to be used concurrently. Since the beginning of the year, strong recovery in the labor market has led to income tax, mainly from earned income tax, exceeding 30 trillion won in just two months. The progress rate is 28.8%. Considering VAT and other taxes linked to inflation, tax revenue this year is indeed optimistic.

However, due to significant domestic and international economic uncertainties such as Russia's invasion of Ukraine and interest rate hikes, there are concerns that it is too early to excessively raise the government's annual tax revenue forecast just after the first quarter. An official from the Ministry of Economy and Finance said, "To make revenue adjustments, clear evidence that tax revenue will increase is needed," adding, "At least the March tax revenue forecast should be reviewed before making a judgment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)