[Asia Economy Reporter Buaeri] Among internet-only banks, the youngest, Toss Bank, is catching up with Kakao Bank and K Bank by focusing on loans for middle- and low-credit borrowers. Toss Bank is pursuing a 'super app' strategy based on the Toss app, which is used by 20 million people, to chase its competitors.

The Highest Proportion of Loans to Middle- and Low-Credit Borrowers

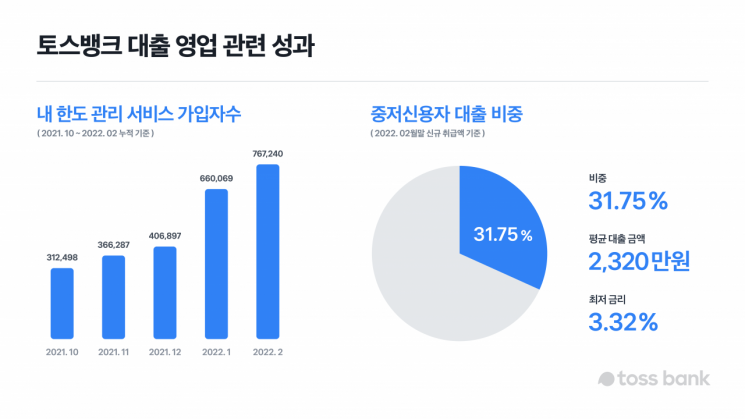

According to the financial sector on the 6th, Toss Bank achieved a 31.75% share of loans to middle- and low-credit borrowers as of the end of February this year. The household loan balance was KRW 1.9446 trillion. The household loan balance, which was KRW 531.5 billion at the end of December last year, more than doubled to KRW 1.6281 trillion at the end of January, and recorded nearly KRW 2 trillion last month. According to Toss Bank, the day with the highest proportion of mid-interest rate loan executions was January 31, when more than half of the customers (50.18%) were middle- and low-credit borrowers.

The performance of Toss Bank, about two months after resuming loan operations, exceeded expectations. Among the three internet banks, Toss Bank had the highest proportion of loans to middle- and low-credit borrowers. Kakao Bank's share of middle- and low-credit borrowers was about 18.6%, and K Bank's was in the 18% range. It is evaluated that Toss Bank has taken the lead in inclusive finance, which aligns with the founding purpose of internet banks. However, since Kakao Bank and K Bank were launched in 2017, there is still a significant difference in the scale of household loans. As of the end of February, Kakao Bank's household loan balance, including credit, jeonse (key money deposit), and mortgage loans, was KRW 25.8979 trillion, while K Bank's was KRW 7.49 trillion.

Over the past five months of loan screening, more than one in four (26.3%) of Toss Bank's middle- and low-credit borrowers were upgraded to high credit. Toss Bank uses its proprietary credit evaluation model (TSS) to analyze customers' actual income to determine loan eligibility. The company explains that customers classified as 'healthy middle- and low-credit borrowers' have opportunities to improve their credit compared to secondary and tertiary financial institutions. The average interest rate for middle- and low-credit customers who took out loans from Toss Bank was 7.7%, which is 5.6 percentage points lower than the average interest rate of savings banks (13.3%).

The interest rate range for customers with the best credit ratings was 2.71% to 3.81%. Toss Bank's middle- and low-credit customers received an average loan amount of KRW 23.2 million, and loans were executed for credit scores as low as 454 points (previously grade 8).

One-App Strategy: 'Toss' Attracts Up to 80,000 Daily Visitors

Toss Bank adopted a 'one-app' strategy that allows users to sign up and use services within the Toss app. The plan is to reduce costs related to app development and offline branch and counter operations and pass those savings on to customers as benefits. In fact, the number of customers newly registered for the 'My Limit Management' service to receive loans from Toss Bank was 360,343. The company explains that the My Limit Management service is similar to customers visiting bank counters for loan consultations. Up to 80,701 people used this service in a single day, and on average, 27,157 people visited Toss Bank daily. In comparison, the average daily number of visitors to commercial banks was 784 (as of the end of January).

Toss Bank's loan screening to disbursement process takes an average of less than 3 minutes. This service is popular because self-employed individuals and small business owners who find it difficult to visit banks can use mobile services without going to the bank directly. Two out of three customers (62%) received loans outside of banking hours, including weekends. Among all loans used by Toss Bank customers, 75.4% were unsecured loans, followed by overdraft accounts (23.4%), emergency loans (0.8%), and Saetdol loans (0.4%).

A Toss Bank official said, "Our advanced credit evaluation model allows us to include a wide range of customers, and especially because we determine new loan eligibility based on actual income, there has been particularly high interest from customers who need loans. We will continue to strive to implement new banking services from the customer's perspective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.