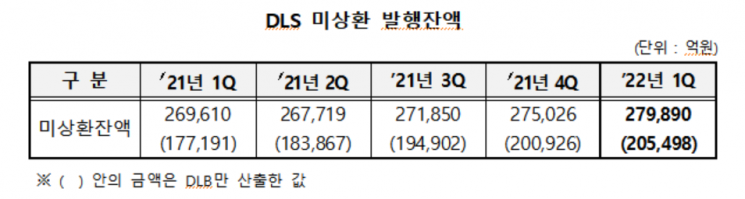

[Asia Economy Reporter Minji Lee] The Korea Securities Depository announced on the 20th that the outstanding balance of DLS unpaid as of the first quarter was 27.989 trillion KRW, an increase of 3.8% compared to the same period last year (26.961 trillion KRW).

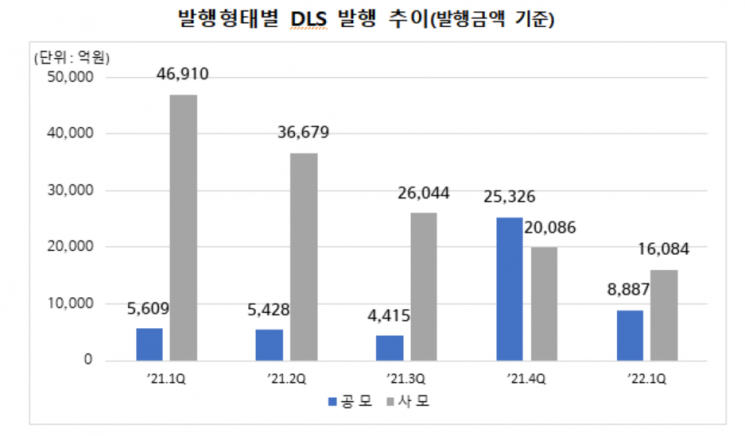

The issuance amount was 2.4917 trillion KRW, a decrease of 52.5% compared to the same period last year (5.2519 trillion KRW). By issuance type, public offerings accounted for 888.7 billion KRW (35.6%) and private placements accounted for 1.6084 trillion KRW (64.4%) of the total issuance amount. The public offering issuance amount increased by 58.4% compared to the same period last year (560.9 billion KRW), while the private placement issuance amount decreased by 65.7%.

By underlying asset type, issuance performance showed interest rate-linked DLS accounted for 58.1% of the total issuance amount, or 1.4505 trillion KRW, and credit-linked DLS accounted for 41.3%, or 1.0306 trillion KRW. These two types accounted for 99.4% of the total issuance amount, or 2.4811 trillion KRW.

Looking at the DLS issuance status by securities firms, a total of 18 firms participated in issuance, with Samsung Securities issuing the most at 406 billion KRW. The top five firms' DLS issuance amount was 1.4146 trillion KRW, accounting for 56.6% of the total issuance amount.

During this period, the repayment amount was 2.2365 trillion KRW,

a decrease of 59.8% compared to the same period last year (5.5612 trillion KRW). By repayment type, maturity repayments amounted to 1.5541 trillion KRW, accounting for 69.5% of the total repayment amount, while early repayments and mid-term repayments were 651.8 billion KRW and 30.6 billion KRW, respectively, accounting for 29.1% and 1.4% of the total repayment amount.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.