[Asia Economy Reporter Hwang Yoon-joo] KB Securities has forecasted that the domestic interest rate will peak at 3% within the next three years.

According to KB Securities on the 10th, researcher Lim Jae-kyun stated, "Based on past cases, we estimate the peak of the domestic 3-year interest rate to be 3%."

The current peak spread between the 3-year government bond and the base interest rate is 166 basis points. Researcher Lim estimated the domestic interest rate peak to be in the 3% range based on the period most similar to the present, 2004-2005.

He explained, "In the early 2000s, due to domestic and international uncertainties, the Bank of Korea lowered the base interest rate to 3.25%, but the economy did not recover, and inflation was below the target. However, the rise in asset prices such as real estate was problematic."

Researcher Lim said, "The Bank of Korea was reluctant to raise interest rates, but the market began to expect rate hikes because the rapid rate increases in the U.S. caused the U.S.-Korea base interest rates to invert." Due to the heightened market expectations for rate hikes at that time, the spread between the 3-year government bond and the base interest rate expanded to 177 basis points in December 2005.

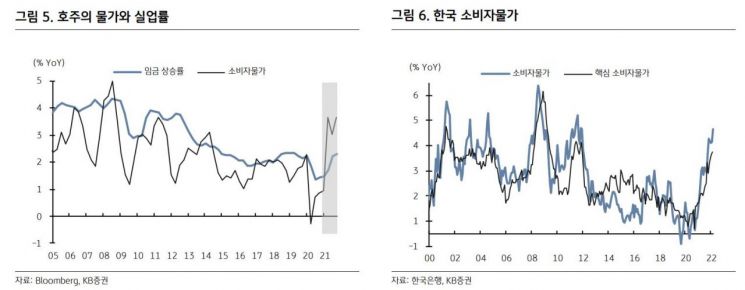

Researcher Lim pointed out, "Depending on the results of the U.S. March consumer price index on April 12, Australia's March unemployment rate on April 14, and Australia's first-quarter consumer price index announced on April 27, the domestic bond market could be affected." This is because there is a possibility that the Federal Reserve will consecutively raise rates by 50 basis points, and the Reserve Bank of Australia (RBA) may increase rates in May.

Researcher Lim evaluated, "However, since the Bank of Korea has already implemented three rate hikes, applying the 2005 spread between the 3-year government bond and the base interest rate suggests that the 3-year government bond rate is already at a peak level."

Nevertheless, he analyzed, "From a supply and demand perspective, with the expansion of bond issuance compared to the past and uncertainties such as the new government's supplementary budget, the spread between the 3-year government bond and the base interest rate could widen more than in 2005. It should also be considered that the proportion of foreigners in the Korean bond market was less than 1% in 2005 but has risen to 8.3% now."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.