Transaction Value Down 25.4% YoY

1Q Brokerage Revenue Decline

Bond Valuation Losses Up... Impact of Interest Rate Hikes

1Q IPOs Completed with LG Ensol Listing

[Asia Economy Reporter Hwang Yoon-joo] Major securities firms are expected to see a significant decline in earnings this first quarter due to the absence of individual investors and losses from bond investments caused by interest rate hikes.

According to FnGuide on the 15th, Mirae Asset Securities' operating profit consensus for Q1 this year is projected at 299.2 billion KRW, a 28.61% decrease compared to the same period last year. NH Investment & Securities (179 billion KRW, -52.19%), Samsung Securities (280 billion KRW, -29.88%), Korea Financial Group (349.5 billion KRW, -27.94%), and Kiwoom Securities (262 billion KRW, -24.55%) are also expected to see declines.

This contrasts with most securities firms recording their highest quarterly earnings ever in Q1 last year. The decline in performance is attributed to reduced brokerage revenue and losses in bond management.

Trading volume in Q1 this year was 19.1709 trillion KRW, down 25.4% from 25.7039 trillion KRW in the same period last year. Due to the sluggish stock market, individual investors' trading volume decreased, leading to an expected reduction in brokerage revenue.

Jeon Bae-seung, a researcher at Ebest Investment & Securities, explained, "A decline in brokerage commission revenue in Q1 is inevitable," adding, "The average daily trading volume by individuals in Q1 was 13.3 trillion KRW, about half of the 25 trillion KRW in the same period last year."

In particular, the bond management division is expected to incur even greater losses this year following last year. As the pace of base interest rate hikes has accelerated faster than expected, bond prices are projected to fall further this year.

On March 16 (local time), the U.S. raised its base interest rate by 0.25 percentage points for the first time in 3 years and 3 months. Since then, Federal Reserve Chairman Jerome Powell has strongly indicated a tightening stance, hinting at a 'big step' (a 0.5 percentage point increase in the base rate at once) in May.

In Korea, on the 11th, the 3-year government bond yield (3.186%) surpassed the 30-year bond yield (3.146%) for the first time ever, causing an inversion of short- and long-term yields.

When bond yields rise sharply due to interest rate hikes, the prices of held bonds fall, resulting in valuation losses. Although securities firms have been reducing their bond holdings since last year in anticipation of rate hikes, bond valuation losses have reportedly increased. NH Investment & Securities is estimated to have relatively large bond valuation losses.

Lee Hong-jae, a representative from Hana Financial Investment, stated, "The 1-year and 3-year government bond yields rose by +47 basis points and +87 basis points respectively compared to the end of last year, and the early redemption amount of ELS was 4.4 trillion KRW, down 77.6% from the previous year."

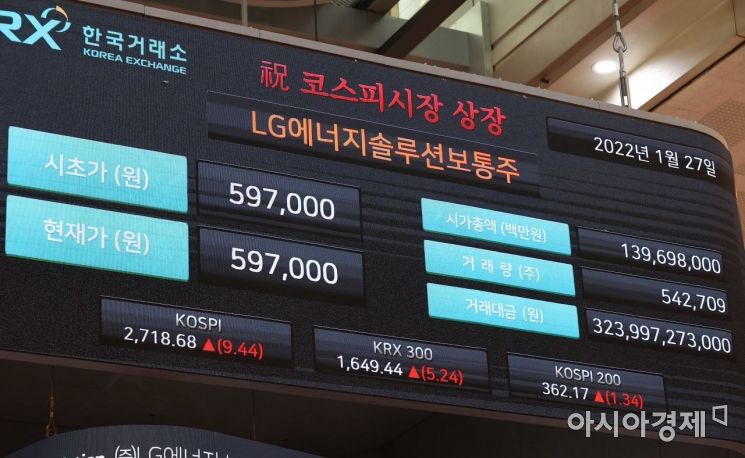

On the morning of the 27th, at the Korea Exchange in Yeouido, Seoul, the opening price of 597,000 won was displayed on the electronic board during the KOSPI listing ceremony of LG Energy Solution. LG Energy Solution's market capitalization is 112.32 trillion won, surpassing SK Hynix to claim the 2nd place in market capitalization rankings. Photo by Kang Jin-hyung aymsdream@

On the morning of the 27th, at the Korea Exchange in Yeouido, Seoul, the opening price of 597,000 won was displayed on the electronic board during the KOSPI listing ceremony of LG Energy Solution. LG Energy Solution's market capitalization is 112.32 trillion won, surpassing SK Hynix to claim the 2nd place in market capitalization rankings. Photo by Kang Jin-hyung aymsdream@

However, IPO (Initial Public Offering) revenue in Q1 this year is expected to be decent. The public offering amount in Q1 reached 13.4 trillion KRW, the highest ever for a first quarter, thanks to the listing of LG Energy Solution, which set a new record in IPO history.

The real estate PF (Project Financing) sector is expected to benefit from a base effect. In February 2021, financial authorities regulated securities firms' real estate PF loans through the 'Plan to Revitalize Corporate Finance by Securities Firms.' Kang Seung-geon, a researcher at KB Securities, analyzed, "Due to an increase in structured finance-related transactions, IB-related fee income is expected to increase by 8.4% compared to the previous quarter."

An industry insider said, "Securities firms' earnings in Q1 this year are worse than last year in brokerage, bond management, and alternative investments," adding, "Due to increased index volatility caused by interest rate hikes, an overall decline in earnings this year is inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)