'Uncollected Residual Claims' to be Recovered from Those Responsible for the Insolvency Crisis

Increasing Decisions Since 2020 Not to Collect Residual Claims

Korea Deposit Insurance Corporation: "Judgment Considering Costs and Practicality"

Still 9.8 Trillion Won Uncollected from Savings Banks

The Korea Deposit Insurance Corporation (KDIC) is giving up on the ‘remaining debt claims’ it should collect from those responsible for the savings bank insolvency crisis. While there is criticism that proper accountability is not being enforced, KDIC maintains that this is an unavoidable decision for realistic fund recovery.

According to the financial sector on the 4th, last month KDIC decided not to pursue the remaining debt claims of four savings banks involved in the 2011 savings bank insolvency crisis: Hanguk, Hanju, Solomon, and Shilla Savings Banks. KDIC is responsible for managing the bankrupt savings banks and recovering the funds it injected. In February, KDIC gave up on filing lawsuits for the remaining debt claims of Mirae and Solomon Savings Banks, and in January for Hanju, Jeil, Samhwa, and Shilla Savings Banks.

Remaining debt claims refer to the amount assigned to individuals responsible for various financial accidents, minus the money recovered through their assets. For example, if an executive responsible for a financial accident was held liable for 50 billion KRW and 10 billion KRW was recovered by seizing assets, the remaining debt claim would be 40 billion KRW. Remaining debt claims can be pursued further through additional lawsuits.

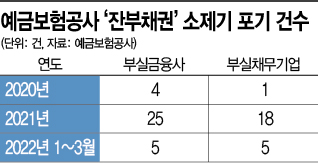

Nevertheless, since 2020, KDIC has decided not to proceed with lawsuits for remaining debt claims. At that time, it gave up on lawsuits for remaining debt claims against four insolvent financial companies and one insolvent debtor company. Last year, it decided to forgo filing lawsuits for 28 and 18 remaining debt claims respectively. So far, KDIC has decided not to recover a total of 61 remaining debt claims.

KDIC: "Decision made considering costs and practicality"

The background behind KDIC’s reluctance to pursue remaining debt claims lies in cost issues. A KDIC official explained, "Remaining debt claims often exceed the assets held by the responsible parties, making it practically difficult to recover. While it aligns with the purpose of holding them accountable, considering various costs such as attorney fees and stamp duties, it results in a loss."

Even when winning lawsuits, the amount KDIC recovers is only about half. KDIC filed damage claims lawsuits against 423 individuals related to the savings bank insolvency crisis, demanding a total of 351.6 billion KRW by the end of last year. The cumulative amount recovered through victories was 95.5 billion KRW, with a recovery rate of only 50.2%.

Accordingly, KDIC has devised a strategy to identify the assets of those involved in the insolvency crisis and recover funds. Since last year, KDIC has focused investigative efforts on items with a high likelihood of asset discovery, recovering 29.9 billion KRW. It has established recovery strategies by debtor and collaborated with related agencies to recover 590 million KRW in overseas hidden assets.

Meanwhile, the amount KDIC has injected due to the savings bank crisis is about 27 trillion KRW. Of this, 13.5528 trillion KRW has been recovered, and an additional 9.8 trillion KRW remains to be recovered.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.