Korea Insurance Research Institute Emphasizes Need to Develop Specialized Insurance for Foreigners in Korea

[Asia Economy Reporter Changhwan Lee] The growth rate of insurance subscriptions among foreigners registered in Korea significantly surpasses that of native Koreans.

According to the Insurance Research Institute's report titled 'Status and Implications of Insurance Subscriptions among Foreigners Registered in Korea' on the 17th, the number of foreigners residing in Korea reached approximately 2.52 million in 2019, accounting for 4.9% of the total population.

Among foreigners residing in Korea, those who stayed for more than 91 days and registered as foreigners numbered 1.272 million in 2019 and 1.146 million in 2020, showing an increase. This represents about 2.5% of the total population.

As of 2020, among registered foreigners in Korea, males accounted for 651,000 (56.9%) and females 494,000 (43.1%), with males having a higher proportion.

By age group, people in their 20s and 30s made up about 57% of all registered foreigners, and by nationality, Korean-Chinese and those from Asian regions (mainly China and Vietnam) constituted the majority of registered foreigners in Korea.

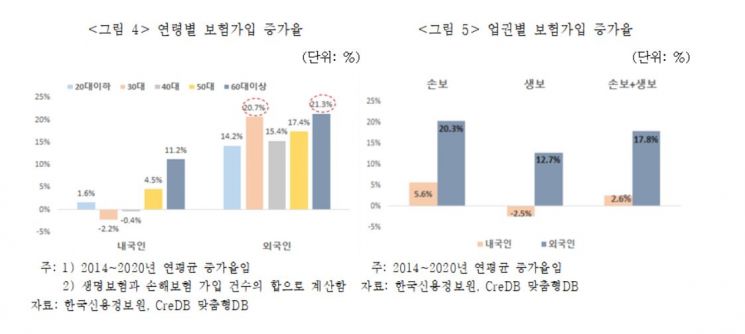

From 2014 to 2020, the growth rate of insurance subscriptions among foreigners was higher than that of native Koreans.

The combined growth rate of life and non-life insurance subscriptions among foreigners was 17.8%, significantly exceeding the 2.6% growth rate among native Koreans. When comparing by sector, the growth rate of non-life insurance was higher than that of life insurance.

Overall, the insurance subscription growth rate among foreigners was higher than that of native Koreans across all age groups, with particularly notable increases in the 30s (20.7%) and those aged 60 and above (21.3%).

Comparing the proportion of insurance subscriptions by product type as of 2015, foreigners had an approximately 11 percentage point higher subscription rate for disease insurance compared to native Koreans, while the proportion of accident insurance was slightly higher by 0.1 percentage points.

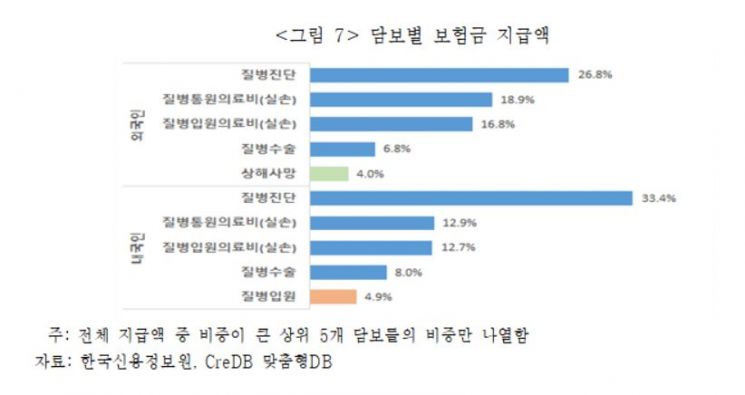

When comparing the proportion of insurance payouts by coverage type between foreigners and native Koreans, the top four coverages by payout amount?disease diagnosis, outpatient medical expenses, inpatient medical expenses, and disease surgery?were the same for both groups. However, foreigners received more payouts for outpatient and inpatient medical expenses compared to disease diagnosis and surgery than native Koreans.

The Insurance Research Institute explained that considering these characteristics of registered foreigners in Korea, insurance companies need sales strategies focused on products and channels that young people require. They also emphasized the necessity of operating foreigner-friendly sales channels that can overcome language and cultural barriers.

The foreign market, with a high proportion of young people in their 20s and 30s, is expected to appeal to protection-type products that allow individuals to select necessary coverage themselves to reduce premium burdens, as well as pension products for retirement preparation. A channel strategy enabling self-directed insurance subscription is also deemed necessary.

Considering that foreigners mainly come from specific regions such as Korean-Chinese and other Asian areas, it is also necessary to operate foreigner-friendly sales channels that reflect their cultural characteristics and improve their understanding of insurance, along with language support.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.