Deregulation Signal, Only Gangnam House Prices Fluctuate

Local Areas Face Sharp Increase in Listings and Worsening Unsold Inventory

"Local Deregulation Areas Need Supply Adjustment"

On the 8th, cherry blossoms are in full bloom along Yeouido Yunjung-ro in Seoul. Yeongdeungpo-gu has decided to open the cherry blossom path from the south end of Seogang Bridge to the Assembly Hall intersection for the first time in three years. Photo by Dongju Yoon doso7@

On the 8th, cherry blossoms are in full bloom along Yeouido Yunjung-ro in Seoul. Yeongdeungpo-gu has decided to open the cherry blossom path from the south end of Seogang Bridge to the Assembly Hall intersection for the first time in three years. Photo by Dongju Yoon doso7@

Expectations for deregulation following the launch of the new government are heating up the Seoul real estate market, but this warmth is not reaching the provinces. Even within Seoul, only some reconstruction complexes in the Gangnam area are filled with the spirit of spring. Under the current administration, regulations were tightened, causing investment demand to disperse to the provinces. Now, with demand in Seoul and the metropolitan area strengthening, concerns are emerging that the provincial housing market will face a crisis.

◆ Deregulation signals have only raised Gangnam housing prices... Polarization between Seoul and the provinces = According to the Korea Real Estate Board on the 8th, the apartment sales supply-demand index in Seoul for the first week of April (as of the 4th) recorded 90.7, up 1.6 points from the previous week (89.1). This marks a recovery to the 90s after 11 weeks since it fell to the 80s in the fourth week of January. The supply-demand index quantifies the ratio of buyers to sellers, and a value below the baseline of 100 indicates that selling pressure exceeds buying pressure.

The expansion of buying demand is also reflected in price changes. In the first week of April, the rate of change in Seoul apartment sales prices stopped declining after 11 weeks and turned stable. In particular, reconstruction complexes in the three Gangnam districts led the upward trend. In contrast, the five major metropolitan cities in the provinces have seen prices fall for 10 consecutive weeks since February, dropping a total of 0.27%. The increase in listings and unsold units in the provinces appears to be driven by supply expansion and deregulation signals from the Presidential Transition Committee, which encourage demand for a 'smart single property.'

The Yoon Seok-yeol administration's real estate policy drive, summarized as supply expansion and deregulation and tax relief, is eliciting real-time market responses. However, those welcoming this are limited to Seoul, especially some areas in Gangnam. Meanwhile, the provincial real estate market is experiencing heightened anxiety due to unsold units and other issues. Sophisticated policies are required to resolve this market polarization.

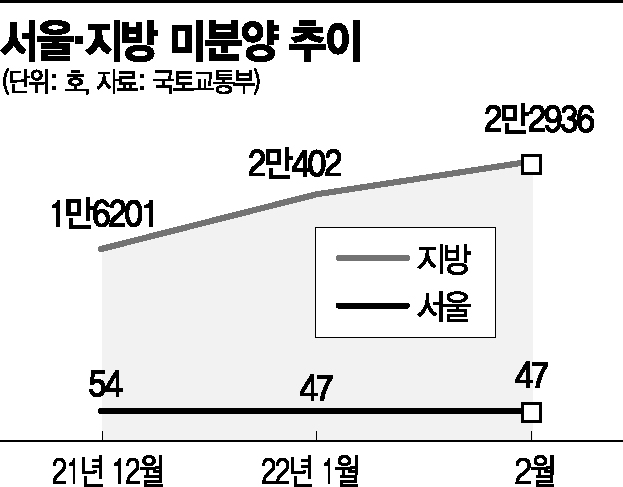

◇ Provinces see a surge in listings and accumulation of unsold units = According to the Ministry of Land, Infrastructure and Transport, the number of unsold units in the provinces reached 22,936 in February, a 12.4% increase from the previous month. The number of unsold units in the provinces rose sharply from 16,201 in December last year to 20,402 in January this year, a 25.9% increase, and the upward trend continued in February. The slowdown is not limited to the sales market.

Due to a downturn in housing market outlook and a chill in the sales market, existing listings are also flooding out. In Jeonnam, the total number of listings increased by about 17%, from around 6,000 at the beginning of the year to about 8,000. Chungnam saw an increase of about 13%, from approximately 18,500 to 21,000. Busan, Daegu, and Ulsan also saw increases in listings by 11.6%, 11.4%, and 11%, respectively.

◇ Reconstruction and tax relief boost... Listings sharply decrease in Seoul = Seoul's unsold units have remained at a stable double-digit level, with 54 units in December 2021 and 47 units in January and February this year. The number of apartment listings also decreased by 1.6%, from about 97,000 at the beginning of the year to about 95,000. In the Gangnam area, asking prices are high or record highs are being set, especially in reconstruction complexes.

This series of phenomena is due to the recent Presidential Transition Committee's plans to temporarily exclude multi-homeowners from capital gains tax surcharges and to reform the reconstruction excess profit recovery system (재초환), which has raised expectations for rising housing prices centered on Seoul. The recent active engagement of the Transition Committee's real estate task force in policy reform has also had a positive impact. Eun Hyung Lee, a senior researcher at the Korea Construction Policy Institute, said, "Excluding capital gains tax surcharges may bring out some listings, but multi-homeowners will have to consider what to do with the profits earned. Ultimately, the demand for a 'smart single property' centered on prime locations or flagship properties is likely to strengthen."

◇ Provinces plead "Please lift regulation zones" = While Seoul's housing prices have turned upward on the wave of deregulation, the provinces are expressing a sense of crisis. Jeong Haeyong, Deputy Mayor for Economic Affairs of Daegu, visited the Transition Committee the day before to explain the local housing market situation, including the increase in unsold units, and requested that the entire city be removed from the list of regulated areas. He argued that housing prices surged mainly in the metropolitan area due to policy failures, but uniform regulations applied to the provinces have accumulated side effects. Besides Daegu, cities such as Ulsan, Gwangju, Pohang, Gwangyang, and Suncheon have also requested deregulation this year. Experts warn of provincial real estate contraction and call for more detailed measures.

Ko Joon-seok, CEO of J-Edu Investment Advisory, said, "Provincial real estate could collapse in the order that cherry blossoms bloom," adding, "For a soft landing, balanced development policies that can revitalize local economies must be prepared simultaneously." Regarding supply, he said, "If the supply of 2.5 million units materializes, it will inevitably deal a serious blow to the provincial real estate market," and emphasized, "It is necessary to reestablish supply plans by predicting regional demand in the mid to long term, including controlling permit volumes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.