[Asia Economy Reporter Ji Yeon-jin] The growth of the top three online food channels ahead of their initial public offerings (IPO) this year was analyzed to be below expectations last year.

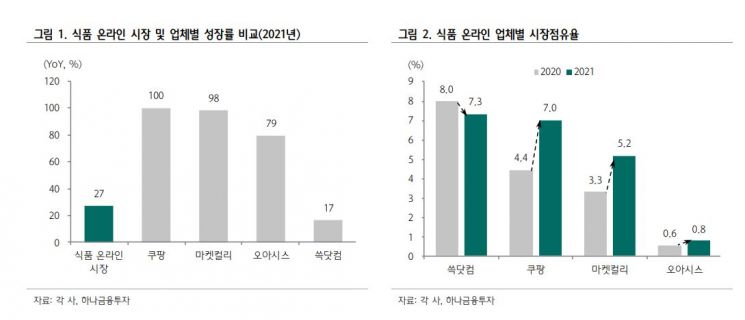

On the 20th, Hana Financial Investment analyzed that the size of the 2021 online food market was 32.8 trillion KRW, growing 27% compared to the previous year. The online penetration rate rose by 4.1 percentage points in one year to 25.4%. During this period, the overall online market growth rate was 21%, with a penetration rate of 47.9%. Although the penetration rate gap between the overall online market and the online food market exceeds 22 percentage points, the growth rate difference between the two markets is not significant. In fact, the increase in penetration rate was greater in the overall online market. Park Jong-dae, a researcher at Hana Financial Investment, said, "This means that the upper limit of the online food market penetration rate may be lower than initially expected," adding, "Since Korea leads the online food market, it is uncertain how much it will grow, but looking at the 2021 performance, there is suspicion that the growth potential may be smaller than originally expected."

Last year, the online food sales growth rates of SSG.com, Coupang, Market Kurly, and Oasis were 16%, 100%, 98%, and 79%, respectively. SSG.com's market share fell from 8% to 7.3%, while Coupang and Market Kurly's market shares increased by 2.6 percentage points and 1.9 percentage points compared to the previous year, reaching 7% and 5.2%, respectively.

Researcher Park said, "Each company has factors that damage valuation. First, the fact that the overall online food growth rate and penetration rate upper limit are low can be a valuation discount factor for online food distribution companies," adding, "If each company lacks clear explanations or solutions for these uncertainties, valuation damage upon listing seems inevitable."

In particular, SSG.com needs a convincing explanation for why the growth rate in the food category has relatively slowed down, and Market Kurly, which will announce its performance at the end of this month, if operating losses have still increased, needs to prepare measures on how to reduce operating losses, similar to Coupang's case. For Oasis, operating profit decreased by 33% compared to the previous year, and since synergies between online and offline such as inventory depletion may have reached their limits, it was added that a different online strategy from the past, including waste rate management and logistics efficiency improvements, is necessary.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.