Samsung Electronics Surpasses 70 Trillion Won in Q1 Sales

Semiconductors Are Undisputed Top Contributor to Record-Breaking Performance

LG Electronics Also Nears 20 Trillion Won in Strong Sales

[Asia Economy Reporters Sunmi Park and Jinho Kim] Samsung Electronics and LG Electronics are expected to deliver their best-ever first-quarter performance (January to March) this year. Despite the prolonged global spread of COVID-19 and supply chain disruptions caused by Russia's invasion of Ukraine, Samsung Electronics is anticipated to surpass 70 trillion KRW in sales for the first time in a first quarter. This is an unprecedented achievement during the seasonally slow first quarter for the semiconductor and display parts industries. The strong performance is attributed to a faster-than-expected recovery in the semiconductor market and robust sales of premium home appliances and TVs. Analysts also credit the effect of stable parts supply through diversification of business partners.

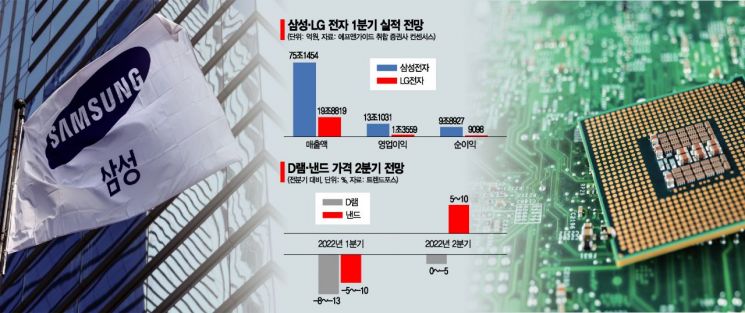

◆ Samsung and LG Electronics start strong amid supply chain crisis = On the 6th, financial information firm FnGuide reported that Samsung Electronics’ average first-quarter consensus forecast is 75.1454 trillion KRW in sales and 13.1031 trillion KRW in operating profit. Compared to the same period last year, sales are expected to increase by 14.92% and operating profit by 39.65%. Net profit is also estimated to rise by 39.48% to 9.8927 trillion KRW in the first quarter.

This is the first time Samsung Electronics’ first-quarter sales have exceeded 70 trillion KRW. Following sales of 73.98 trillion KRW in the third quarter of last year, it is expected to surpass 70 trillion KRW in sales for three consecutive quarters. If this trend continues, Samsung Electronics will become the first domestic company this year to exceed 300 trillion KRW in sales and 60 trillion KRW in operating profit.

The primary driver behind Samsung Electronics’ record-breaking first-quarter performance is undoubtedly its semiconductor business. The decline in memory semiconductor prices was less severe than expected, allowing the company to easily overcome the traditional first-quarter “lean season.” Considering the numerous internal and external challenges such as the COVID-19 pandemic, global supply chain crisis, and the Ukraine situation, this reaffirms the success formula of “Semiconductors are Samsung.”

With the semiconductor market recovering faster than anticipated, there is growing optimism that this year’s semiconductor sales will exceed 94 trillion KRW, surpassing U.S. Intel and far exceeding last year’s achievement of becoming the world’s number one semiconductor sales company for the first time in three years.

LG Electronics is also expected to post its highest-ever first-quarter sales of 19.8819 trillion KRW, a 5.7% increase from the same period last year. This growth is driven by significantly increased sales of premium home appliances and TVs. However, operating profit is estimated to decline by 10.6% to 1.3559 trillion KRW, and net profit is expected to decrease by 8.87% to 909.8 billion KRW. This reflects the impact of supply chain disruptions amid uncertain global conditions such as the Russia-Ukraine conflict, which caused sharp rises in raw material prices and logistics costs.

◆ Soaring thanks to semiconductors = The so-called “semiconductor winter,” initially expected to last until the first half of this year, ended sooner than anticipated. The semiconductor division’s sales in Samsung Electronics’ first-quarter provisional results are expected to exceed 25 trillion KRW. Although the first quarter is traditionally a slow season for the electronics industry and sales are expected to decline compared to the third and fourth quarters of last year, the decrease is not significant, and a clear growth trend is visible compared to the same period last year.

The market expected first-quarter price declines of 6.2% for DRAM and 5.1% for NAND flash, but the actual situation was much better. According to TrendForce, last month’s fixed transaction price for DRAM remained flat for the second consecutive month. While DRAM prices are expected to continue declining in the second quarter, NAND prices may rebound by 5-10% due to reduced supply from global manufacturers.

Financial analysts also pointed to this rapid recovery in the memory market as the reason behind Samsung Electronics’ strong performance. Geunchang Noh, a researcher at Hyundai Motor Securities, said, “Contrary to expectations of a low single-digit decline in DRAM and NAND shipment volumes in the first quarter, DRAM shipments remained flat and NAND shipments increased by 3%, showing favorable results.” Doyeon Choi, a researcher at Shinhan Financial Investment, also predicted, “The decline in memory semiconductor prices will be smaller than market expectations.”

A positive outlook is also expected for Samsung Electronics’ semiconductor performance in the second quarter. Due to factory shutdowns at major global NAND manufacturers such as Kioxia and Western Digital, Samsung Electronics may benefit from a spillover effect. Additionally, prolonged parts supply issues are expected to accelerate the timing of semiconductor price rebounds. The foundry division, which had yield (ratio of normal products among manufactured products) issues, is also showing recent improvements. Due to the base effect of last year’s shutdown of the Austin plant in the U.S., significant sales growth is expected this year.

Both Samsung Electronics and LG Electronics are expected to be minimally affected by the external aftershocks of Russia’s full-scale invasion of Ukraine. Although exports to Russia have been halted, the region’s small share means the overall performance impact is limited. However, the industry anticipates that if raw material prices continue to surge, both Samsung and LG Electronics could face increased pressure on profitability in their home appliance divisions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.