[Asia Economy Reporter Lee Seon-ae] #A in their 30s, an office worker, is planning a new financial investment strategy. Among various investment options such as funds, real estate, and exchange-traded funds (ETFs), what caught A's attention was unlisted stocks. The idea of being able to invest early, avoiding the increasingly fierce competition in public offering subscriptions, felt very attractive. Contrary to the traditional perception of unlisted stock investment as a blind transaction, the linkage with securities firms' safe trading systems allows for secure investment, and the convenience of investing via mobile also won A's heart. He said, "I plan to gradually increase my investment in unlisted stocks, focusing on mobile and fintech companies that I know well and frequently use."

Recently, 'early retail investors' who invest ahead of others in promising companies are increasing, especially among the MZ generation (Millennials + Generation Z). Most unicorn companies familiar to the MZ generation, such as Viva Republica and Yanolja, are unlisted, and with the upcoming listings of large companies like Hyundai Oilbank, Kyobo Life Insurance, SSG.com, Kurly, and Oasis, the influx of 20s and 30s early retail investors is expected to become even more active.

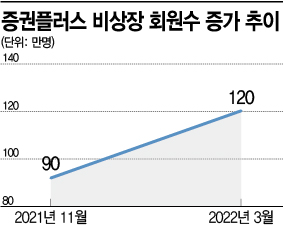

According to 'Securities Plus Unlisted,' a leading domestic unlisted stock trading platform, the number of its members surged by 300,000 from about 900,000 in November last year to 1.2 million as of early this month. The cumulative number of downloads also exceeded 1 million.

Launched in November 2019 by Dunamu and Samsung Securities, Securities Plus Unlisted is popular for pioneering a securities firm safe trading service in the industry, breaking down the chronic problems of instability and opacity in the unlisted stock market and leading the creation of a secure investment environment. Stock transactions are based on one-on-one negotiations, and trades are only executed after confirming the buyer's balance and the seller's stock holdings through Samsung Securities' safe trading system.

A representative from Securities Plus Unlisted explained, "With various convenient features such as 24-hour reservation orders including holidays and immediate orders under 30 million KRW, as well as a simple UX/UI based on mobile, even novice investors can easily enter unlisted stock investment," adding, "There is no need to participate in fierce public offering subscription competitions, and if the invested unlisted stock gets listed, the held shares are converted into listed shares without any separate procedures, which is also an attractive factor."

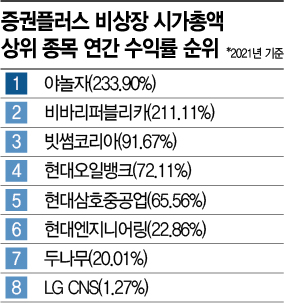

Profitability is also a driving force leading early retail investors. Among the top market capitalization stocks, last year's annual return rankings were Yanolja (233.90%), Viva Republica (211.11%), Bithumb Korea (91.67%), Hyundai Oilbank (72.11%), Hyundai Samho Heavy Industries (65.56%), Hyundai Engineering (22.86%), Dunamu (20.01%), LG CNS (1.27%), Hyundai Capital (0.00%), and Hyundai Transys (-1.69%).

Yanolja saw a surge in corporate value last February through a 1-for-19 bonus issue, common stock conversion, and large-scale investment from SoftBank Vision Fund. In the case of Viva Republica, its valuation rose following Hanwha Investment & Securities' decision to invest 30 billion KRW in Toss Bank and plans to launch a postpaid payment service.

A representative from Securities Plus Unlisted said, "It is also helpful to observe overall market trends when investing in unlisted stocks," adding, "In 2021, mobile and fintech companies showed remarkable progress in the unlisted stock market," and "This year, the popularity of mobile and fintech companies is expected to continue with the active participation of MZ generation early retail investors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.