Belgian protesters urging climate change measures on the opening day of COP26. The photo and article content are unrelated. [Image source=Yonhap News]

Belgian protesters urging climate change measures on the opening day of COP26. The photo and article content are unrelated. [Image source=Yonhap News]

[Asia Economy Reporter Myunghwan Lee] As the U.S. Securities and Exchange Commission (SEC) announced its policy to mandate climate disclosures, securities analysts have suggested that a company's high carbon efficiency could serve as a competitive advantage.

On the 10th, DB Financial Investment analyzed that investors will be able to verify specific information, including emissions, when assessing a company's climate risks.

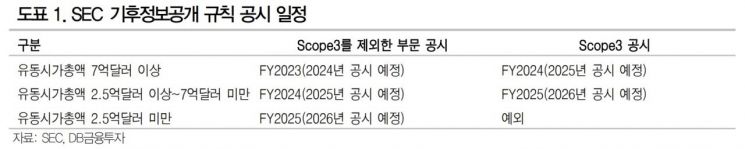

On the 21st of last month (local time), the SEC released a draft of the climate disclosure system. According to this, companies must disclose their greenhouse gas reduction targets, methods, and timelines along with their greenhouse gas emissions. Listed companies are required to include this information in their annual reports submitted to the SEC. The International Sustainability Standards Board (ISSB) also released a draft of the climate disclosure system on the 31st of last month. It requires companies to provide information related to governance, strategy, risk management, and metrics and targets concerning climate. In the metrics and targets section, companies must numerically disclose indicators managed to achieve climate goals, including greenhouse gas emissions.

If finalized as drafted within this year, companies with a market capitalization of $700 million or more will be obligated to disclose climate information. Investors will be able to objectively evaluate companies' levels of goal achievement and commitment through the disclosed data.

One commonality between the two drafts is the requirement for companies to disclose emissions at the 'Scope 3' level. Scope 3 includes carbon emissions across all corporate activities beyond direct operations and electricity consumption, such as raw material procurement, transportation, and product life cycles. According to DB Financial Investment's analysis, this is to meet the interest of financial institutions and investors in a company's carbon efficiency, climate impact, and progress toward greenhouse gas reduction targets.

One way companies can manage Scope 3 emissions is by directly investing in external projects that reduce atmospheric carbon, such as carbon capture and forest creation. Apple plans to achieve carbon neutrality by 2030 by investing $200 million annually (approximately 245 billion KRW) in green spaces and wetlands to reduce unavoidable emissions. Another method is to demand carbon efficiency improvements from partners or replace them with more carbon-efficient suppliers to enhance the carbon efficiency of the supply chain.

Daeseung Kang, a researcher at DB Financial Investment, analyzed, "Increased investor interest in emissions due to disclosures could lead to the activation of eco-friendly investments," adding, "High carbon efficiency can act as one of the elements of competitive advantage."

Domestic companies with superior carbon efficiency compared to global competitors include Hyundai Mobis and POSCO.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.