Last Year, 3 Korean OTT Companies Recorded 150 Billion KRW Deficit

US Offers 25-35% Tax Credit on Production Costs

Production Support Significantly Lacking Compared to Major Countries

Despite Difficult Situation, Investment Continues

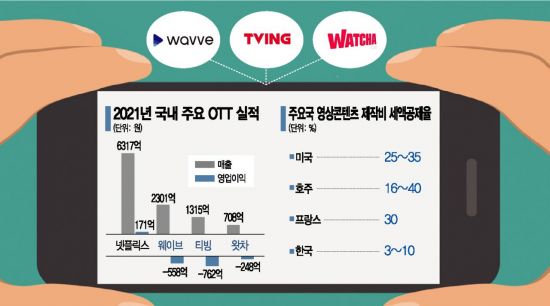

[Asia Economy Reporter Cha Min-young] While Netflix posted an operating profit of 17.1 billion KRW last year, three domestic native online video service (OTT) companies (Wavve, TVING, Watcha) recorded a total loss of 150 billion KRW, causing a shock. The OTT industry points out that the gap in tax credit rates for video content production between the U.S. and Korea is large, and that Korea falls short of the average of major countries.

Up to 40% Tax Credit for Production Costs in the U.S., Australia, etc.

According to the OTT industry on the 18th, compared to major countries such as the U.S., France, and Australia, support for video content production in Korea is significantly insufficient. The U.S., where most global OTT companies such as Netflix, Disney, and Amazon are located, provides a tax credit of 25-35% on content production costs. Australia offers 16-40%, and France about 30%. In Korea, according to Article 25 of the Restriction of Special Taxation Act, tax credit rates of 3% for large corporations, 7% for medium-sized enterprises, and 10% for small and medium enterprises are applied. The special tax law will sunset at the end of this year.

This is the background for calls in the market to increase the tax credit rate for video content production costs. Professors Koo Sung-kwon of Myongji College and Park Jong-soo of Korea University stated, "The current system is set very low compared to major countries, so it does not exert industrial ripple effects commensurate with the legislative intent," and added, "It is reasonable to raise the tax credit rates by company size to double, i.e., 6-20%." The Korea Economic Research Institute under the Federation of Korean Industries and the Korea Chamber of Commerce and Industry have also urged raising the tax credit rate for video content production costs to the level of major advanced countries and extending the sunset period of the Restriction of Special Taxation Act.

Korean OTTs Do Not Receive Tax Credits

Even so, domestic OTT companies are completely excluded from tax support because they lack legal status. They cannot receive tax credits when producing original content worth hundreds of millions of KRW. The 2021 tax law amendment bill submitted by the Ministry of Economy and Finance to the National Assembly included provisions to include OTT operators in the tax credit targets for video content production costs, but support is difficult because the legal status of OTT operators is not defined in the Broadcasting Act or the Film and Video Act.

An OTT industry official said, "It seems that some level of national support is needed not only for the final external production companies but also in the intermediate planning and development stages." Professor Koo said, "Reducing tax burdens will lead to securing investment capital and expanding investment, which in turn will secure the global competitiveness of content and re-spread the Korean Wave, establishing a virtuous cycle structure for national economic development and image."

"Continued Investment" Despite Large Losses

Netflix Services Korea's sales for the 2021 fiscal year were 631.7 billion KRW, a 52.0% increase from the previous year (415.5 billion KRW). Operating profit doubled to 17.1 billion KRW from 13.3 billion KRW. Most of the earnings are transferred to the headquarters. The fees paid by Netflix Korea to the group as distribution fees increased by 61.2%.

During the same period, the losses of domestic OTT companies grew larger. The total sales of the three companies Wavve, TVING, and Watcha were 432.4 billion KRW, far behind Netflix. The operating loss reached 156.8 billion KRW. Despite the difficult situation, all three companies plan to make large-scale investments. An OTT industry official said, "There is talk of OTT integration by the government, but the industry’s distant stance is because they want the tax credit amount raised to the level of competing countries and legal status granted to OTT operators," adding, "The home of K-content, Korea, must not lose its own platforms."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.