KakaoBank to Hire at Least 100 Experienced Developers

Toss Plans 600 Hires Across All Affiliates

Intense Competition for Large-Scale Talent Acquisition

Commercial Banks Passive Amid Digitalization

NongHyup, Woori, Others Yet to Set Recruitment Schedules

Hiring Focused Mainly on IT Personnel

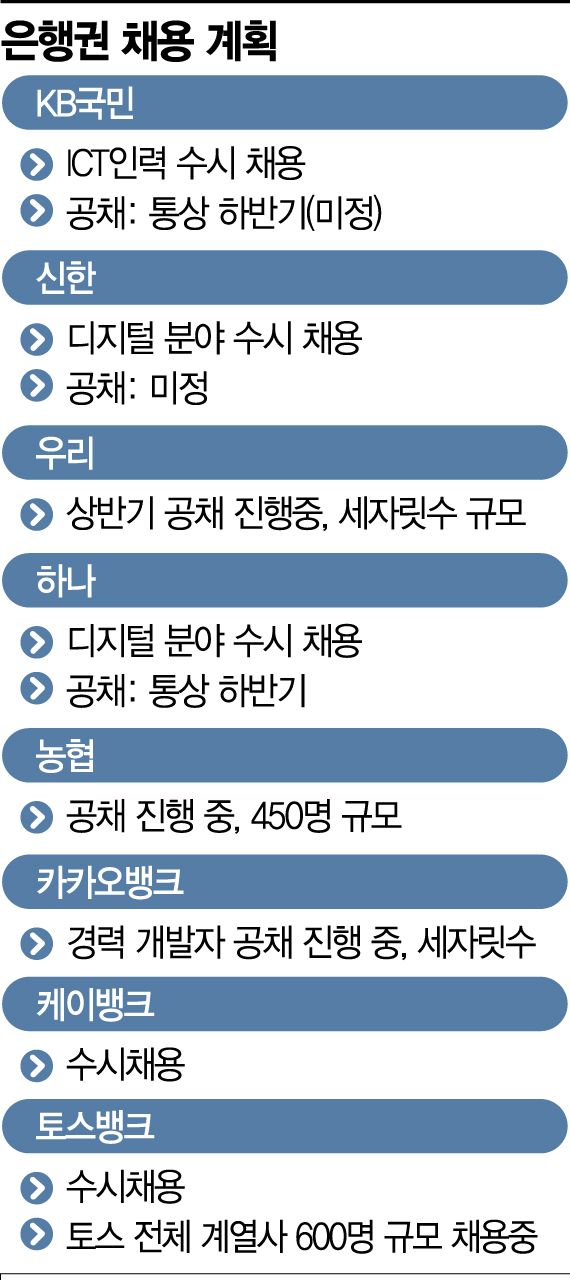

As bank recruitment intensifies in the first half of the year, internet-only banks, which have recently grown rapidly through digital and platform services, are expanding their workforce. Although commercial banks are also conducting open recruitment, the scale is not as large as before due to the impact of rapid Digital Transformation.

According to the financial sector on the 4th, KakaoBank is starting a large-scale recruitment of over 100 experienced developers from today. Considering KakaoBank's total workforce (about 1,100 employees), this means hiring around 10% new staff. The self-introduction section was excluded, and the recruitment process was greatly simplified by conducting the first and second interviews on the same day.

Toss is also recruiting 600 new employees across all its affiliates by the end of this month. Given that Toss Bank, launched last year, initially had about 250 employees, this represents a significant expansion of talent. Since there are no physical branches, most of the recruitment positions are concentrated in digital and marketing departments.

The aggressive talent acquisition by internet-only banks is due to their rapidly growing size. As of the third quarter of last year, the won-denominated deposits of internet-only banks (KakaoBank and K Bank) reached 41.37 trillion won, about ten times the amount at their launch in the third quarter of 2017 (4.19 trillion won). Although not comparable in scale, this growth far exceeds the approximately 40% increase in deposits across the entire domestic banking sector during the same period. KakaoBank alone has tripled its workforce from around 300 employees at launch to 1,135 as of the end of last month over four years.

Commercial banks are also ramping up recruitment. NH Nonghyup Bank plans to hire about 450 employees (420 general positions and 30 IT positions) through open recruitment that started at the end of last year, and Woori Bank is also conducting triple-digit recruitment through its first half open recruitment. Meanwhile, KB Kookmin, Shinhan, and Hana Banks have yet to finalize their open recruitment schedules.

However, the overall atmosphere is quite different. The number of open recruitment positions in the banking sector has decreased over the past few years. According to data released last year by Justice Party lawmaker Bae Jin-gyo, the regular open recruitment numbers for the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) increased from 1,479 in 2017 to 2,158 in 2019 but dropped to 1,382 last year. Considering that banks have conducted ICT sector recruitment to attract digital talent, it can be interpreted that the scale of general recruitment is steadily declining.

The reason commercial banks' recruitment is not as robust as before is that the demand for personnel itself is decreasing due to digital transformation and the rise in non-face-to-face services. According to the Financial Supervisory Service's electronic disclosure system, as of the third quarter of last year, the number of employees at the four major commercial banks was 57,467, a 6.0% (3,705 employees) decrease compared to 2017. During the same period, the number of domestic branches also decreased by 11.3%, from 3,613 to 3,203.

However, commercial banks are significantly increasing their digital transformation (DT) related talent. Shinhan Bank's digital workforce last year was 785, a 57.0% increase compared to 2017. A financial sector official said, "With digital transformation and the expansion of non-face-to-face demand due to the COVID-19 pandemic, the demand for face-to-face services at frontline branches has greatly decreased, making it difficult for recruitment numbers to increase significantly. However, commercial banks are expanding the scale of digital-related talent recruitment through both open and continuous hiring methods."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.