JP Morgan and Korea Economic Research Institute among Domestic and International Institutions

"If Ukraine Crisis Worsens,

Oil Prices May Hit Record Highs"

Could Surge to $150-$185

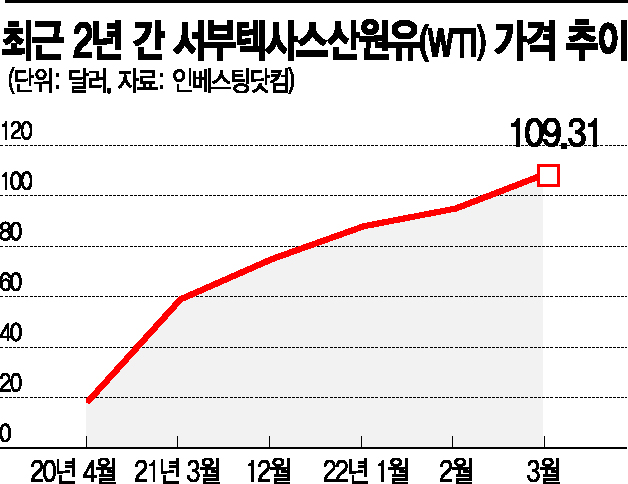

[Asia Economy Reporter Jeong Dong-hoon] As international oil prices soar due to Russia's invasion of Ukraine, the cost burden on Korean companies, which have the highest crude oil dependence among OECD member countries, is increasingly intensifying. In particular, concerns are growing as forecasts suggest prices could rise from the previous record high of $116?147 per barrel during the 2008 financial crisis to $150?185 per barrel.

On April 4 (local time), West Texas Intermediate (WTI) crude oil for April delivery on the New York Mercantile Exchange (NYMEX) closed at $115.68 per barrel, up 7.4% ($8.01) from the previous day. According to Dow Jones Market Data, this closing price was the highest since September 2008. The weekly price increase was 26.3% ($24.09), the largest percentage rise since April 2020 and the biggest dollar increase since April 1983.

On April 3 (local time), U.S. bank JP Morgan Chase forecast that if disruptions in Russian crude oil supply continue, Brent crude prices could rise to $185 per barrel. This level far exceeds the previous record high of $147 per barrel set during the 2008 global financial crisis. JP Morgan noted that currently 66% of Russian crude oil is struggling to find buyers and expressed concerns that it could face further sanctions, leading to difficulties in market sales.

Domestic government research institutes also foresee a significant rise in international oil prices. The Korea Energy Economics Institute projected that if Russian energy is included in Western sanctions, international oil prices could rise to $150 per barrel. Depending on the level of economic sanctions and Russia's response, prices could surge to $150 per barrel.

In fact, international oil prices are rising sharply. Dubai crude, which was around $76.9 per barrel at the beginning of this year, surged to $95.8 immediately after Russia's invasion of Ukraine. On the day before the announcement of Russia's removal from the SWIFT payment network, prices soared to $110.1. On the same day, WTI crude oil for April delivery on NYMEX briefly reached $116.57 per barrel, marking the highest price since September 22, 2008.

International credit rating agency Moody's identified Korea as one of the major importers negatively affected by inflationary pressures in emerging markets caused by rising commodity prices following Russia's invasion of Ukraine. Moody's stated, "Commodity price pressures are leading to currency depreciation in several emerging markets and heightening inflation through import prices," and forecasted that "importers such as China, Turkey, Korea, Japan, India, and Indonesia will be most negatively impacted." It also predicted, "Rising oil and food prices limit household spending on other goods, tighten fiscal conditions, and weaken growth."

Domestic companies that heavily import crude oil for energy and raw materials are in an emergency situation. According to the Hyundai Research Institute, production costs have surged in key domestic industries such as refining, steel, and chemicals. When oil prices reach $100 per barrel, the cost increase rate in the refining industry was 23.5%, with steel (5.26%) and chemicals (4.82%) also significantly rising.

A steel industry official said, "Blast furnaces used to melt iron require a lot of coal or electric energy, so rising oil prices could lead to higher electricity rates, which is a burden," and expressed concern that "if oil and energy prices do not stabilize, it could greatly affect profits this year." A petrochemical industry official also predicted, "With international oil prices rising, naphtha (a basic raw material for plastics and textiles) prices are also increasing, and if demand does not support this, profitability will deteriorate."

To minimize the impact on domestic energy supply and the internal economy, there are calls for policies such as reducing fuel taxes, extending the suspension of tariff quotas, increasing the operating rate of coal power plants, and expanding the scope of electricity rate hikes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.