Linked to Specific Legal Tender Value

Trading Volume 2.11 Times That of Bitcoin

Investment Increases as Volatility Grows

[Asia Economy Reporter Lee Jung-yoon] As inflation impacts increase volatility in the cryptocurrency market, investment funds are flowing into stablecoins. Stablecoins are cryptocurrencies pegged to the value of fiat currencies such as the US dollar.

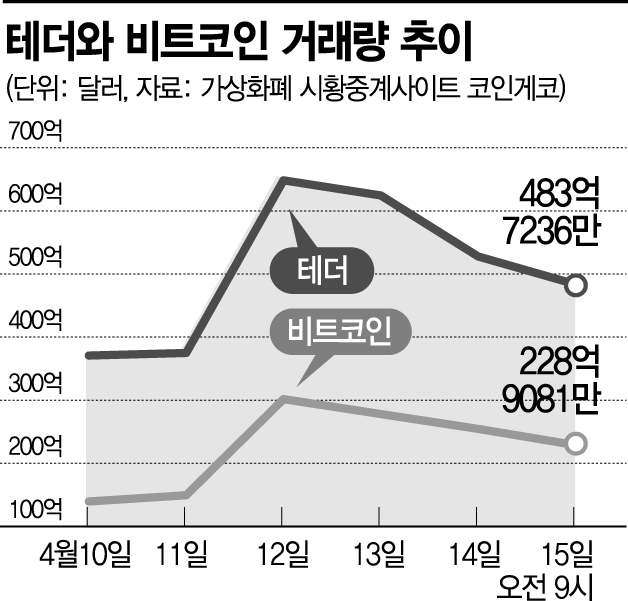

According to cryptocurrency market tracking site CoinGecko as of 9 a.m. on the 15th, the 24-hour trading volume of the leading stablecoin Tether reached $48.37236 billion (approximately 59.5174 trillion KRW). During the same period, Bitcoin’s trading volume was $22.89081 billion (approximately 28.1626 trillion KRW). Another stablecoin, USD Coin, had a trading volume lower than Bitcoin’s but still traded about $7.9159 billion (approximately 9.7437 trillion KRW).

Stablecoins serve as a base currency in the cryptocurrency market, used to purchase other cryptocurrencies. Unlike Korea, most overseas cryptocurrency exchanges trade coins not with fiat currencies but with stablecoins, where users first convert their local currency into stablecoins and then use those stablecoins to buy other coins. Tether and USD Coin are designed to maintain a value of 1 dollar. For this reason, as the cryptocurrency market grows, the trading volume of stablecoins has also increased.

Recently, with increased volatility in the cryptocurrency market, stablecoins have gained more attention as a hedging tool. On the 12th, when the US Consumer Price Index (CPI) for March surged to record highs, the Federal Reserve (Fed) announced a 'big step' of raising the benchmark interest rate by 0.5 percentage points at once, shocking the cryptocurrency market. At that time, Ethereum, the leading altcoin, plunged about 9%. Ripple and Solana also dropped more than 8% and 12%, respectively. Bitcoin’s price fell about 6% due to uncertainty. On that day, Bitcoin’s trading volume increased by $15.23235 billion (approximately 18.745 trillion KRW) compared to the previous day, while Tether’s surged nearly twice as much to $27.36331 billion (approximately 33.676 trillion KRW).

This is explained by the increased demand for stablecoins, which are perceived as safe assets amid rising volatility. Professor Hong Ki-hoon of Hongik University’s Department of Business Administration said, “If the money in the cryptocurrency market does not return to the fiat currency market, it is highly likely that during times of volatility, investors will move to stablecoins to hedge. It is similar to moving to the dollar or gold when problems are expected in the stock market.”

Another reason stablecoins are seen as safe assets is that they can be deposited in DeFi platforms to earn interest. Stablecoins offer much better interest rates than putting US dollars in a bank account. For example, depositing USD Coin in the DeFi lending and borrowing service AAVE yields an annual interest rate of 5.59% (as of September 24), DAI yields 4.16%, and Tether yields 3.12%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.