Blue Ocean in Distribution: 'Vegan Market'

286 New Vegan-Certified Products Last Year

Product Range Expands with Major Companies Joining

[Asia Economy Reporter Song Seung-yoon] The vegan market is emerging as a 'blue ocean' in the distribution sector. As the vegan population increases and interest in health grows, the market, which was previously dominated mainly by small and medium-sized food companies, is shifting towards large corporations and diversifying.

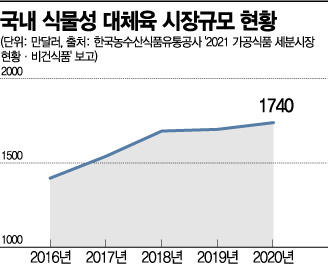

According to the '2021 Processed Food Submarket Status and Vegan Food' report by the Korea Agro-Fisheries & Food Trade Corporation on the 21st, 286 food products received new vegan certification from the Korea Vegan Certification Institute last year. This represents a 44% increase compared to 199 products in 2020. Compared to 114 products in 2019, it increased by 151%. As of 2020, the domestic plant-based meat substitute market was valued at $17.4 million, a 23.7% increase from 2016, with an average annual growth rate of 5.6%. The industry expects it to grow to $22.6 million by 2025.

Because it is still considered an early-stage market, related businesses were mainly concentrated in small and medium-sized enterprises and startups. However, recently, large corporations have also turned their attention to the vegan market and are expanding their product lines. With the vegan population increasing mainly among the MZ generation (Millennials + Generation Z) and most domestic vegans choosing vegan diets for health reasons, competition in the industry is expected to intensify.

CJ CheilJedang recently launched the 100% plant-based 'Bibigo PlanTable Wang Gyoja' product, which received vegan certification, and within just over two months, expanded exports to 10 countries including South Korea, Australia, Singapore, Malaysia, the Philippines, and Hong Kong. Nongshim has independently developed alternative meat and sells it through its affiliate Taekyung Nongsan. Lotte Foods is also discovering related startups alongside its plant-based alternative meat brand 'Zero Meat.' Pulmuone, which entered the market early, continues to expand its product line using plant-based alternative meats, including the representative vegan ramen 'Jeongmyeon' and 'Jeong Bibimmyun,' as well as dumplings and tofu tenders.

The distribution channels are similar. E-Mart has established a vegetarian zone in its stores that sells only products containing plant-based ingredients. Lotte Mart operates a vegan specialty zone within its frozen food section, and Homeplus also runs vegan zones in major stores nationwide. Convenience stores such as GS25, CU, 7-Eleven, and E-Mart24 are also showcasing various vegan foods in their stores and gradually expanding their product lines.

While growth is increasing, there are significant challenges to overcome. Vegan foods tend to have higher manufacturing costs compared to other foods, making profitability a challenge. Given Korea's food culture characteristics, some question whether the vegan market can grow as much as in the US or Europe. An industry insider said, "There are still many people unfamiliar with vegan foods, and prices are not cheap, so how it will settle is the issue. However, since the global alternative food market is growing significantly, investment and development are expected to take place domestically as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.