[Asia Economy Reporter Jang Hyowon] FSN, a KOSDAQ-listed company, announced on the 14th that it has achieved its highest performance since its establishment.

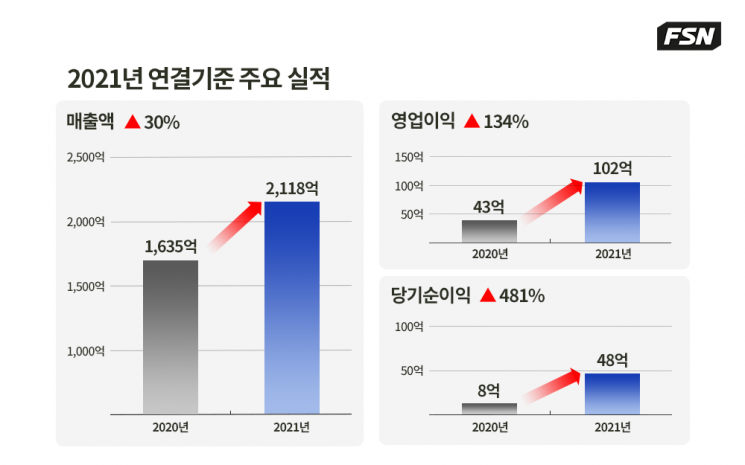

FSN's consolidated sales last year reached 211.8 billion KRW, a 30% increase compared to the previous year, and operating profit rose 134% to 10.2 billion KRW. Net profit for the same period also increased by 481% to 4.8 billion KRW. Notably, sales have grown annually without exception since FSN's KOSDAQ listing in 2015, surpassing the 200 billion KRW mark.

Along with achieving record performance, financial soundness has also greatly improved. The CB volume of FSN, which was 42.7 billion KRW at the beginning of 2021, has been completely extinguished through continuous repayment and conversion, significantly reducing liabilities. Total equity increased from 76 billion KRW in 2020 to 137.1 billion KRW last year, lowering the debt ratio to 73%.

Growth accelerated further last year when FSN's largest shareholder changed to ‘J2B,’ an alliance corporation of FSN's management. FSN reorganized its business structure into marketing, tech, commerce, and global sectors to enhance profitability and lead future industries. Subsequently, each business sector grew comprehensively, achieving the highest performance ever.

The commerce division recorded the most remarkable growth last year, with sales increasing 168% year-on-year to 45.6 billion KRW. ‘Boosters,’ operating a D2C commerce business, led FSN's commerce sector by stably establishing a business model that discovers promising brands and shares profits based on sales performance.

The existing brand ‘Ling Tea’ achieved significant growth by launching new products and expanding offline sales through convenience stores nationwide. From the second half of the year, ‘Airleaf,’ newly incorporated into Boosters, achieved good results with its posture correction product ‘Didac Neck.’ Additionally, several new category products such as the key growth health food ‘Keycleo’ and the infant home furnishing brand ‘Petit Maison’ contributed to the growth of the commerce business.

The existing marketing and tech divisions also played pivotal roles, driving FSN's balanced growth. Led by the digital-based integrated advertising agency ‘Adqua Interactive,’ large-scale projects for domestic and international clients are continuously underway, and the company has been recognized for its business performance and capabilities by winning multiple awards at major digital marketing ceremonies. Furthermore, the overall tech business, including ad tech and platforms, performed well, and the global business achieved favorable results despite the impact of COVID-19.

Having stably established a structure capable of sustainable growth through changes in major shareholders and business restructuring, FSN expects even greater growth this year. Particularly encouraging is the visible success in the blockchain business, such as selling out Sunmi PFP NFTs within one second.

Seojeonggyo, Co-CEO of FSN, stated, "Last year, we established an independent management foundation through affiliate separation and reorganized our business into a structure that can improve profitability and lead future industries, resulting in the highest performance since our founding. We will continue this momentum this year by enhancing competitiveness in each business sector, pursuing various collaborations, and discovering new growth engines for the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)