Corporate Loans Reach Record High Increase Centered on Cyclical Industries

Expansion of Loans by Non-Bank Deposit Institutions such as Savings Banks and Credit Unions

Interest Also Rises, Increasing Repayment Burden

Banks Face Higher Credit Risk

The Corona Victims Self-Employed General Federation (Coja Federation), composed of 14 self-employed organizations including the Korea Federation of Restaurants, held a "Government Condemnation Gwanghwamun Rally" on the 15th at the Gwanghwamun Citizen Open Square in Seoul. They demanded the abolition of business hour restrictions, retroactive application of loss compensation and realization of 100% compensation, inclusion of self-employed persons with sales exceeding 1 billion KRW in loss compensation, preparation of separate support plans by Seoul and local governments, and additional application of loss compensation for all businesses opened after the outbreak of COVID-19. Photo by Moon Honam munonam@

The Corona Victims Self-Employed General Federation (Coja Federation), composed of 14 self-employed organizations including the Korea Federation of Restaurants, held a "Government Condemnation Gwanghwamun Rally" on the 15th at the Gwanghwamun Citizen Open Square in Seoul. They demanded the abolition of business hour restrictions, retroactive application of loss compensation and realization of 100% compensation, inclusion of self-employed persons with sales exceeding 1 billion KRW in loss compensation, preparation of separate support plans by Seoul and local governments, and additional application of loss compensation for all businesses opened after the outbreak of COVID-19. Photo by Moon Honam munonam@

[Asia Economy Reporter Sim Nayoung] Corporate loans have significantly increased while loan interest rates have simultaneously risen, intensifying the repayment burden on self-employed individuals who borrowed funds to operate their businesses. In particular, a study revealed that loans from the secondary financial sector, which has a relatively higher proportion of low-credit and multiple debtors compared to commercial banks, have surged, raising the risk of corporate loan defaults.

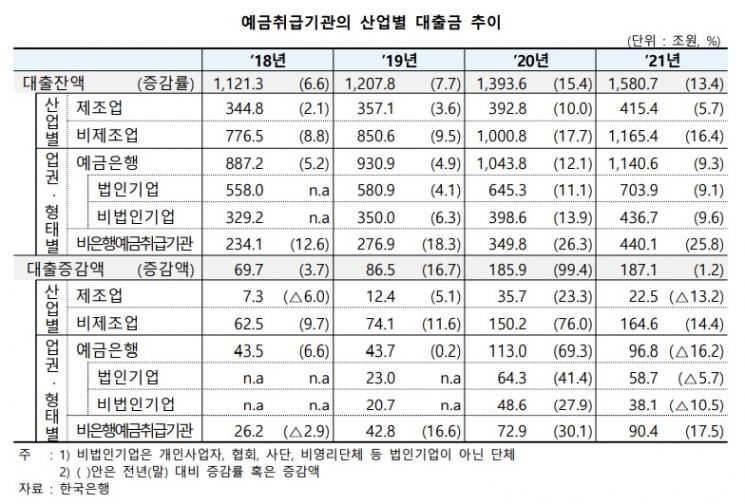

According to the "Trends in Corporate Loans and Interest Rate Increases" report released on the 28th by the KDB Future Strategy Institute, the industrial loan balance of deposit-taking institutions stood at 1,580.7 trillion KRW at the end of last year. This represents a 13.4% increase compared to the end of 2020. The increase amount (187.1 trillion KRW) was the largest ever recorded. Deposit-taking institutions refer to a combined concept of deposit banks (commercial banks, regional banks, and domestic branches of foreign banks) and the secondary financial sector (including savings banks, mutual finance, credit cooperatives, etc.).

Loans in 'Economically Sensitive and Face-to-Face Sectors' Hit Hard by COVID-19 Surge

Looking at the data by industry, it is evident that loan balances in economically sensitive sectors and face-to-face service sectors increased significantly during the same period. This suggests that loans grew primarily among self-employed individuals whose sales sharply declined due to quarantine measures limiting operating hours and personnel following the COVID-19 outbreak.

The loan balance in the non-manufacturing sector, which includes many self-employed individuals, reached 1,165.4 trillion KRW, with a growth rate (16.4%) far surpassing that of the manufacturing sector (5.7%). Breaking down the non-manufacturing sector, notable increases were seen in wholesale and retail trade (18.5%), construction (16.2%), real estate (15.4%), and accommodation and food services (13.0%).

Another key feature is that corporate loans increased mainly in the secondary financial sector, including savings banks, credit unions, and Saemaeul Geumgo. The loan balance growth rate in the secondary financial sector (25.8%) far exceeded that of deposit banks (9.3%). Although the loan balance (as of the end of last year) was still higher in deposit institutions (1,140.6 trillion KRW) than in the secondary financial sector (440.1 trillion KRW), the annual increase amounts were similar at 96.8 trillion KRW and 90.4 trillion KRW, respectively. This indicates that the secondary financial sector significantly expanded its loan volume relative to its overall size. The report analyzed that "due to strengthened household loan regulations, the secondary financial sector, which has a high household loan proportion, expanded loans mainly to corporations."

Interest Rates on Savings Bank Corporate Loans Rise More Sharply Than Those of Deposit Banks

Above all, the simultaneous rise in corporate loan interest rates is problematic because it increases the debt repayment burden on companies. The interest rate on new corporate loans from deposit banks rose by 0.61 percentage points from January last year to January this year (2.69% → 3.30%). In the case of mutual savings banks, the increase was even higher at 0.68 percentage points (6.69% → 7.37%).

The report forecasts that corporate interest expenses will continue to rise for the time being. Between 2020 and 2021, the base interest rate was near zero, and loan conditions were relatively favorable due to government financial support. However, the base interest rate, which was 0.5% in May 2020, rose to 1.25% in January this year and is expected to increase further, meaning corporate loan interest rates will likely follow this trend.

Ultimately, the report warns that corporate credit risk will increase. Lee Si-eun, a researcher at the KDB Future Strategy Institute, stated, "Although the profitability of financial institutions improved last year, loans have expanded significantly in the non-bank sector, which has a high proportion of mid-interest, low-credit, and multiple debtors, so latent defaults that have been dormant until now may surface, requiring preparedness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)