Management Dispute Rekindled at Kumho Petrochemical

Former Executive Director Park Cheol-wan Criticizes Excessive Cash Holdings

Considers Treasury Stock Cancellation

Tobis Announces Shareholder Return Plan

Chipartners' Shareholder Letter Sparks Voluntary Change in About 10 Days

Market Optimism Rises, Stock Price Up

[Asia Economy Reporter Minji Lee] This year's shareholder meeting season has seen a noticeable increase in the aggressive actions of institutional investors. They are not hesitant to form alliances with individual investors to enhance shareholder value, actively proposing changes such as governance reforms, expanded dividend policies, shareholder value enhancement, and recommendations for outside director candidates. Some institutional investors have achieved their goals during the shareholder meeting period, leading to temporary stock price increases for companies that received shareholder proposals.

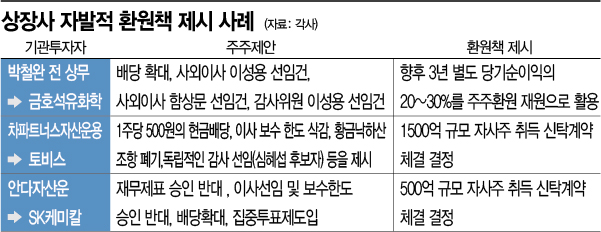

◆Strengthening Fiduciary Responsibility... Voluntary Changes by Listed Companies

According to the financial investment industry on the 24th, Kumho Petrochemical recently announced a trust contract for acquiring treasury shares worth 150 billion KRW for the purpose of treasury share cancellation. Kumho Petrochemical is currently experiencing a renewed management dispute between Chairman Park Chan-gu and Park Cheol-wan, the largest individual shareholder and former executive director, after one year. Ahead of the shareholder meeting, Park Cheol-wan's side criticized excessive cash holdings and low dividends, prompting the company to consider the treasury share cancellation option.

Tobis also announced on the 21st, before its shareholder meeting, that it would use 20-30% of its separate net income over the next three years as resources for shareholder returns. To fulfill this, the company plans to maintain a dividend payout ratio of 10-15% based on separate net income and acquire and cancel treasury shares equivalent to that proportion. Additionally, it declared it would cancel 300,000 shares already acquired. This voluntary change came just about ten days after Chapter Partners Asset Management began shareholder activities targeting Tobis.

SK Chemicals, facing a proxy battle with Anda Asset Management on the 28th, announced it would enter into a trust contract to acquire treasury shares worth 50 billion KRW to enhance shareholder value. Anda Asset Management has demanded ▲opposition to approval of financial statements ▲opposition to director appointments and approval of remuneration limits ▲dividend expansion ▲introduction of cumulative voting system, and the company is interpreted to be trying to appease shareholders by requesting proxy voting from individual shareholders to counter opposition to its agenda.

On the other hand, SM's situation is somewhat different. SM is firmly rejecting the shareholder letter from Align Partners Asset Management demanding improvements regarding Like Planning and is focusing all efforts on defending management rights. SM also refused to respond to a similar shareholder letter from KB Asset Management in 2019. Align plans to engage in a proxy battle at the shareholder meeting on the 31st over the appointment of auditor Kwak Jun-ho, former CFO of KCF Technologies (now SK Nexilis).

◆Institutional Investors' Growing Influence... Stock Prices Also 'Soar'

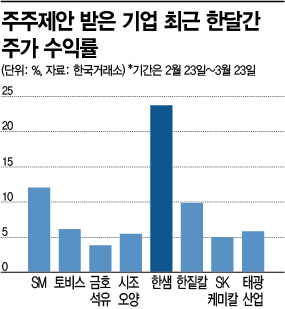

As institutional investors' shareholder engagement activities gain influence in the market, expectations for corporate value enhancement are also rising. Major companies receiving shareholder proposals are showing upward trends even in the volatile stock market affected by external factors.

Taekwang Industrial's stock price has risen nearly 6% since the 22nd after it became known that Truston Asset Management, holding 6% of the shares, demanded an expansion of dividend payout ratio, increased stock liquidity, and new business investments. Truston Asset Management stated, "We received a response to our shareholder letter from Taekwang Industrial on the 22nd, but it did not meet our expectations," adding, "We will engage in more active shareholder activities to improve governance and protect minority shareholder rights."

Additionally, SM, which is expected to have a close proxy battle over auditor appointments, surged 12% in the past month, while Tobis (6.12%), SK Chemicals (5%), and Kumho Petrochemical (3.8%), which introduced shareholder return policies, also showed upward trends. Hanssem, where the largest shareholder (IMM PE) and the second-largest shareholder (Teton Capital Partners) engaged in a proxy battle over board composition, rose nearly 20% over the past month.

Hwang Se-woon, a research fellow at the Korea Capital Market Institute, said, "Companies are increasingly accepting institutional investors' proposals, and stock prices are responding accordingly. From the perspective of companies or major shareholders, institutional investors' demands may seem excessive. However, considering that investors' voices have been suppressed until now, this is a stage of rebalancing the tilted scales, and the voices of institutions need to become clearer."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)