GM Signs Cobalt Supply Contract with Australian Mining Company for EV Batteries

Ford Also Moves to Secure Lithium... Musk Says "May Need to Enter Direct Mining"

[Asia Economy Reporter Jeong Hyunjin] As raw material prices soared due to the impact of COVID-19 and the Ukraine war, global automakers are facing an emergency to secure key raw materials such as cobalt, nickel, and lithium. The rise in raw material prices is contributing to the increase in electric vehicle prices.

According to the Wall Street Journal (WSJ) on the 12th (local time), General Motors (GM) announced that it had signed a cobalt supply contract with Australia's Glencore PLC for use in batteries. GM plans to use this cobalt in its self-developed batteries for the electric pickup trucks Chevrolet Silverado and GMC Hummer, which were unveiled this year. Although the specific scale was not disclosed, GM plans to produce 1 million electric vehicles annually in North America by the end of 2025. Glencore has already signed cobalt supply contracts with Tesla and BMW.

GM's contract news came a day after Ford announced a preliminary contract to purchase lithium produced at facilities in Argentina from Australian mineral company Lake Resources. In February, Jim Farley, CEO of Ford, had revealed that discussions were underway to secure supply chains for key battery raw materials such as lithium and nickel, suggesting that this deal had been under consideration at that time. Ford plans to use lithium in its electric vehicle batteries.

The reason the automotive industry is putting so much effort into securing key battery raw materials is that it is nurturing electric vehicles as a core industry. The industry expects the electric vehicle market value to exceed $5 trillion (approximately 6155 trillion KRW) over the next decade. WSJ reported, "Automakers, who have set aggressive targets to accelerate electric vehicle sales, are deeply concerned about the rising prices of raw materials such as cobalt, lithium, and nickel," adding, "Prices are rising due to increased demand, and new supply chain issues have emerged due to the Ukraine war."

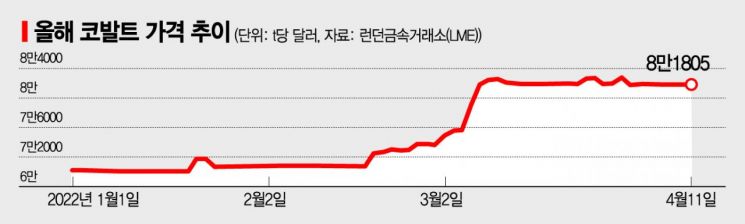

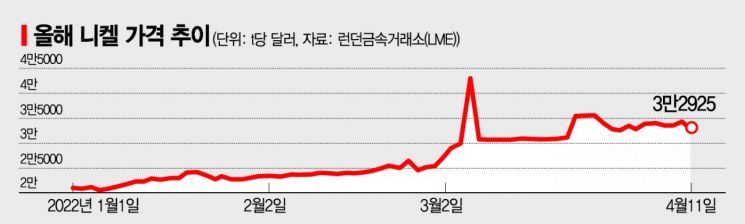

According to the London Metal Exchange (LME), the price of cobalt, a key raw material used in electric vehicle batteries, was around $42,000 per ton in October last year but has surpassed $81,000 as of the 11th. Nickel, which had not exceeded $20,000 per ton until the first half of last year, surged to around $33,000 on the 11th. Amid ongoing supply and demand disruptions caused by COVID-19, cobalt prices rose 12% and nickel prices rose 26% within about a month following Russia's invasion of Ukraine this year.

When raw material prices rise, product prices inevitably increase as well. Tesla, the world's largest electric vehicle manufacturer, has already raised electric vehicle prices considering the sharp rise in raw material costs. Tesla CEO Elon Musk recently tweeted, "Lithium prices have reached crazy levels. If lithium prices do not improve, Tesla may have to get directly involved in actual mining and refining," adding, "Lithium itself exists all over the Earth, so there is no shortage, but the extraction and refining speed is slow."

Toyota Motor recently stated that the price increases of cobalt, lithium, and other materials will raise vehicle prices and that this is an unavoidable situation. U.S. electric vehicle startup Rivian also noted in its annual report last year that cost increases due to rising prices of lithium, nickel, and cobalt would pose a burden on its business and predicted significant volatility ahead.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.