Analysis of Top Institutional Purchase Stocks' Returns Over 10 Years

Declining Trend Since 2014

Impact of Passive Fund Expansion Since 2015

Conversely, Higher Returns for Institutional Net Selling Stocks

[Asia Economy Reporter Ji Yeon-jin] How do the returns of stocks that institutions particularly buy perform? To get straight to the point, the analysis shows that they do not perform well.

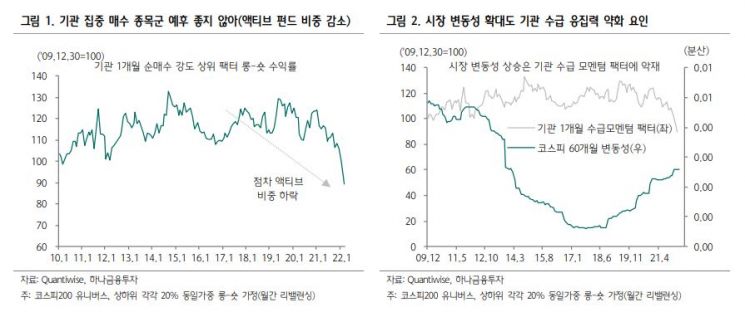

According to a report published on the 6th by Hana Financial Investment, the top stocks by one-month net purchases by institutions from 2010 to the present showed positive returns until 2014, but have been on a continuous decline since then.

This is analyzed to be due to the weakening of institutions' supply-demand cohesion as the assets under management of active funds decreased. Since 2015, major profit-making institutions have started shifting active funds to passive funds under the pretext of global asset allocation. The scale of funds that focus on bottom-up based concentrated purchases of specific stocks has declined, while the scale of passive funds using benchmark-based quantitative trading companies has increased.

Also, from 2020, around the time of COVID-19, as stock market volatility increased, top-down environments had a greater impact on stock prices than bottom-up approaches, and the probability of loss cuts (automatic sales when a specific held stock falls below a certain limit) increased, causing the performance of institutional supply-demand momentum factors to sharply decline. The bottom-up approach is an investment method focusing on micro factors such as a company's financial condition or operating profit, while the top-down approach is a method of discovering promising industries through industry or macroeconomics and then investing in individual stocks.

Lee Kyung-soo, a researcher at Hana Financial Investment, said, "It seems difficult to expect a recovery in the performance of institutional supply-demand momentum factors in the future," adding, "Korea, which is closer to developed countries than emerging markets fundamentally, is an environment where active funds are unlikely to increase. Rather, due to the increased proportion of passive funds and private equity funds, strategies that exploit institutional shareholding reports on specific stocks may emerge."

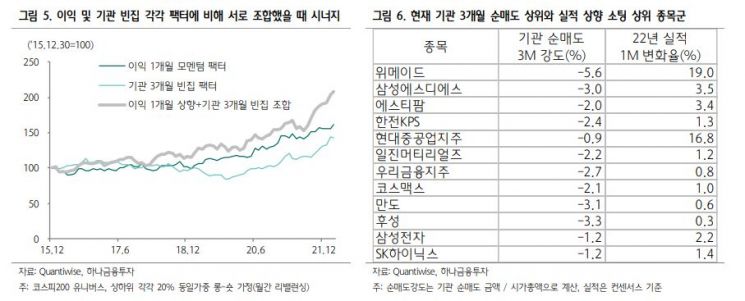

The fact that the returns of stocks bought by institutions are not good can be interpreted as meaning that the performance of stocks sold by institutions is good. Measuring the one-month, three-month, six-month, and one-year long-short and long-KOSPI returns of institutional net selling factors from 2016 to the present, it was found that the three-month and one-year institutional net selling factors had higher returns in that order. The researcher explained, "Since institutions tend to bet based on quarterly earnings, strong institutional buying pressure on specific stocks over three months should be considered with the corresponding downside. Ultimately, if institutional supply-demand concentrates on stocks expected to have strong quarterly earnings, it means that selling should be considered."

However, realistically, it is somewhat burdensome to use the single factor of institutional three-month selling pressure alone, so when the 'earnings' factor was added, a significantly high synergy was observed. The one-month upward earnings factor's long-short return from 2016 to the present is 62.2%, and the institutional three-month net selling top (empty house) factor is +43.1% over the same period. Combining the one-month upward earnings and institutional three-month net selling intensity top factors results in a long-short return of +108.1% from 2016 to the present.

The researcher said, "In conclusion, the 'answer' is stocks whose earnings are rising but are not heavily held by institutions." As a result of combining the one-month upward earnings and institutional three-month net selling top factors, the stocks selected in order were WEMADE, Samsung SDS, ST Pharm, KEPCO KPS, Hyundai Heavy Industries Holdings, Iljin Materials, Woori Financial Group, Cosmax, Mando, Hwasung, Samsung Electronics, SK Hynix, Devsisters, Korea Zinc, Daehan Petrochemical, F&F, and LG Innotek.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)