17% of Users Are Over 50... More Than Teens

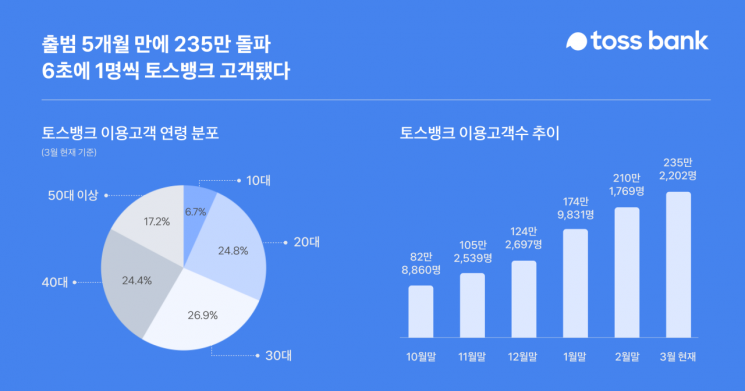

[Asia Economy Reporter Minwoo Lee] Toss Bank's customer base has surpassed 2.35 million just five months after its launch. Despite facing household loan volume regulations immediately after its debut, it has steadily grown by attracting responses from all age groups.

On the 23rd, Toss Bank announced that as of the 21st, the total number of registered customers reached 2,352,202. This marks 167 days since it began operations on October 5 last year. That equates to one new customer every 6 seconds, or 10 per minute. The daily average number of new customers is about 14,000. Initially, the bank started operations targeting pre-registered customers, and after fully opening to the public on October 14, over 230,000 people joined in a single day. This influx occurred despite the bank having to halt loan operations due to government household loan volume regulations on that day.

The number of Toss Bank account holders also exceeded 2.05 million. As of the 21st, the total was 20,155,255, of which 83.2% were active users with balances. On average, each customer deposited and used 8.31 million KRW. Consequently, deposits surpassed 17 trillion KRW. A Toss Bank official explained, "About 85% of the deposit amount is concentrated in banks, internet-only banks, and securities firms, reflecting continued customer visits across the entire financial sector. Toss Bank accounts offer the highest benefits compared to commercial banks with an annual interest rate of 2% (before tax), and customers can make deposits and withdrawals anytime they want, which seems to have attracted their attention."

Meanwhile, Toss Bank customers received an average monthly interest of 37,200 KRW. This is attributed to the recent launch of the ‘Get Interest Now’ service, the first in domestic banks to pay daily interest on demand deposit accounts. Noting the effect of daily compounding interest added to the existing monthly compounding, 878,053 customers used the service within a week.

The age range of account holders was also diverse. Customers in their 30s accounted for the largest share at 26.9%, followed by those in their 20s (24.8%) and 40s (24.4%). Those aged 50 and above made up 17.2%, which was higher than the 10s age group at 6.7%.

Toss expanded its scope by launching the first internet bank personal business loans on the 14th of last month. It strengthened its soundness by conducting two rounds of paid-in capital increases, raising a total capital of 850 billion KRW. A Toss Bank official stated, "The reason Toss Bank has been able to understand finance from the customer's perspective, introduce products, and continuously grow so far is because of our customers. Having overcome the initial limitations of credit operations, we will continue to grow through various customer-centered services."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)