Record Highs in Traditional Off-Season Draw Attention

Strong Q1 Sales... Samsung at 71 Trillion, LG at 21 Trillion

Both Forecasted to Perform Well in Q2

[Asia Economy Reporter Kim Jin-ho] Samsung Electronics and LG Electronics have received 'record-breaking' results for the first quarter (January to March) of this year, far exceeding market expectations. Despite various adverse factors such as the spread of COVID-19 and global supply chain instability, the two companies recorded sales of 71 trillion won and 21 trillion won, respectively. This is an unprecedented achievement in the first quarter, which is traditionally considered the 'lean season' in the electronics industry.

In Samsung Electronics' case, the faster-than-expected improvement in the semiconductor market and the success of the new flagship smartphone Galaxy S22 series are analyzed as the main reasons. LG Electronics appears to have achieved such results due to strong sales of premium home appliances combined with temporary factors such as patent income.

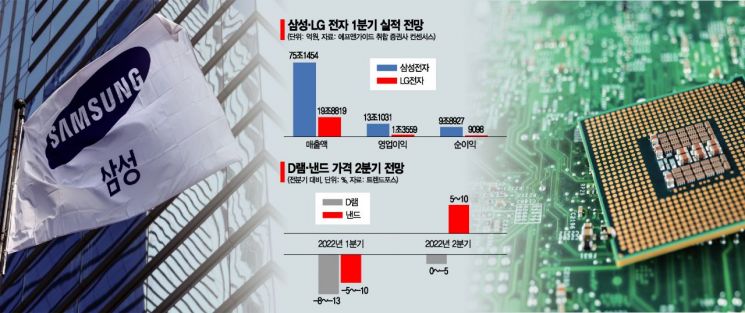

◆ Samsung and LG Electronics both achieve 'record-breaking performance' = Samsung Electronics announced on the 7th that its consolidated sales for the first quarter of this year were 77 trillion won, and operating profit was 14.1 trillion won on a provisional basis. This far exceeds the market's initial expectations of 75.1454 trillion won in sales and 13.1031 trillion won in operating profit for the first quarter.

Sales rose 17.76% compared to the same period last year, marking an all-time high. Compared to the previous quarter, sales increased by 0.56%. Operating profit also increased by 50.32% compared to the same period last year and rose 1.66% compared to the previous quarter.

Samsung Electronics has succeeded in surpassing 70 trillion won in quarterly sales for three consecutive quarters since recording 73.98 trillion won in sales in the third quarter of last year. If this trend continues, Samsung Electronics is expected to be the first domestic company this year to exceed 300 trillion won in sales and 60 trillion won in operating profit.

LG Electronics also announced that its provisional consolidated results for the first quarter showed sales of 21.1091 trillion won and operating profit of 1.8801 trillion won. Sales increased by 18.5% and operating profit by 6.4% compared to the first quarter of last year. The market initially expected LG Electronics' operating profit to decrease by 10.5% to 1.3559 trillion won compared to the first quarter of last year due to rising oil prices, increased global logistics costs, and rising raw material prices.

◆ Samsung's semiconductor and Galaxy S22, LG's premium appliances are the 'main contributors' = The main contributor to Samsung Electronics' 'record-breaking performance' in the first quarter is undoubtedly 'semiconductors.' Thanks to the smaller-than-expected decline in memory semiconductor prices, the company easily overcame the traditionally weakest first quarter 'lean season.' Considering the numerous internal and external adversities such as the spread of COVID-19, global supply chain crises, and the Ukraine situation, this reaffirms the successful formula of 'Semiconductors are Samsung.'

Although business segment results have not been disclosed due to provisional figures, the securities industry expects Samsung Electronics to have recorded sales of over 25 trillion won from semiconductors alone in the first quarter. Given that the first quarter is traditionally the off-season in the electronics industry, sales are expected to decline compared to the third and fourth quarters of last year, but the decline was not significant, and there was clear growth compared to the same period last year.

In fact, the market had expected the price decline for DRAM and NAND flash in the first quarter to be 6.2% and 5.1%, respectively, but the situation turned out to be much better. According to TrendForce, the fixed transaction price of DRAM last month remained flat for the second consecutive month without rising or falling. The downward trend in DRAM prices is expected to continue into the second quarter, but NAND prices are expected to rebound by 5-10% in the second quarter due to reduced supply from global manufacturers.

The securities industry also pointed to the 'rapid recovery' of the memory market as the background for Samsung Electronics' strong performance. Noh Geun-chang, a researcher at Hyundai Motor Securities, said, "Contrary to expectations that DRAM and NAND shipment growth rates would both decline in the low single digits in the first quarter, they were stable and increased by 3%, respectively."

The success of the Galaxy S22 series launched in the first quarter, despite the 'Game Optimization Service (GOS)' controversy, is also analyzed as having a significant impact on the performance. According to the industry, sales are expected to surpass 1 million units about two weeks earlier than the predecessor Galaxy S21. Considering the launch at the end of February, this means an average daily sale of more than 23,000 units.

In LG Electronics' case, increased sales of home appliances and TVs centered on premium products are analyzed as having a significant impact on sales. In addition, a decrease in non-recurring expenses (HR costs for company-wide personnel restructuring) and temporary patent income appear to have helped operating profit exceed market expectations.

Along with the provisional results announcement, LG Electronics explained, "The profit generated by each business division through actual business activities is at a level similar to market expectations," but "due to the company-wide personnel restructuring costs carried out to enhance organizational dynamism, a significant difference from market expectations is expected in the final results."

The personnel restructuring costs are presumed to refer to retirement benefits due to voluntary retirement, etc. It was also stated that the provisional operating profit for the first quarter includes a temporary increase in patent income.

◆ Strong performance expected in the second quarter as well = Samsung Electronics and LG Electronics are expected to continue strong performance in the second quarter. For Samsung Electronics, this is due to the potential benefits from the factory shutdown issues of major global NAND manufacturers such as Kioxia and Western Digital, and the expectation that the semiconductor price rebound will be accelerated due to prolonged component supply issues.

In particular, the foundry (semiconductor contract manufacturing) sector, which had yield (ratio of normal products among manufactured products) issues, is recently analyzed to be in a favorable condition. Due to the base effect of the factory shutdown in Austin, USA, last year, significant sales growth is expected this year.

LG Electronics is also expected to continue strong performance in the second quarter, supported by efforts in global supply chain management, business structure efficiency, and cost structure improvement. The financial investment industry forecasts LG Electronics' second-quarter results to be sales of 17.9 trillion to 18 trillion won and operating profit of 1.16 trillion to 1.2 trillion won. This represents a slight increase in sales and about a 30% increase in operating profit compared to the same period last year.

Meanwhile, the provisional results of the two companies are estimated based on the Korean International Financial Reporting Standards (IFRS) and are provided to assist investors while the final settlement has not yet been completed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)