Ssangbangwool and KG Group Reveal Acquisition

Individuals Buy Shares Worth 7.38 Trillion KRW

Net Purchase Amount Reaches 128.5 Billion KRW

Foreigners and Institutions Net Sell 45.3 Billion KRW and 41.6 Billion KRW Respectively

Some Question the Acquisition Capability of the Two Groups

Concerns Over 1 Trillion KRW Fundraising

[Asia Economy Reporter Lee Myunghwan] The stock prices of companies related to Ssangyong Motor, which is seeking a new owner, have been showing large fluctuations day after day. In this process, individual investors have poured over 7 trillion won into companies that have expressed their intention to acquire Ssangyong Motor. This contrasts with foreigners and institutions who have been net sellers of these stocks during the same period. Experts advise cautious investment due to the high uncertainty from the actual acquisition to normalization.

On the 11th, an analysis by Asia Economy of data from the Korea Exchange revealed that after Ssangbangwool Group and KG Group announced their intention to acquire Ssangyong Motor, individual investors bought stocks related to these companies worth 7.38 trillion won. The net purchase amount, calculated by subtracting sales from purchases, also reached 128.5 billion won. This contrasts with foreigners and institutions who were net sellers of 45.3 billion won and 41.6 billion won respectively during the same period.

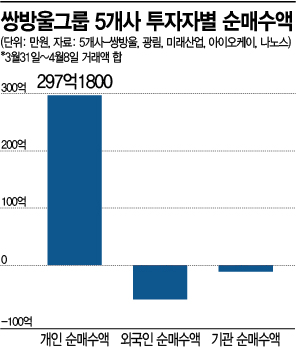

Immediately after Edison Motors’ acquisition fell through, Ssangbangwool Group, which announced its participation in the acquisition battle, attracted over 4 trillion won from individual investors. From the 31st of last month to the 8th, individual investors purchased 4.21 trillion won worth of stocks in five affiliated companies (Ssangbangwool, Gwanglim, Mirae Industry, IOK, Nanos). Gwanglim, which took the lead as the acquisition entity, alone attracted 1.55 trillion won in individual purchases. During this period, the net purchase amount of Ssangbangwool affiliated stocks by individuals was 29.718 billion won, which stands out compared to foreigners (-5.97 billion won) and institutions (-1.113 billion won).

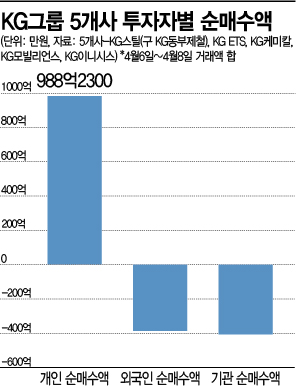

Similarly, KG Group, which also entered the Ssangyong Motor acquisition battle, attracted strong investment sentiment from individual investors. From the 6th to the 8th, when KG Group’s acquisition plans became known, individuals purchased 3.17 trillion won worth of related stocks (KG Steel (formerly KG Dongbu Steel), KG ETS, KG Chemical, KG Mobilians, KG Inicis). This amount corresponds to 7.34% of the total individual purchase amount of approximately 43 trillion won in the KOSPI and KOSDAQ markets during the same period. While foreigners and institutions were net sellers of 39.3 billion won and 40.4 billion won respectively in these stocks, individuals were the only group to be net buyers with 98.8 billion won.

However, some raise doubts about their acquisition capability. Concerns exist about whether they can secure funding as the acquisition price of Ssangyong Motor is expected to exceed 1 trillion won. Amid the sharp rise in related companies’ stock prices, it was found that Mirae Industry, an affiliate of Ssangbangwool, sold shares of another affiliate, IOK, realizing capital gains, which has increased investors’ concerns.

The financial authorities have announced plans for thorough investigations targeting the large daily fluctuations in related stocks. On the 6th, Financial Supervisory Service Governor Jeong Eun-bo stated at an executive meeting, "We will focus investigative capabilities to respond swiftly to specific theme stocks showing abnormal price movements during the sale of insolvent companies, and strictly take action against any discovered illegal activities."

Experts advise cautious approaches when investing in related stocks. They explain that not only should the acquisition decision process be observed, but also that it will take a long time for Ssangyong Motor to generate substantial profits after acquisition, making the uncertainty high. Hwang Sewoon, Senior Research Fellow at the Korea Capital Market Institute, said, "It seems many individual investors have vague expectations that stock prices will rise rather than making judgments about the actual possibility of acquisition," adding, "Hasty investments as if investing in theme stocks can lead to dangerous outcomes, so careful decisions are necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.