[Asia Economy Reporter Minji Lee] Meituan is expected to show a favorable stock price trend as the second half of the year progresses. Although the stock price has been sluggish due to the Chinese government's big tech regulations, a rebound is anticipated as the scale of losses is shrinking.

On the 3rd, Meituan's stock price stood at 155.5 Hong Kong dollars. It rose 10.28% over the past five trading days, and despite the lingering big tech regulatory risks, the release of solid earnings is believed to have played a significant role in expanding investor sentiment.

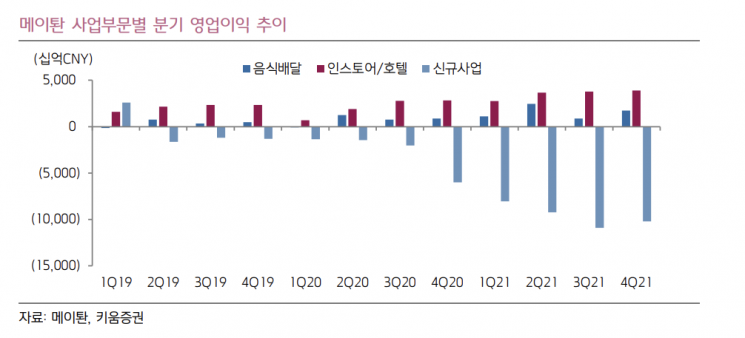

Meituan recorded revenue of 49.5 billion yuan in the fourth quarter of last year, a 31% increase compared to the same period the previous year. Operating losses narrowed to 5 billion yuan, exceeding market expectations. Juyoung Park, a researcher at Kiwoom Securities, said, "The deficit in new businesses narrowed compared to the previous quarter," adding, "Despite the spread of COVID-19, food delivery, in-store, and hotel businesses showed stronger-than-expected profit growth."

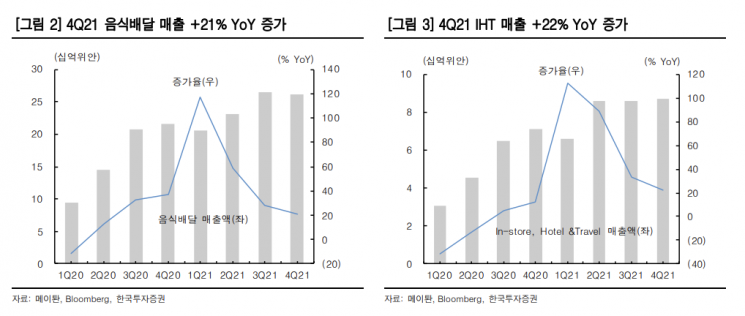

By segment, food delivery recorded revenue of 26.1 billion yuan and operating profit of 1.7 billion yuan. Quarterly revenue growth slowed, decreasing by 1% due to weak Chinese consumer demand and the spread of COVID-19. However, profitability improved as rider performance-based compensation decreased, leading to a 98% increase in operating profit compared to the previous quarter.

The in-store and hotel segments recorded revenue of 8.7 billion yuan and operating profit of 3.9 billion yuan. Despite increased penetration of the in-store business in small and medium-sized cities, the hotel business was sluggish due to COVID-19, with hotel reservations down 4% quarter-on-quarter. However, operating profit margin grew by 5 percentage points year-on-year due to improved operational efficiency.

The new business segment recorded revenue of 14.7 billion yuan and an operating loss of 10.2 billion yuan. Indiscriminate investments due to government regulations were reduced, and the business model of the retail division improved, leading to a decrease in losses. Dongyeon Lee, a researcher at Korea Investment & Securities, explained, "Looking at the fourth-quarter earnings announcements, the growth rate of Chinese big tech companies generally declined, but Meituan delivered solid results," adding, "It maintained growth and improved profitability despite the challenging environment."

However, a slowdown in first-quarter earnings this year is expected to be inevitable. Although operating performance in January and February was solid, the resurgence of COVID-19 is expected to slow growth in food delivery, in-store, and hotel segments. Researcher Dongyeon Lee said, "Stock prices will also rebound with reduced volatility from the point when new COVID-19 cases on the mainland decrease," and added, "We expect earnings and stock prices to improve as the second half of the year progresses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.