Supply Shortages Worsen Amid COVID-19 and Ukraine Crisis

Main Car Model Factories Halt or Reduce Production

Some New Cars Delivered Without Certain Parts, Repaired Later

[Asia Economy Reporter Choi Dae-yeol] It has been revealed that automakers are still facing issues where production lines stop due to delayed parts supply or new cars are sold without certain parts. The parts supply shortage, which has been hampering the global automotive industry since early 2020 when COVID-19 first emerged, appears to have worsened due to Russia's invasion of Ukraine.

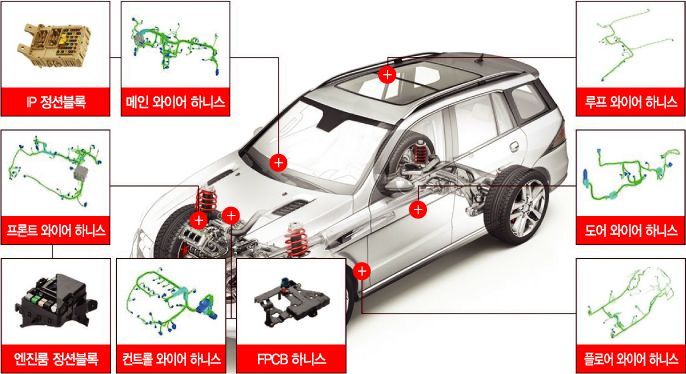

According to industry sources on the 14th, Hyundai Motor adjusted production schedules at some domestic plants due to disruptions in the supply of wiring harness parts. A wiring harness is a component that connects wiring bundles and control devices, supplying the power needed to operate electronic components in the vehicle and transmitting electrical signals to each electronic control module. It can be compared to blood vessels or nerve networks in the human body.

It was reported that parts supply was disrupted because a supplier's factory in China, which delivers to Hyundai Motor, halted operations due to COVID-19. Production volumes of models such as the Palisade, Porter, Tucson, and Genesis GV60, GV70, and GV80 made at the Ulsan plant were adjusted accordingly.

Hyundai Motor Group had previously halted all plant operations in February 2020 due to the inability to receive this part. An industry insider said, "In China, even one or two confirmed COVID-19 cases in a factory can lead to a complete shutdown due to strict quarantine measures," adding, "While some production was shifted to parts of Southeast Asia after initial COVID-19 issues, the majority of supply still comes from China."

Without Critical Parts, Entire Assembly Line Cannot Operate

Hyundai Motor and Genesis Adjust Production Volumes for Some Models

Toyota Also Plans Up to 20% Production Cut from April to June

Considering that the automotive production process operates on a tightly knit supply chain that can extend up to 4 or 5 tiers of suppliers centered around the automaker, missing even one or two key parts inevitably affects the entire assembly process. Especially in recent years, due to cost-cutting measures, parts inventories have been kept minimal, and production lines have been run tightly, making such parts shortages potentially fatal for automakers.

At the start of the COVID-19 pandemic, factories producing automotive semiconductors closed, immediately disrupting parts supply. Subsequently, due to contracts with other industries, outsourced production volumes could not be secured, and this parts shortage has shown no signs of improvement for two years. Additionally, unexpected variables such as abnormal weather and logistics difficulties have repeatedly emerged worldwide. Recently, Russia's invasion of Ukraine has also negatively impacted manufacturing industries, including automakers.

Toyota, the world's largest automaker, has decided to reduce production by up to 20% in the second quarter of this year. The company explained that this is to ease the burden on suppliers amid prolonged parts supply difficulties. They plan to cut production by about 20% next month, 10% in May, and 5% in June.

Ford in the United States has decided to deliver new cars without parts unrelated to safety. They will first deliver cars to customers who pre-ordered and then provide free repairs through dealers once the parts are supplied. This is a measure also taken by General Motors (GM) for some models. Similarly, Kia has been offering so-called minus-option vehicles without navigation functions on displays domestically since this month, shortening delivery times by several months.

European automakers are increasingly concerned as the Ukraine crisis prolongs. The entire logistics system for bringing in parts or transporting new cars is faltering. This mainly affects automakers with many factories in Europe, such as Volkswagen, Mercedes-Benz, Audi, and BMW. These companies typically outsource a significant portion of parts production to Eastern Europe, where labor costs are lower. This is similar to how Korean and Japanese automakers have parts supply networks in China or Southeast Asia, and North American automakers have them in Mexico and other parts of Latin America.

An industry insider said, "Parts supply remains unstable, and production conditions are worsening due to soaring costs of energy such as oil and raw materials," adding, "It is expected to take a longer time for the entire automotive industry to recover to pre-pandemic levels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.