5-Year Bond Bid Rate Plummets from Early Year 300% to 223% by Late March... Interest Rates Rise as Investment Demand Declines

Bond Market's Government Bond Absorption Capacity Weakens... Increased Government Bond Issuance May Lead to 'Failed Bids' Reality

[Asia Economy Sejong=Reporter Kwon Haeyoung] Following the announcement of an additional supplementary budget (supplementary budget) of up to 50 trillion won after the launch of the next government, the possibility of issuing deficit bonds has increased, and the bid rate for government bonds, which exceeded 300% at the beginning of the year, has recently plummeted to the low 200% range. This is due to the sharp cooling of demand for government bonds caused by the rapid increase in bond issuance due to the COVID-19 supplementary budget and the global interest rate hike trend. There are even concerns that if additional supply pours in the future, government bonds issued by the government may fail to be sold, leading to the worst-case scenario of a decline in the country's credit rating.

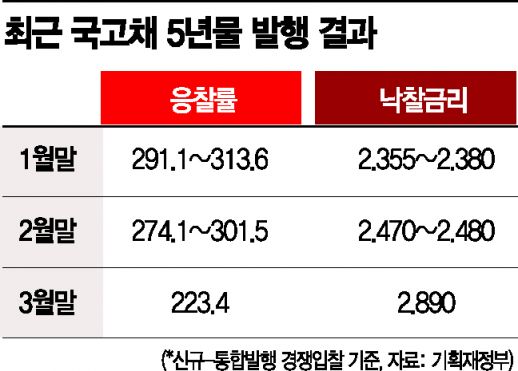

According to the Ministry of Economy and Finance on the 4th, the bid rate for the 5-year government bond competitive auction issued on the 28th of last month, amounting to 2.8 trillion won, was 223.4%. The bid rate for the 5-year government bonds issued twice at the end of February was between 274.1% and 301.5%, so the bid rate dropped by as much as 78.1 percentage points in just one month. Considering that the bid rate for government bonds has been moving in the high 200% range for several years, recording an average of 282.3% last year, it is reported that this decline in the bid rate has triggered an emergency within the Ministry of Economy and Finance recently.

As the bid rate for government bonds fell, the winning interest rate for 5-year bonds also soared from 2.355-2.380% at the end of January and 2.470-2.480% at the end of February to 2.890% at the end of March.

An official from the Ministry of Economy and Finance said, "The decline in the bid rate for government bonds is a cause for concern as it indicates that the market's investment capacity is shrinking accordingly," adding, "As a result of the global interest rate hike trend overlapping with discussions on the supplementary budget, if this investment sentiment contraction continues, the issuance interest rate for government bonds could rise even more steeply in the future."

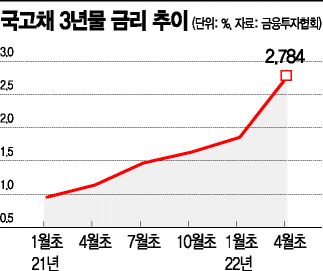

Looking at the recent scale of government bond issuance, it increased from 101.7 trillion won in 2019 to 174.5 trillion won in 2020, when COVID-19 occurred, and 180.5 trillion won in 2021. The government-approved issuance limit for this year is 177.3 trillion won. Although the Presidential Transition Committee has announced that it will prioritize expenditure restructuring and promote the supplementary budget, the market judges that a considerable scale of bond issuance is inevitable to secure 50 trillion won in resources, continuing the uneasy trend. According to the Korea Financial Investment Association, the 3-year government bond yield soared from 0.954% in early January last year to 1.855% in early January this year and 2.784% on the 1st of this month. The 10-year bond yield exceeded 3% for the first time in 7 years and 6 months, reaching 3.031% as of the 28th of last month. The rise in government bond yields affects corporate bond borrowing costs and loan interest rates, increasing the interest burden on companies and ordinary citizens.

The market views that the government's capacity to issue bonds has nearly reached its limit. The government's approved bond issuance volume for this year, including the first supplementary budget, is 177.3 trillion won. There is only 3.2 trillion won left to reach last year's record high of 180.5 trillion won. If the additional bond issuance exceeds 3.2 trillion won, the government will have to set a new record for the highest issuance.

What is even more concerning is that in a market weakened to the point where the capacity to absorb bonds cannot be gauged, if bond issuance increases due to a second supplementary budget, the worst-case scenario of 'failed bids' could become a reality. This goes beyond simply increasing the national debt by several trillion won and burdening the national finances; there is also the possibility that the Korean government's bonds may lose the trust of domestic and foreign investors, leading to a decline in the country's credit rating. In fact, there was a case last October where monetary stabilization bonds issued by the Bank of Korea failed to be sold, prompting calls for the government to minimize bond issuance by assuming the worst-case scenario.

A fiscal expert said, "Bond issuance should be viewed not only from the perspective of fiscal soundness but also from whether the market can handle it," adding, "The next government should carefully consider whether bond issuance will be stable and who will bear the burden if interest rates surge due to reduced investment demand, and thus reduce the scale of the supplementary budget and minimize bond issuance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.