Entering Large-Cap Bargain Buying

KOSPI Moves to Support Downside

Individual Investors Net Buying Overall

82% in Top Market Cap Stocks

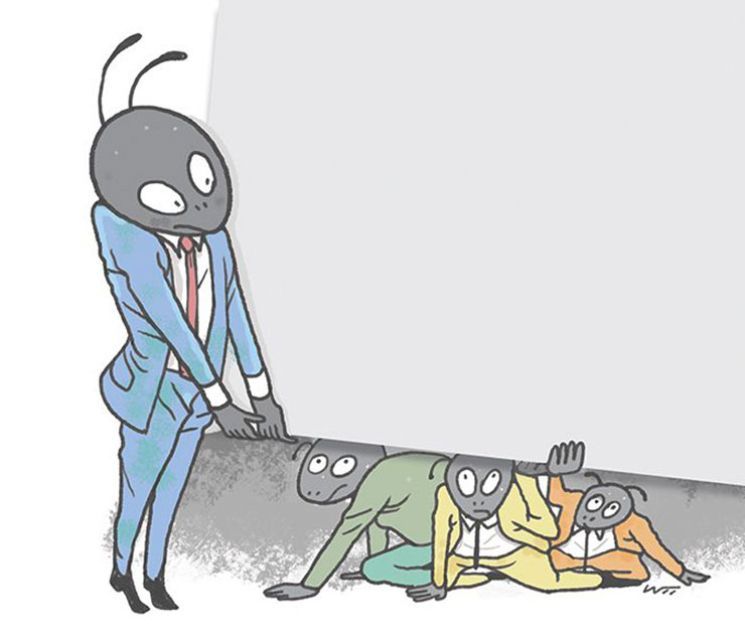

[Asia Economy Reporter Minji Lee] The power of retail investors, known as Donghak Ants, is growing stronger. Individual investors have poured more than 3.3 trillion won into the top 10 KOSPI market capitalization stocks this month alone. This is analyzed as a move to buy at low prices as major large-cap stocks, including Samsung Electronics, the largest market cap company in Korea, saw significant price drops.

According to the Korea Exchange on the 12th, as of the 11th, individual investors have accumulated stocks in the domestic market in the order of Samsung Electronics (2.2354 trillion won), SK Hynix (484.1 billion won), NAVER (235.3 billion won), Kakao (195.5 billion won), and Samsung Electronics Preferred (179.1 billion won). The money invested in these stocks alone approaches 3.3496 trillion won. During the same period, individuals net purchased 4.051 trillion won worth of stocks in the KOSPI market, with 82% of that amount flowing into the top 10 large-cap stocks by market capitalization.

Recently, the KOSPI fell more than 2%, dropping to the 2600 level. Last month, it seemed to be trading around the 2750 level, but the prolonged war between Russia and Ukraine and the Federal Reserve’s drive to normalize monetary policy suppressed investment sentiment toward risk assets.

Despite this situation, individuals stepped in to support the downside of the index. Except for one day on the 4th, individuals have continued net buying this month. Meanwhile, foreigners and institutions sold stocks worth 1.972 trillion won and 291.7 billion won, respectively.

The basis for individuals buying domestic stocks can be found in the lowered valuations. A low valuation means that stock prices are low relative to corporate value, making them attractive investments. Individuals believe that despite stable earnings from large-cap stocks, stock prices have fallen excessively due to the uncertain external environment.

Samsung Electronics, the most purchased stock by individuals, has struggled to recover to the 70,000 won level after falling more than 3% in the past month. The biggest cause is attributed to foreign investors’ sell-offs. Concerns have grown that prolonged inflation could significantly dampen consumption of IT durable goods, overshadowing the positive factor of “record-high sales in Q1 this year.”

Lee Seung-woo, a center director at Eugene Investment & Securities, analyzed, “Due to concerns about the external environment, it is difficult for the current stock price to gain upward momentum in the short term, but considering the solid earnings and low valuation, the potential for a rebound is greater than further decline.”

In the case of NAVER, although Q1 earnings are expected to be somewhat low due to the traditional off-season effect, growth is anticipated to continue. The stock price plunged 6% over the past month. The company is expected to see notable growth in its search platform business, supported by display advertising revenue growth, and in its content division centered on webtoons and Snow. The current price-to-earnings ratio (PER), which measures valuation, stands at about 27 times, lower than the past five-year average of 32 times.

Kakao fell 9% in a month, dropping below the 100,000 won level again, prompting more individuals to “pick up” shares. Kim Hyun-yong, a researcher at Hyundai Motor Securities, advised focusing on long-term earnings rather than short-term results, explaining, “Attention should be paid to the expansion of overseas-centered businesses such as webtoons, global operations, K-POP overseas concerts, and album sales.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.