Platform Casa Public Offering Total Amount 24.2 Billion

Splitting Sales from Buildings to Hotels

Successive Challenges from Latecomers like LucentBlock and Funble

[Asia Economy Reporter Ryu Tae-min] The market for 'real estate fractional investment,' a method of investing in buildings in small amounts as if investing in stocks, is expanding its reach. Following the successive listings of office buildings, even commercial facilities such as hotels are now going public. Additionally, with two more exchanges opening in the first half of this year, their growth is expected to accelerate sharply.

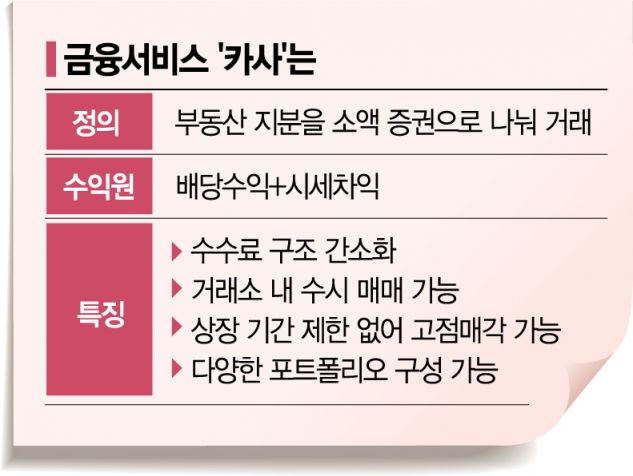

Real estate fractional investment is conducted by listing buildings on a trading platform, similar to how companies are listed on a stock exchange. Investors purchase 'Digital Asset-Backed Securities (DABS),' which represent shares of the building, and receive rental income benefits quarterly in proportion to their share, just like building owners.

The advantage is that ordinary individuals can invest small amounts in assets like buildings, which were previously exclusive to high-net-worth investors, without any separate management obligations. Furthermore, DABS have no restrictions such as fixed contract periods or redemption limits, allowing trading anytime on the platform exchange. The transaction fee is 0.2%, and income tax on capital gains is 15.4%.

The scale of listed assets and users in this market is steadily increasing. The total public offering amount on the trading platform 'Kasa' reached 24.27 billion KRW as of the 17th. Moreover, the number of application downloads, which was only 25,000 at the time of the first listing, has now exceeded 320,000. The number of registered members is 156,000, with the 20-30 age group accounting for 54%, surpassing half of all investors.

As the related market grows rapidly, the scope of public offerings is recently expanding to commercial real estate such as hotels. Kasa announced that it will conduct a public offering for the boutique hotel 'Le Lit' near Dongdaemun History & Culture Park Station over two days starting today. Considering that real estate fractional investment has so far focused on office buildings, this represents a challenge in a new field. In fact, Kasa has previously listed and offered four office buildings in areas such as Yeoksam, Seocho, and Yeouido.

Not only Kasa but also latecomers like LucentBlock and Funble are entering the market in partnership with major securities firms. LucentBlock, cooperating with Hana Financial Investment and Korea Investment & Securities, has been accepting pre-reservations via its application since last month and plans to launch its official service and reveal its first building this month. Funble, partnering with SK Securities, will also introduce its application service this month. They plan to offer highly scarce assets not previously handled as their first building. The public offering is scheduled for May to June.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.