20 Major Automakers Including Tesla Forecast More Conservative Targets

"Cannot Ignore Risks in Charging Infrastructure, EV Production Costs, and Parts Supply Chain"

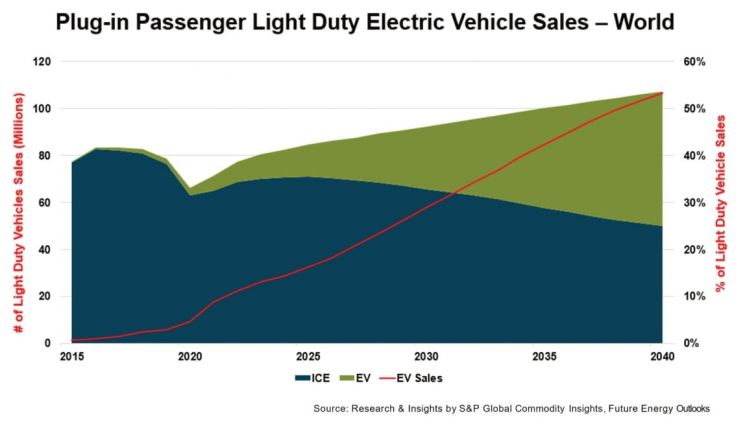

[Asia Economy Reporter Moon Chaeseok] A global energy analysis company has projected that the market share of electric vehicles (EVs) in the automobile market will reach around 30% in eight years. This is a conservative figure, only about half of the 56% target set by the automotive industry. The point at which EV sales surpass internal combustion engine vehicles is also expected to be in 2040, not 2030 as targeted by the industry. This indicates that there are still many challenges to overcome, such as charging infrastructure, EV production costs, and parts supply chains.

On the 14th, S&P Global Platts reported that last year, EV sales for light-duty vehicles (LDVs) reached 6.29 million units, accounting for 8.9% of the total vehicle market. This figure is about double (102%) compared to 2020 and roughly triple compared to 2019, marking a record high.

Notably, Platts forecasted that the EV share will only surpass that of internal combustion vehicles by 2040. According to the goals set by major automakers like Tesla, EVs should outsell internal combustion vehicles by 2030.

Platts expects EV sales to reach 27 million units in 2030, about 30% of the total vehicle market, and 57 million units in 2040, about 54%. These figures fall far short of the targets set by 20 major automakers?including Tesla, Volkswagen, BYD, Hyundai Motor, and Kia?who aim for 46 million units (56%) in 2030 and 80 million units (84%) in 2040. Among these 20 companies, 5 (25%) plan to achieve 100% EV transition by 2030, and 12 (60%) by 2040, indicating a rapid pace of business transformation, but Platts believes these targets will not be met.

Platts cited charging infrastructure, EV production costs, and risks in parts supply chains as reasons for their conservative outlook. They stated, "There are still obstacles preventing consumer demand from meeting the sales targets set by automakers." David Kappati, an EV analyst at Platts, explained, "For consumers to choose EVs without hesitation, charging stations need to be expanded and the price gap with internal combustion vehicles must be reduced. Government roles such as subsidy support are crucial." He added, "Considering that key components like batteries and semiconductors are procured from countries in different time zones, which lengthens production times, it is necessary not only to strengthen production capacity at regional plants but also to achieve organic coordination across supply chains."

Platts analyzed that raw material supply shortages are acting as obstacles to lowering EV production costs. The rising price of battery packs makes it more difficult to reduce EV prices. Battery packs account for about 30% of an EV's price. According to Platts, last month, prices for lithium hydroxide, lithium carbonate, cobalt sulfate, and nickel sulfate rose by 33.2%, 16.8%, 3.6%, and 21.5% respectively compared to the previous month. The price of nickel-cobalt-manganese (NCM) battery packs increased by an average of 25%. The upward trend, which has continued since last year, shows no signs of abating. As a result, companies such as Tesla, BYD, and X-peng have raised prices of their EV models by $900 to $3,000.

However, Platts also acknowledged that internal combustion vehicles have been in decline since peaking in 2016, and the rapid growth of EVs, which has become the mainstream, will continue. They reported that major automakers are strengthening cooperation with domestic battery companies such as LG Energy Solution and SK On to respond to rising battery prices and build parts supply chains. According to Platts, Ford has agreed to jointly invest 10.5 trillion KRW with SK On to build an EV battery factory in the United States. General Motors (GM) is constructing three battery joint venture plants with LG Energy Solution.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)