Developers Postpone Sales Amid Home Price Decline Theories and High Pre-sale Price Controversies

Sales Market Expected to Revive Only After New Government Launch in May

Ongoing Uncertainty Raises Concerns Over Large-scale Unsold Inventory Crisis

[Asia Economy Reporter Kangwook Cho] March and April are the peak seasons for the housing pre-sale market, but this year, developers are postponing pre-sales, causing the market landscape to differ from previous years. This is due to the deepening housing transaction freeze since the second half of last year, which has led to a surge in unsold units. The resumption of pre-sale schedules and market revitalization are expected to become clearer only after the new government takes office and policy uncertainties are resolved.

According to industry sources on the 14th, several areas including Imun 1 District (3,069 households), Imun 3 District (4,321 households), Daecho 1 District in Eunpyeong-gu, Bomun 2 District in Seongbuk-gu, and Imun 3 District in Dongdaemun-gu have recently postponed their pre-sale schedules. Amidst falling housing prices and controversies over high pre-sale prices, cases where applicants fill out subscription forms but remain uncontracted have become frequent, breaking the 'Seoul subscription invincibility' formula, leading developers to delay pre-sale schedules.

According to Korea Real Estate Board's Subscription Home, Cantavil Suyu Palace in Seoul, which was pre-sold on the 2nd of last month, had about 198 out of 216 households (approximately 92%) remain uncontracted, prompting a non-priority subscription on the 11th. However, even in this round, 5 out of 22 types failed to meet their recruitment quotas. In Mia-dong, Gangbuk-gu, the 'Buk Seoul Xi Polaris' (Mia 3 District redevelopment), which attracted attention as Seoul's first pre-sale this year, had 18 uncontracted units in the January pre-sale, leading to a non-priority subscription at the end of last month.

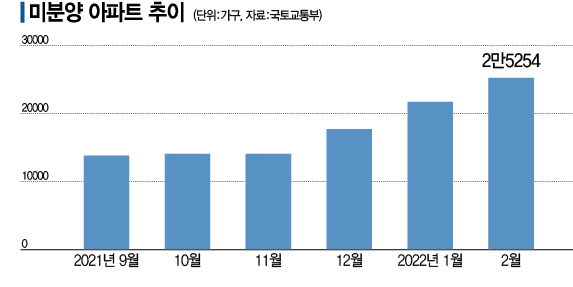

Unsold units nationwide have also surged this year. As of the end of last year, the nationwide unsold units stood at 17,710 households, increasing by 42% to 25,254 households as of the end of February this year. This marks an increase of over 3,000 units per month for three consecutive months from 14,094 units in November. Unsold units mainly occurred in provincial areas, especially increasing around Chungbuk and Daegu. Compared to the end of last year, unsold units increased by ▲Chungbuk 189% ▲Daegu 130% ▲Gyeonggi 80% ▲Chungnam 56% ▲Gyeongbuk 49%.

According to a survey by real estate research firm Real Today, regions that failed to close first-priority subscriptions in complexes nationwide during the first quarter this year were mainly provincial areas such as Daegu, Ulsan, Jeonnam, Jeonbuk, and Jeju. Although to varying degrees, the metropolitan area is no exception. Unsold units in the metropolitan area increased by 74.9% (993 units) from the previous month to 2,318 units in February. Unsold units are accumulating mainly in outer areas of Gyeonggi Province such as Anseong City (1,068 units), Hwaseong City (236 units), and Yongin City (222 units).

The market expects that with the new government's regulatory easing policies, the pre-sale market could gain momentum after the government takes office in May. Seungjun Kim, an analyst at Hyundai Motor Securities, said, "Developers need to start pre-sales after regulatory easing appears to significantly reduce risks," adding, "Since unsold units are currently occurring in some areas, the tendency to postpone pre-sales until after policy changes will become stronger."

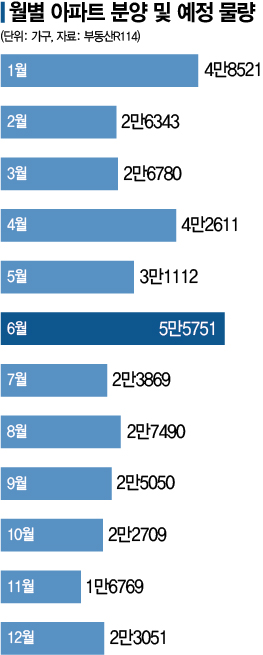

According to Real Estate R114, June is scheduled to have the largest pre-sale volume this year with 55,751 households. Additionally, pre-sales postponed from the first quarter are expected to proceed, likely increasing the volume further. Once policy uncertainties are resolved, the pre-sale market is expected to heat up from this summer. However, if uncertainties persist due to political disputes even after the new government takes office, there is a risk that the flooded supply could lead to a large-scale surplus of unsold units.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.