Already Soaring House Prices... "Even with DSR Relaxation, Loan Increase Won't Be Significant"

NIM Rise Expected to Have Greater Impact on Bank Earnings

[Asia Economy Reporter Minwoo Lee] The next government is on high alert regarding the potential easing of the Debt Service Ratio (DSR) regulation. While such a relaxation could lead to an increase in loans, analyses suggest that the rise in Net Interest Margin (NIM) will have a greater impact on banks' performance.

On the 9th, IBK Investment & Securities made this assessment. President-elect Yoon Seok-yeol has pledged to raise the Loan-to-Value ratio (LTV) up to 80% for first-time homebuyers and up to 70% for genuine buyers who are not first-time purchasers. However, the Presidential Transition Committee remains cautious about easing the DSR regulation.

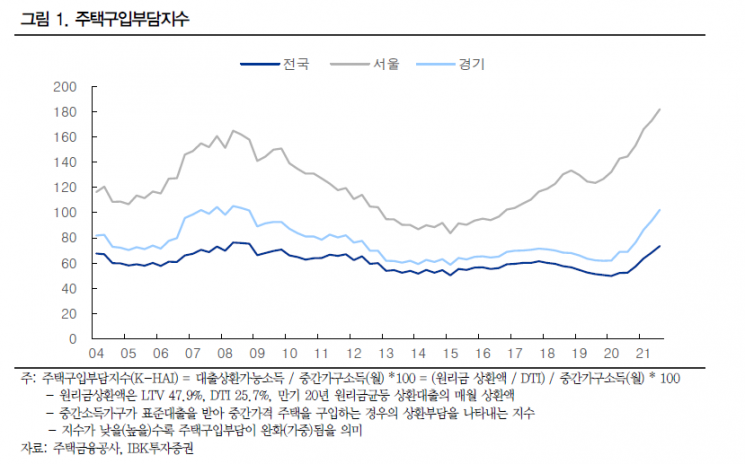

Even if the DSR is eased, a significant increase in loans is unlikely. This is because housing prices have surged over the past few years, increasing the burden of home purchases. According to the Housing Finance Corporation's Housing Purchase Burden Index, which shows the repayment burden when a middle-income household buys a median-priced home, the index rose by 41% nationwide from early 2017 to the fourth quarter of last year. In Seoul and Gyeonggi Province, the increases were 95% and 65%, respectively. Based on housing prices and loan interest rates in the fourth quarter of last year, purchasing a home in Seoul would require about 51% of income to be used for principal and interest repayments. Ultimately, even with a DSR limit of 50%, buying a home remains challenging.

The fundamental cause of the rising Housing Purchase Burden Index is attributed more to housing price increases than to interest rate hikes. In fact, during 2007-2008, when the index previously reached its peak, new mortgage loan interest rates were between 6-7%, much higher than current rates.

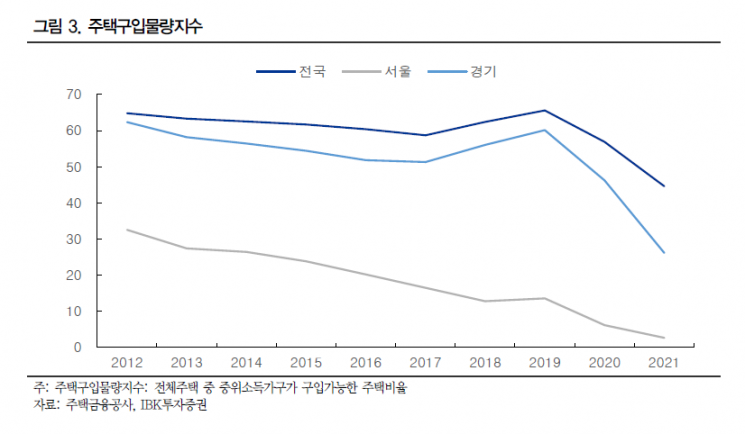

According to the Housing Purchase Quantity Index, which indicates the proportion of homes affordable to middle-income households, only 2.7% of homes in Seoul are affordable. This is a significant drop from 20.2% in 2016. Nationwide, the figure fell from 65.6% in 2019 to 44.6% last year. In Gyeonggi Province, it dropped by more than half from 60.1% in 2019 to 26.2% last year. This means that in Seoul, the rise in housing prices is so steep that easing the DSR limit will not significantly affect loan growth.

Consequently, analyses suggest that NIM will be a more crucial factor for banks' performance. Easing the DSR regulation is difficult to decide on and may take time to implement even if approved. Kim Eun-gap, a researcher at IBK Investment & Securities, explained, "Although the DSR regulation may be eased, concerns about household debt increase and the current interest rate hike period make significant relaxation unlikely. If loan growth rates do not change much, changes in NIM will be more important from a financial impact perspective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.