Average Subscription Competition Rate for Nationwide Officetels in Q1 This Year 10.5 to 1... 2.5 Times Higher Than Same Period Last Year

Real Demand Buyers Target Seoul Villas... 7,619 Sales in Q1 This Year

89.5% Are Under 60㎡ Exclusive Area... Popularity Due to Consideration for Exclusion from Taxation

[Asia Economy Reporter Jo Gang-wook] Warmth is returning to the officetel and villa markets, which had been sluggish for a while. This is interpreted as an effect of the new government’s consideration to exclude residential officetels and small villas from the taxable housing count.

According to an analysis of the Korea Real Estate Agency’s subscription website by real estate research firm Realtoday on the 20th, in the first quarter of this year, 40,356 people applied for subscriptions for 4,018 officetel units (15 complexes) nationwide, recording an average competition rate of 10.5 to 1. This is 2.5 times the competition rate of 4.2 to 1 in the first quarter of last year.

Last year, officetels enjoyed a spillover benefit as an alternative to apartments. According to the Ministry of Land, Infrastructure and Transport, the total sales amount of officetels last year was 13.6476 trillion won, an increase of 28.7% from 10.6028 trillion won a year earlier. The subscription competition rate also jumped from 13.14 to 1 in 2020 to 25.81 to 1 last year. However, concerns over a price drop due to overheating and the abolition of the rental business operator system by the current government led to some subscription shortages early this year. The expansion of various tax regulations and borrower-specific DSR (Debt Service Ratio) regulations, which previously applied only to apartments, to officetels in January this year also had an impact.

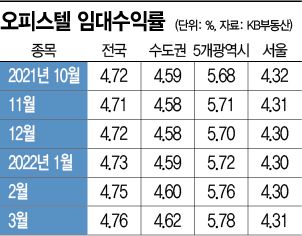

In February, the subscription competition rate for ‘Elcrew Seocho’ in Seocho-gu, Seoul, was only 0.7 to 1. Out of a total of 330 units, 108 units remained unsold. Also, according to KB Real Estate, the rental yield of officetels in Seoul, which was 4.41% in January last year, fell by 0.11 percentage points to 4.30% in December of the same year. This figure remained unchanged at 4.30% for three consecutive months until February this year. However, in March, when the presidential election took place, it slightly rose to 4.31%, showing the first reversal this year.

Additionally, actual demand buyers are flocking to the villa (multi-family housing) market in Seoul. In particular, the proportion of small-sized transactions with lower price burdens is increasing. According to an analysis of actual transaction price disclosure data from the Ministry of Land, Infrastructure and Transport by Real Estate R114, the number of villa sales in Seoul in the first quarter (January to March) of this year was 7,619. Among these, 6,818 units, or 89.5%, were under 60㎡ in exclusive area, showing an overwhelming proportion. On the other hand, sales of units over 60㎡ accounted for only 801 units, or 10.5%. Nine out of ten villa sales were small-sized, the highest figure for the first quarter since the actual transaction price survey began in 2006. The market expects the trend of increasing proportions of small villas to continue.

The reason why demand for officetels, which had been sluggish, is reviving and demand for small villas is surging is interpreted as being influenced by expectations of regulatory easing under the next government. Currently, the Presidential Transition Committee is considering excluding villas, multi-family houses, and residential officetels from the comprehensive real estate tax taxable housing count when registering rental business operators to stabilize the rental market. Villas and multi-family houses under 59㎡ and officetels up to 84㎡ are likely to be included. Currently, officetels are only excluded from the housing count for tax purposes such as capital gains tax when used as office space, thus avoiding tax surcharges. The transition committee’s plan is to expand the scope of small housing and reduce the holding tax burden on multi-homeowners to increase private rental supply. However, there is also concern that ‘gap investment’ may increase again in this case.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.