Loan Regulations Frustrate Genuine Borrowers... Effectiveness in Question

Only Some High Earners Benefit, Survival Expected Without Transaction Tax Relief

On the afternoon of the 27th, a view of downtown Seoul was seen from the Seoul Sky observation deck at Lotte World Tower in Songpa-gu, Seoul.

On the afternoon of the 27th, a view of downtown Seoul was seen from the Seoul Sky observation deck at Lotte World Tower in Songpa-gu, Seoul. As the new government's plan to ease loan regulations takes shape, it is expected that if this measure is implemented, active transactions will continue due to pent-up demand for switching homes. In particular, a chain movement from small and medium-sized housing units to larger units and to higher-tier areas is anticipated, potentially causing short-term fluctuations in the housing market centered around Gangnam. While there is a possibility of some speculative demand entering the market, experts generally agree that easing regulations for genuine buyers is inevitable.

◇Loan Regulations That Only Frustrated Genuine Buyers... Effectiveness in Question= On the 31st, real estate industry insiders and experts viewed the new government's easing of loan regulations as an opportunity to resolve market distortions caused by the current administration's real estate policies. The prevailing assessment was that loan regulations, intended to stabilize the housing market, instead crushed genuine buyers' dreams of owning a home. As housing prices rose but loans were blocked, panic buying of low-priced and mid-priced homes emerged as a representative phenomenon. Loan regulations also had the side effect of pushing up housing prices according to price ceilings. Homes priced around 500 to 600 million KRW surged to 900 million KRW, and apartments that were around 1 billion KRW climbed up to the loan prohibition threshold of 1.5 billion KRW. The loan ceiling set by the government ironically acted as a price baseline, driving up housing prices.

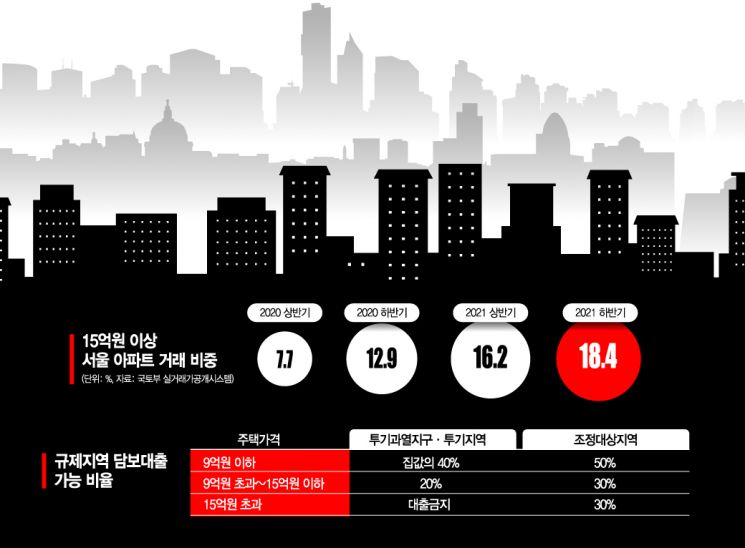

There were many criticisms that the structure where loans are allowed for homes priced at 1.4 billion KRW but prohibited starting at 1.5 billion KRW does not align with market principles. Homes priced above 1.5 billion KRW actually have higher collateral value, and financial institutions consider them safe assets, yet loans cannot be granted. The effectiveness of the regulation is also questionable. The proportion of apartment sales in Seoul priced above 1.5 billion KRW steadily increased from 7.7% in the first half of 2020 to 18.4% in the second half of 2021.

◇Short-term Surge Expected Centered on Gangnam... Home Move-in Also Likely= According to the Ministry of Land, Infrastructure and Transport's real transaction price disclosure system, apartments traded in Seoul in the second half of last year priced between 1.5 billion and 2 billion KRW accounted for 9.6%. These are expected to directly benefit from the easing of loan regulations. Once loan regulations are relaxed, genuine buyers' purchasing activity is expected to become active. Go Jun-seok, CEO of J-Edu Investment Advisory, said, "There is a high possibility of switching demand to high-priced housing clusters such as Gangnam."

In fact, genuine buyers' complaints about loan regulations were particularly high. In the case of Goduk Lotte Castle Bene Luce in Gangdong-gu, Seoul, which attracted about 170,000 applicants for non-priority subscription this month, the 59㎡ units are priced between 1.2 billion and 1.4 billion KRW, and the 84㎡ units are around 1.6 billion KRW. If a household wants to move to a larger unit within the same complex due to an increase in family members, at least 200 million KRW more is needed. However, since loans are not available for homes priced over 1.5 billion KRW, moving was difficult. Loans for apartments priced above 1.5 billion KRW were even prohibited for deposit return funds. There were numerous complaints on real estate communities that even if tenants wanted to move into their own homes after purchasing with a lease, they could not secure the large deposit to return to tenants, making move-in impossible.

Professor Sung Tae-yoon of Yonsei University's Department of Economics said, "The loan ban on homes priced above 1.5 billion KRW effectively gave purchase opportunities only to cash-rich buyers," adding, "It is necessary to raise the standard to an appropriate level reflecting the reality of rising housing prices." He also explained, "If loans are allowed to some extent through screening based on stable income and employment, these buyers can move into the sales market, which would also ease pressure on the rental market."

◇Criticism That Only High-Income Earners Benefit... Some Predict 'Survival Without Transaction Tax Relief'= However, there are also many concerns that easing loan regulations may benefit only some high-income earners. Especially considering the Debt Service Ratio (DSR), which sets loan limits based on income, those with lower incomes may not gain much benefit. This means that social newcomers with relatively low income might not receive benefits from the easing of loan regulations.

There are also criticisms that partial easing of loan regulations alone is insufficient to normalize the real estate market. Lim Byung-chul, senior researcher at Real Estate R114, said, "While easing the loan prohibition ceiling will ease transaction volume constraints, it is difficult to expect a large-scale buying spree given the continued uncertainty in the market environment." He added, "Since the number of apartments priced above 1.5 billion KRW has increased significantly, it is necessary to appropriately lower the loan prohibition ceiling to allow genuine buyers to enter the market," and "Relaxing loan standards is unlikely to cause a housing price surge."

CEO Go said, "Tax reform must accompany the easing of loan regulations for the market to normalize." He stated, "Since it is impossible to immediately create move-in supply, an environment must be created where multi-homeowners' properties can be released to the market," and "Transaction costs such as capital gains tax surcharges must be drastically reduced to allow smooth circulation of properties."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.