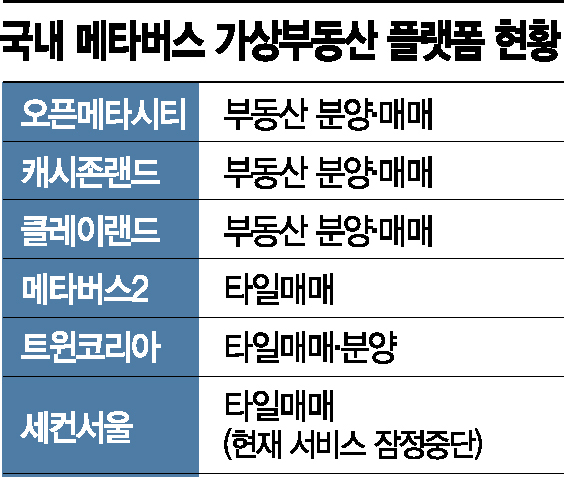

Metaverse Boom Spurs Platform Proliferation

Subscription Rate Hits 681.8 to 1 Amid Investment Frenzy

No Legal Measures in Place

SeconSeoul Allocates Over 10 Billion KRW in Pre-Distribution

Service Termination and Hacking Compensation Not Possible

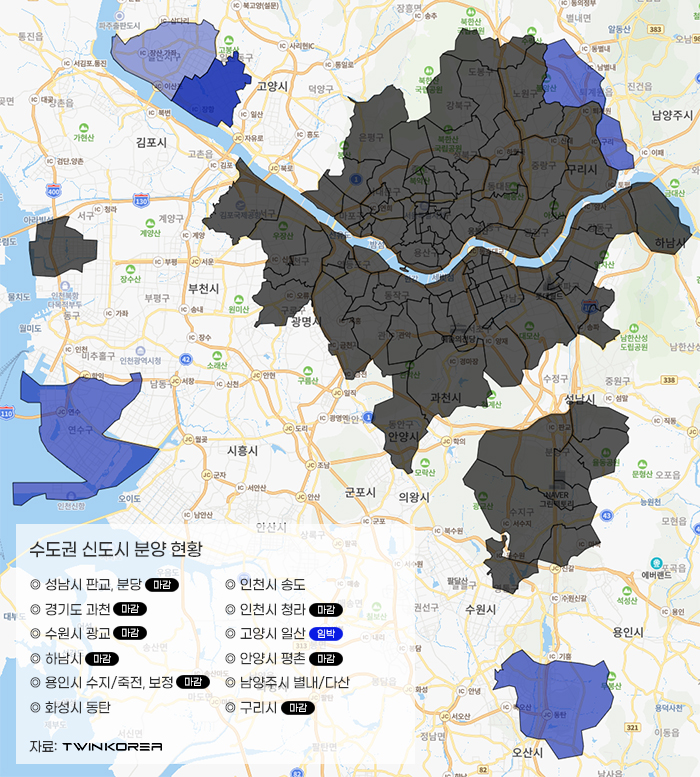

A scene of real estate sales in the Seoul metropolitan area on the metaverse virtual real estate platform 'Twin Korea'.

A scene of real estate sales in the Seoul metropolitan area on the metaverse virtual real estate platform 'Twin Korea'.

[Asia Economy Reporter Donghyun Choi] #. ‘Second Seoul,’ a metaverse (extended virtual world) platform developed to divide the entire city of Seoul into virtual real estate tiles for investment, leasing, and advertising revenue, attracted great expectations with 250,000 pre-registered users. However, recent reports revealed that the CEO and executives of the company developing Second Seoul pre-allocated virtual real estate worth over 10 billion KRW among themselves. Suspicious circumstances suggesting stock price manipulation were also confirmed. The parent company has filed a criminal complaint against them. (☞[Exclusive] Seoul Virtual Real Estate 'Second Seoul'... Pre-launch 10 Billion KRW Pre-allocation Among Executives)

#. ‘Metaverse2,’ a virtual real estate platform combining metaverse and non-fungible tokens (NFTs), has recently gained high popularity due to asset trading among users and meta-token mining. However, a user recently filed a lawsuit against The Future Company, the operator of this service, alleging false advertising of interest rates and price manipulation through wash trading.

Recently, cases of damage related to virtual real estate investment have been emerging one after another. While related platforms are springing up rapidly in the venture and startup sectors, fueled by the metaverse craze, concerns are growing that the lack of legal mechanisms to monitor these businesses will only lead to more victims.

Currently, companies in Korea that have launched or are preparing metaverse virtual real estate trading services include NBT, WEAR, OpenMeta, The Future Company, SikSin, and MetaRax. Following the early success of global companies such as Google, Pixowl, and Decentraland with related services, many platforms have recently begun to imitate their business models.

There are two main types of services. One is creating a fictional world like ‘The Sandbox’ or ‘Decentraland,’ and the other is replicating actual countries or cities in virtual space like ‘Earth2.’ Virtual real estate transactions are conducted by dividing land into tile units or by selling buildings through subscription.

Virtual real estate investment has recently become a frenzy. In OpenMetaCity, a service operated by the domestic company OpenMeta, a subscription for ‘Acro Riverheim’ in Heukseok-dong, Dongjak-gu, Seoul, recorded a competition rate of 681.8 to 1. This figure is about 7.6 times the average competition rate (89.5 to 1) for this apartment in the real world in 2016.

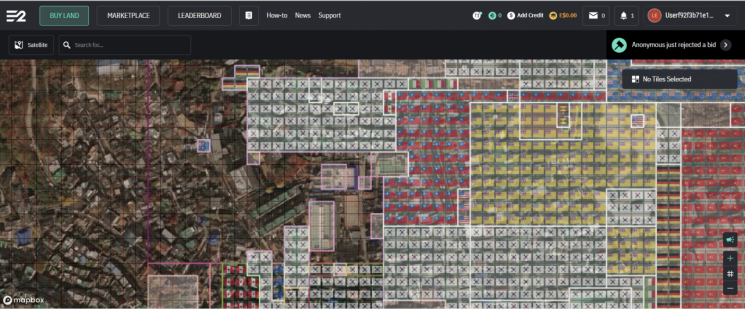

‘Earth2,’ which has been in service since November 2020, has gained great popularity worldwide by replicating the real Earth. It divides all land on Earth into 100㎥ tiles for trading on a map identical to ‘Google Earth.’ As of the 1st of this month, the asset size of Earth2 virtual real estate owned by Korean investors is $13,663,482 (approximately 16.6 billion KRW), ranking first in the world. Currently, the price per tile of the Blue House site exceeds 20 million KRW.

The metaverse virtual real estate platform "Earth2," launched in November 2020, is gaining popularity worldwide.

The metaverse virtual real estate platform "Earth2," launched in November 2020, is gaining popularity worldwide.

The problem is that virtual real estate purchased in this way is not legally protected. It remains unclear whether virtual real estate or NFTs issued based on it fall under virtual assets according to the ‘Act on Reporting and Using Specified Financial Transaction Information’ (Special Financial Transactions Act). There is also no agreed standard on whether these services are games, commerce, or merely simple websites. Therefore, if the service suddenly shuts down or is hacked, compensation is almost impossible. There is no way to prevent developers from embezzling virtual real estate or artificially manipulating prices in certain areas through wash trading. The recent surge in so-called ‘scam’ frauds that extort transaction funds in domestic and international metaverse services is for the same reason.

Professor Sangkyun Kim of Kyung Hee University Graduate School of Business said, "Virtual real estate of the tile trading type can attract a lot of capital with relatively low development costs," and pointed out, "Most services are simple websites without detailed blockchain technology applied." He added, "In the case of the 10 billion KRW pre-allocation of virtual real estate in Second Seoul, it would be different if users were notified in advance, but the problem is that some executives monopolized the assets while making it seem like everything would be sold according to market logic. Currently, there is a lack of legal and institutional systems to block such behavior."

He advised that users should choose services with well-established governance and compliance (internal control) to minimize fraud damage. Professor Hyukjun Kwon of Soonchunhyang University Department of Economics and Finance emphasized, "For example, even within the metaverse, the real estate you buy can fluctuate sharply due to development prospects or height restrictions, so the more detailed the rules on these aspects, the lower the risk. Just as in the real world, where owning two houses in a condominium management association gives you two votes, the more governance is well implemented in the virtual world, the greater the trust."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.