Financial Authorities' Strong Commitment to Strict Investigation of Unfair Trading 'Empowered Special Judicial Police'... EdisonEV 'First Targeted'

'Acquisition Announcement → Stock Price Surge → Major Shareholder Profit Realization → Stock Price Plunge' Pattern Repeats Amid Individual Investor Caution

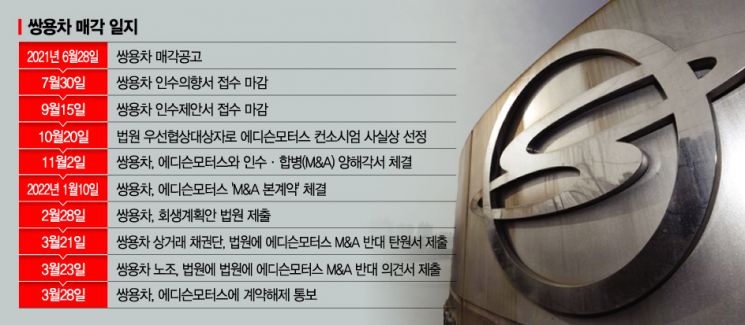

[Asia Economy Reporter Lee Seon-ae] Financial authorities have begun to closely monitor the 'Ssangyong Motor acquisition battle,' which is showing speculative tendencies. This comes from the judgment that only individual investors are suffering losses as the pattern of 'acquisition announcement → stock price surge → major shareholder profit-taking → stock price plunge' continues to repeat. As a result, Edison EV, which was the funding channel for Edison Motors whose Ssangyong Motor acquisition failed, is highly likely to become the first investigation target ('No. 1') of the Financial Services Commission's Capital Market Special Judicial Police (Special Investigation Unit).

According to the financial investment industry on the 10th, the recent Ssangyong Motor acquisition battle has heated up again as Ssangbangwool Group, KG Group, and others have shown interest. However, there are still many controversies regarding their funding capabilities, and the stock prices of related companies are experiencing severe volatility. In response, Jeong Eun-bo, Governor of the Financial Supervisory Service, recently stated at a capital market-related executive meeting, "In the recent restructuring process through the acquisition of listed companies, there have been situations where the capital market was abused, undermining market credibility and causing concerns about investor damage," adding, "If unfair trading suspicions are found, we will conduct thorough investigations in cooperation with the Financial Services Commission's Capital Market Investigation Team and take strict measures against illegal activities."

This is effectively targeting Edison EV and the companies involved in the Ssangyong Motor acquisition battle.

Companies that have been directly or indirectly known in the market to have pushed for or considered acquiring Ssangyong Motor include Edison Motors (Edison EV, U&I), SM Group (Namsun Aluminum, Daehan Shipping, TK Chemical), Ssangbangwool Group (Kwanglim, Nanos, Vivian, IOK), KH Philux Group, and KG Group (KG Dongbu Steel, Chemical, ETS, Mobilians, Inicis). The stock prices of these groups' listed affiliates have shown sharp fluctuations since rumors of acquisition consideration began circulating.

Edison EV's stock price, adjusted for modifications, rose sharply from early March last year?one month before the court began Ssangyong Motor's rehabilitation and merger & acquisition (M&A) process?until the day before trading was suspended on the 29th of last month. The intraday low on March 9 last year was 1,343 KRW, rising to an intraday high of 82,400 KRW on November 12, marking a 6,036% (60.3 times) increase. During this period, the average daily trading value was 68.7 billion KRW, 53 times the previous year's daily average of 1.3 billion KRW. The average daily trading volume was about 2.67 million shares, exceeding the previous average of 140,000 shares by 19 times.

Looking at Ssangbangwool Group's stock price and trading value from the 31st of last month to the 8th of this month, Ssangbangwool's stock price surged 150%, from an intraday 626 KRW to 1,565 KRW. The average daily trading value during this period increased to 214.8 billion KRW, 179 times last year's 1.2 billion KRW. After Edison Motors' Ssangyong Motor acquisition failed on the 31st of last month, Ssangbangwool Group announced it would form a task force (TF) to proceed with the acquisition. Kwanglim's stock price jumped 119% in four days, from 2,475 KRW to 5,430 KRW, while Mirae Industry and Nanos surged 98% and 81%, respectively. IOK's stock price rose 1.8 times from 1,210 KRW on the 31st of last month to 2,185 KRW on the 5th, but then halved to 1,130 KRW immediately after news of stock sales emerged.

On the 6th, KG Group affiliates KG Dongbu Steel (66%), KG Chemical (64%), KG ETS (51%), and KG Mobilians (33%)?all listed companies?rose between 33% and 66% over three days after entering the acquisition battle.

The problem is that during this process, five investment associations, including DMH, bought Edison EV shares and then sold them amid the stock price surge, sparking 'pump-and-dump' controversy. The combined shareholding of these five investment associations dropped from 34.8% at the end of May last year to 11.0% in early August of the same year. Additionally, Mirae Industry, an affiliate of Ssangbangwool Group, disclosed on the 4th that it sold 6,476,842 shares of IOK for 12.41479 billion KRW, which also sparked controversy. The average selling price per share was about 1,917 KRW, approximately 55% higher than the closing price of 1,235 KRW on the 31st?the day before the Ssangyong Motor acquisition issue caused the stock price surge. Even if the selling price was lower than the purchase price, the recent stock price surge helped reduce losses.

According to the Financial Supervisory Service's electronic disclosure system, as of the end of June last year, when the Ssangyong Motor acquisition battle officially began, the number of small shareholders of Edison EV was 14,548, holding 41.27% of the total shares. By the end of last year, just six months later, the number of small shareholders had increased by over 90,000 to 104,615, and their shareholding ratio doubled to 80.34%. It is estimated that small shareholders ultimately suffered losses during the major shareholders' pump-and-dump process.

Therefore, there is growing speculation that the Special Investigation Unit will take command to prevent precedents such as the Edison EV major shareholders' stock disposals.

A senior industry official familiar with financial authorities said, "The financial authorities have shown a strong will to thoroughly investigate unfair trading activities in the capital market and take strict measures, which is boosting the momentum of the recently launched Special Investigation Unit," adding, "They are focusing on closely examining Edison EV, which is at the center of recent controversies." Another senior official said, "Edison EV has had many issues from the start, and it is unusual that financial investors (FIs) withdrew early from the acquisition consortium," adding, "There are many suspicions that they entered the acquisition battle aiming for stock price gains, so the fact that the exchange and financial authorities are scrutinizing it already implies a Special Investigation Unit investigation."

Another senior official said, "The Special Investigation Unit, launched to strengthen enforcement against unfair trading in the capital market, will aim to achieve results in the new government era that emphasizes fairness as a policy direction," adding, "Recently, financial authorities have been at the center of criticism for weakening in all aspects of capital market management, supervision, and crackdown due to various incidents, so they will examine Edison EV meticulously to secure evidence." Regarding this, a senior official from the Financial Services Commission said about whether Edison EV would be the first investigation target of the Special Investigation Unit, "In principle, an ex officio investigation is possible."

The Korea Exchange has requested Edison EV to submit an opinion letter on the audit report issued as 'disclaimer of opinion' by Samhwa Accounting Corporation by the 11th. Additionally, it is reported that an in-depth analysis is underway to determine whether there were unfair trading activities related to the major shareholders' stock disposals. If, after the exchange's review, the need for investigation conversion is recognized, direct investigation by the Special Investigation Unit is possible. Unlike the existing Financial Supervisory Service Special Investigation Unit, the Financial Services Commission's Special Investigation Unit has the authority to investigate ex officio cases.

An industry insider said, "Although there are investment groups that enjoyed large profits, major shareholders cannot be punished simply because they sold shares," adding, "Ultimately, the key will be to find concrete evidence such as nominee accounts, collusive trading, and false acquisition documents to prove that they entered the acquisition battle aiming for stock price gains."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)