[Asia Economy Reporter Lee Jung-yoon] As grain prices soar due to the Ukraine crisis, the stock prices of feed and fertilizer companies are skyrocketing. However, since the rise in grain prices does not necessarily lead to improved performance for these companies, investors need to exercise caution.

According to the Korea Exchange on the 23rd, Hyundai Feed surged 59.79% over the previous two trading days. Following Russia's invasion of Ukraine, the United Nations Food and Agriculture Organization's (FAO) Food Price Index (FFPI) reached 140.7 (2014-2016 average = 100) last month, and the grain price index also rose sharply to 144.8. This stimulated expectations that feed companies would raise their product prices accordingly, driving the stock price surge.

However, past cases show that stock price increases due to rising grain prices did not necessarily translate into improved corporate performance. Influenced by droughts in Latin America and increased grain imports by China, last year the global food price index and grain price index recorded 125.7 and 131.2, respectively. At that time, international prices of major grains such as corn, wheat, and soybeans reached their highest levels in eight years since 2013.

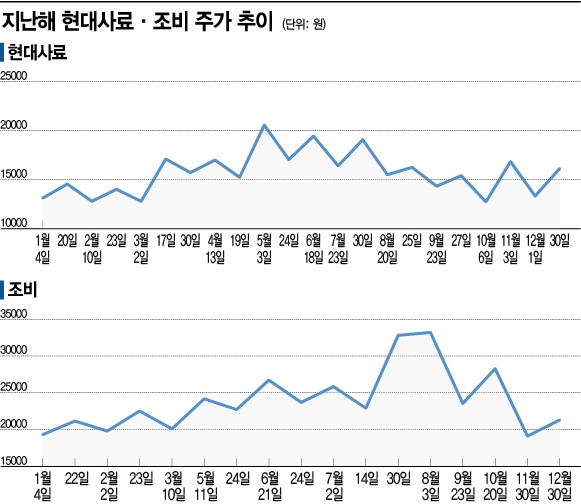

As grain prices rose, Hyundai Feed's stock price also increased, similar to this year. From early January last year, the price rose from 13,250 KRW to 20,250 KRW on May 3, marking a 52.83% surge. However, performance did not improve as much as the stock price. Hyundai Feed's sales last year increased by 2.6% compared to the previous year, and operating profit turned positive. However, it recorded a net loss of 725.29 million KRW, turning to a deficit. According to the business report for the last fiscal year, sales increased by 2.82906 billion KRW compared to 2020, but the cost of sales rose by 7.72959 billion KRW, which was larger. As a result, gross profit decreased by 4.9 billion KRW compared to the previous year.

Fertilizer company Jobi also saw its stock price rise to 33,250 KRW on August 3 last year, a 75% increase from the beginning of the year. On July 30 last year, it surged 22.35%. Expectations that fertilizer demand would increase to boost production as grain prices rose played a role. Jobi's sales increased by 14.9% last year, but net profit decreased by 38.4%. The company explained this as "a decrease in gross profit due to rising cost ratios and an increase in selling and administrative expenses such as service fees."

Experts advise that since rising grain prices do not automatically lead to improved performance, investors should be cautious. Jo Sang-hoon, a researcher at Shinhan Financial Investment, said, "Since grain is a raw material, there is an expectation that 'prices will rise,'" adding, "So far, price increases have not been implemented, so investors need to approach carefully."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.