TQQQ Most Bought in Q1 with $4.186 Billion Inflow

SOXL Tracking Philadelphia Semiconductor Index Also Net Bought $560 Million

Market Volatility Widens, Returns Low... BULZ Halved in 3 Months

Industry Advises Short-Term Investment Strategies

[Asia Economy Reporter Myung-hwan Lee] Domestic investors strongly bet on the rise of the U.S. stock market in the first quarter of this year. They heavily invested in leveraged products that track indices threefold, but as the indices declined, their investment returns dropped by up to half.

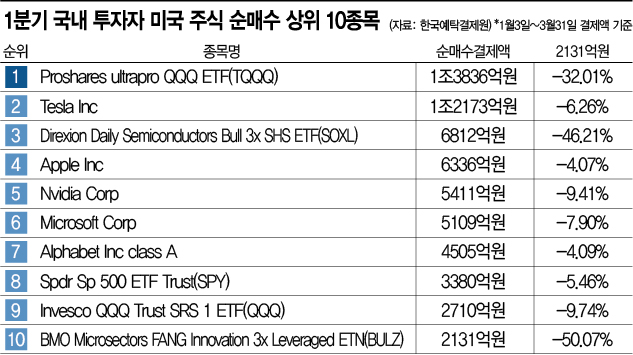

On the 6th, Asia Economy analyzed data from the Korea Securities Depository and found that domestic investors most actively net purchased TQQQ (Proshares Ultrapro QQQ), a leveraged exchange-traded fund (ETF) that tracks the Nasdaq 100 index three times, in the first quarter. From the first trading day of the year, January 3, to March 31, the net purchase amount of TQQQ by domestic investors reached $1.14 billion (approximately 1.3836 trillion KRW). Considering the total purchase amount, about $4.186 billion, nearly 5 trillion KRW, was poured in.

The third highest net purchase was SOXL (Direxion Daily Semiconductors Bull 3x SHS), an ETF that tracks the Philadelphia Semiconductor Index threefold. SOXL’s net purchase amount reached $560 million (approximately 681.2 billion KRW). Considering that Apple’s net purchase amount during the same period was $521.89 million (approximately 633.6 billion KRW), ranked fourth, domestic investors net purchased more leveraged ETFs than large-cap stocks belonging to the so-called ‘FAANG’ group.

In addition, investment sentiment was strong for other leveraged products such as BULZ, an exchange-traded note (ETN) that tracks the price fluctuations of 15 major U.S. big tech companies threefold (about 213.1 billion KRW), and QLD, an ETF that tracks the Nasdaq 100 index twofold (about 176.4 billion KRW). With leveraged products occupying the top net purchase items, it is interpreted that overseas Korean investors’ risk appetite for such products has increased.

The problem is that, due to the large volatility in the U.S. stock market in the first quarter, the returns of index-tracking leveraged products were dismal. BULZ, which was $29.52 on the first trading day of the year, January 3, closed at $14.74 on the 31st of last month, falling 50.07% in three months, effectively halving in value. Other leveraged products such as TQQQ (-32.01%) and SOXL (-46.21%) also showed high loss rates. The average return of the three leveraged exchange-traded products (ETPs) among the top 10 net purchased items was -42.76%. Considering that the returns of the other top 10 items were -6.70%, the decline is notably steep.

The securities industry warned of the potential losses from investing in leveraged products and advised responding with short-term investment strategies. Haein Kim, a researcher at Daishin Securities, explained, "Leveraged ETFs have high volatility, and if the market moves sideways, there is a high possibility of principal loss, making them unsuitable for long-term investment." Dongyoung Kim, a researcher at Samsung Securities, also advised, "The longer the investment period in leveraged ETFs, the greater the risk of volatility loss. When using leveraged products in a rapidly changing market, one should respond with short-term rather than long-term investment."

Meanwhile, besides ETPs, large tech stocks such as Tesla, Apple, Nvidia, and Microsoft were also among the top net purchased stocks by domestic investors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)